Get the free Corporate Account Application

Show details

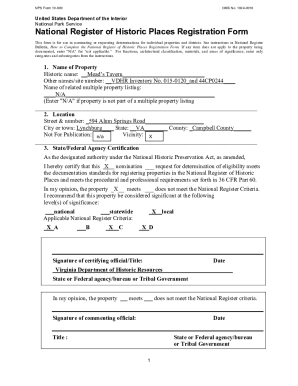

A form to apply for a corporate account, including details such as business name, contact information, credit limit, and authorized persons. It outlines the invoicing process and terms of payment.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate account application

Edit your corporate account application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate account application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit corporate account application online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit corporate account application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate account application

How to fill out Corporate Account Application

01

Obtain the Corporate Account Application form from the financial institution or website.

02

Fill in the company's legal name as registered.

03

Provide the business address, including street, city, state, and zip code.

04

Supply the tax identification number (TIN) or employer identification number (EIN).

05

Include details of the primary account holder including their name, title, and contact information.

06

List additional authorized signers if applicable, including their names and titles.

07

Specify the type of accounts needed (checking, savings, etc.).

08

Provide information regarding the company's industry and nature of business.

09

Sign the application where indicated, including any required notarization.

10

Submit the application along with any required supporting documents.

Who needs Corporate Account Application?

01

Businesses that require a dedicated account for corporate transactions.

02

Companies that wish to manage business finances separately from personal finances.

03

Organizations looking to establish a banking relationship for various corporate banking services.

04

Corporations, partnerships, and limited liability companies (LLCs) seeking to open a corporate bank account.

Fill

form

: Try Risk Free

People Also Ask about

How do I write a letter to open a current account?

I would like to open a [type of account, e.g., savings or current account] account with your bank. Enclosed with this letter are the necessary documents for account verification, including a copy of my [identity proof, e.g., passport or driver's license], proof of address, and [any other required documents].

How to fill an application form for account opening?

Here's a detailed guide on how to fill out a bank account opening form offline: Personal Information. Please provide your full name, including any surnames or suffixes. Identification Details. Permanent Account Number (PAN) Contact Information. Employment Information. Account Type. Initial Deposit. Nomination Details.

How to write an application for account opening?

Subject: Request for opening of account I am depositing a sum of Rs. __ to be credited in that account. The account shall be operated by me individually as proprietor of M/s. I agree to abide by the terms and conditions of accounts operation and other rules of the bank, issued from time to time.

How to write application in English for bank?

Format of Application Letter to Bank Manager Salutation: Begin the letter with a formal salutation, such as “Dear [Bank Manager's Full Name].” Introduction: State the letter's purpose, clearly indicating whether you are applying for a loan or requesting to issue an ATM card or close an account.

What is corporate account in English?

A corporate account, also known as a business account, is a dedicated bank account in a company's name that is used by businesses to manage their finances.

How to write an application for bank statement in English?

Sir, As I have to file my income tax returns for the financial year 2020-2021, I request you to provide me with the bank statement from the 1st of April, 2020 to the 31st of March, 2021 for the savings bank account. I have enclosed herewith the account number and a copy of the passbook for your reference.

How to write an application for a new account opening?

Subject: Request for opening of account I am depositing a sum of Rs. __ to be credited in that account. The account shall be operated by me individually as proprietor of M/s. I agree to abide by the terms and conditions of accounts operation and other rules of the bank, issued from time to time.

How do I write an application letter for an account?

How to write an account executive cover letter Introduce yourself and why you're applying. Begin the first paragraph by introducing yourself to the hiring manager and expressing your interest in the role. Discuss your account executive experience. Thank the hiring manager and conclude.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Corporate Account Application?

The Corporate Account Application is a formal document that businesses use to create or manage an account with financial institutions or service providers, typically required for tax identification, compliance, and operational purposes.

Who is required to file Corporate Account Application?

Businesses seeking to open a corporate account with banks, investment firms, or other service providers are required to file a Corporate Account Application.

How to fill out Corporate Account Application?

To fill out the Corporate Account Application, businesses should provide accurate details such as business name, structure, tax identification number, contact information, and information about corporate officers or authorized signers.

What is the purpose of Corporate Account Application?

The purpose of the Corporate Account Application is to provide financial institutions with necessary information to verify the identity and legitimacy of the business, enabling them to open an account and comply with regulatory requirements.

What information must be reported on Corporate Account Application?

The information that must be reported on the Corporate Account Application includes the business's legal name, structure, address, tax identification number, contact details, and details of all authorized personnel associated with the account.

Fill out your corporate account application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Account Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.