Get the free ESTATE PRESERVATION

Show details

ESTATE PRESERVATION THE MANUFACTURERS LIFE INSURANCE COMPANY Do you want an investment that can help you protect your financial legacy? For many of us, planning for retirement also means thinking

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estate preservation

Edit your estate preservation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estate preservation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing estate preservation online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit estate preservation. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estate preservation

How to fill out estate preservation:

01

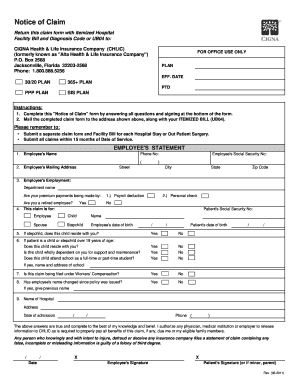

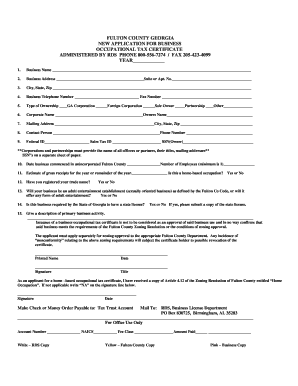

Gather all necessary documents related to your assets and liabilities, including property deeds, bank statements, investment account statements, insurance policies, and debts.

02

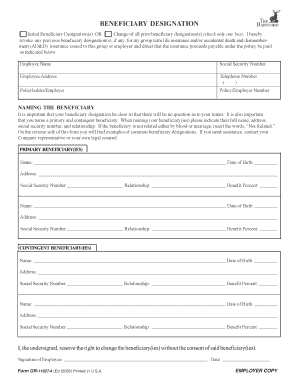

Make a list of all beneficiaries and heirs who will receive your assets after your passing. Include their full names, contact information, and any specific instructions regarding the distribution of your estate.

03

Determine if you need professional assistance, such as an attorney or financial advisor, to help you navigate complex estate planning laws and ensure your wishes are properly documented.

04

Create a comprehensive will that outlines how you want your assets to be distributed and who will be responsible for handling your estate. Include specific details regarding any special bequests, trusts, or charitable donations you wish to make.

05

Consider establishing a trust to protect certain assets, provide for dependents, or minimize estate taxes. This could involve working with an attorney or financial advisor familiar with trust creation and administration.

06

Review and update your beneficiary designations for retirement accounts, life insurance policies, and any other assets that allow you to designate beneficiaries directly. Ensure these designations align with your overall estate plan.

07

Evaluate the potential impact of estate taxes on your assets. If necessary, explore strategies to minimize estate tax liability, such as making gifts during your lifetime or establishing a trust for future generations.

08

Communicate your wishes and plans with your loved ones, ensuring they are aware of your estate preservation efforts and know how to access important documents and information when the time comes.

09

Periodically review and update your estate plan as circumstances change, such as major life events, changes in financial situation, or evolving laws and regulations.

Who needs estate preservation:

01

Individuals who have accumulated significant assets, including real estate, investments, or businesses, and want to ensure their assets are distributed according to their wishes.

02

Anyone with dependents, such as minor children or individuals with special needs, who want to provide for their ongoing care and financial support after their passing.

03

Those seeking to minimize the impact of estate taxes on their wealth, thereby preserving a greater portion of their assets for future generations.

04

Individuals who want to designate beneficiaries for their retirement accounts, life insurance policies, and other assets outside the scope of a traditional will.

05

Any person who wants to avoid potential conflicts among family members or heirs by clearly outlining their intentions for asset distribution and estate administration.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the estate preservation in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your estate preservation in minutes.

How can I edit estate preservation on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit estate preservation.

How do I fill out estate preservation using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign estate preservation and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is estate preservation?

Estate preservation refers to the process of protecting and managing assets to ensure their continued value and distribution according to the wishes of the individual during and after their lifetime.

Who is required to file estate preservation?

The requirement to file estate preservation typically falls on the executor or administrator of the estate, who is responsible for managing the estate's assets and ensuring compliance with applicable laws and regulations.

How to fill out estate preservation?

The process of filling out estate preservation forms may vary depending on the jurisdiction, but generally involves providing information about the deceased individual, their assets, debts, beneficiaries, and other relevant details. It is advisable to seek guidance from a legal or financial professional to ensure accurate completion of the necessary documentation.

What is the purpose of estate preservation?

The purpose of estate preservation is to safeguard and preserve the estate's assets, minimize unnecessary taxes, fees, and expenses, and ensure the orderly distribution of the assets to the intended beneficiaries or heirs.

What information must be reported on estate preservation?

Information commonly reported on estate preservation forms includes the deceased individual's personal information, details of their assets and liabilities, information about beneficiaries or heirs, as well as relevant legal and financial documentation.

Fill out your estate preservation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estate Preservation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.