Get the free CPA Select™ Catastrophic Health Insurance Plan Application

Show details

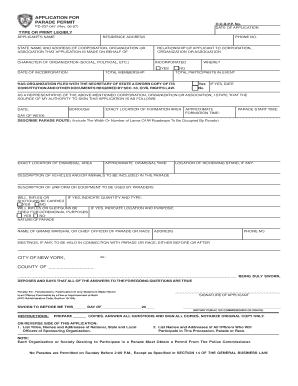

This document is an application form for the CPA Select™ Catastrophic Health Insurance Plan offered by Manulife Financial. It requires applicants to provide personal information, contact details,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cpa select catastrophic health

Edit your cpa select catastrophic health form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cpa select catastrophic health form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cpa select catastrophic health online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit cpa select catastrophic health. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cpa select catastrophic health

How to fill out CPA Select™ Catastrophic Health Insurance Plan Application

01

Obtain the CPA Select™ Catastrophic Health Insurance Plan Application form from the official website or authorized provider.

02

Read the application instructions carefully before starting.

03

Fill in your personal information, including your full name, address, date of birth, and contact details.

04

Provide information about your household members who will be covered under the plan.

05

Indicate your preferred coverage start date and any relevant prior insurance details.

06

Disclose any pre-existing conditions or health history as required.

07

Review the payment options and select your preferred method for premium payments.

08

Read through the terms and conditions of the policy thoroughly before signing.

09

Sign and date the application form to confirm that all information provided is accurate.

10

Submit the completed application form as instructed, either online or via mail.

Who needs CPA Select™ Catastrophic Health Insurance Plan Application?

01

Individuals under 30 years old who want to manage their healthcare costs.

02

People who qualify for a hardship exemption or meet certain criteria for affordability.

03

Those looking for minimal essential coverage to protect against high medical costs.

04

Self-employed individuals needing basic health coverage solutions.

05

Individuals who do not have access to employer-sponsored health insurance.

Fill

form

: Try Risk Free

People Also Ask about

What does CPA mean in health insurance?

One such term is CPA, which stands for “Claims Paid Amount.” Understanding CPA is crucial for policyholders as it directly affects their insurance coverage and claims settlement.

Can I buy only catastrophic health insurance?

Do I qualify for catastrophic insurance? You must either be under 30, or qualify for a hardship exemption. Usually, an exemption means that you can't afford health care insurance because you've recently been homeless, declared bankruptcy, or meet other qualifying criteria.

What does catastrophic health insurance not cover?

What don't catastrophic health plans cover? Your catastrophic health plan doesn't cover emergency care until you've met your deductible.

Is catastrophic health insurance ok?

Catastrophic plans are another option for certain people who qualify. They usually have even lower monthly premiums than bronze plans. But they have high deductibles, which is what you have to pay for covered services before the plan starts paying.

What are the downsides of catastrophic health insurance plans?

You should also note the downsides of catastrophic health insurance, including: High deductibles. Limited coverage for routine health care. The potential for high out-of-pocket costs that outweigh low premiums.

What are the downsides of getting catastrophic health insurance?

You should also note the downsides of catastrophic health insurance, including: High deductibles. Limited coverage for routine health care. The potential for high out-of-pocket costs that outweigh low premiums.

What is the average cost of catastrophic health insurance?

How much does catastrophic health coverage cost? Forbes Advisor2 found the average monthly premium for catastrophic health insurance for a 27-year-old is $260 in 2024. The average is $443 for a 50-year-old. ing to KFF3, the annual deductible for covered services in 2024 is $9,450 for an individual.

What is the deductible for catastrophic health insurance?

Catastrophic plans are required to cover at least three primary care visits before the deductible, and they have deductibles that are higher than the allowable limits for HDHPs (in 2025 the deductible and maximum out-of-pocket for a catastrophic plan is $9,200).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CPA Select™ Catastrophic Health Insurance Plan Application?

The CPA Select™ Catastrophic Health Insurance Plan Application is a specific form used to apply for a catastrophic health insurance plan offered under the CPA Select program, which provides coverage for unexpected medical expenses.

Who is required to file CPA Select™ Catastrophic Health Insurance Plan Application?

Individuals who wish to obtain catastrophic health insurance coverage under the CPA Select program are required to file the CPA Select™ Catastrophic Health Insurance Plan Application.

How to fill out CPA Select™ Catastrophic Health Insurance Plan Application?

To fill out the CPA Select™ Catastrophic Health Insurance Plan Application, applicants should carefully complete all sections of the form, providing accurate personal information, health history, and any required documentation to support the application.

What is the purpose of CPA Select™ Catastrophic Health Insurance Plan Application?

The purpose of the CPA Select™ Catastrophic Health Insurance Plan Application is to enable individuals to apply for insurance coverage that protects against high medical costs resulting from serious health issues or emergencies.

What information must be reported on CPA Select™ Catastrophic Health Insurance Plan Application?

Applicants must report personal information such as their name, address, date of birth, as well as health history, income details, and any previous insurance coverage on the CPA Select™ Catastrophic Health Insurance Plan Application.

Fill out your cpa select catastrophic health online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cpa Select Catastrophic Health is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.