Get the free PUBLIC SECTOR PENSION SCHEME OF VBL

Show details

This document provides a comprehensive overview of the public sector pension scheme in Germany, covering the features, governance, population involved, financial data, contribution rates, pension

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign public sector pension scheme

Edit your public sector pension scheme form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your public sector pension scheme form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing public sector pension scheme online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit public sector pension scheme. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

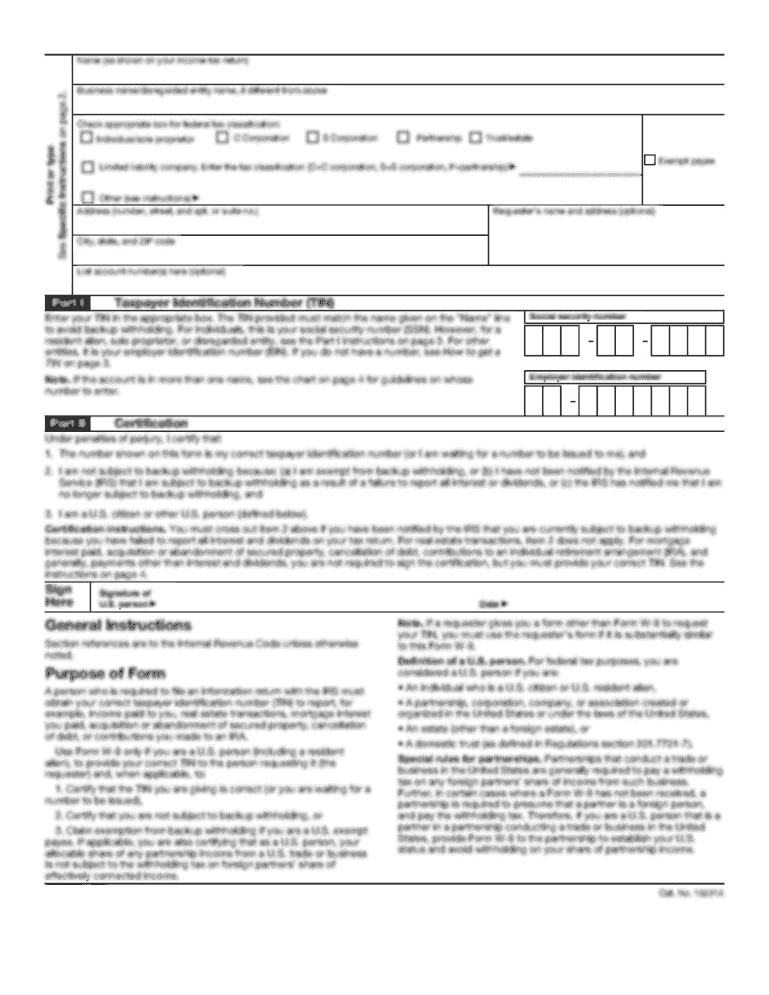

How to fill out public sector pension scheme

How to fill out PUBLIC SECTOR PENSION SCHEME OF VBL

01

Obtain the Public Sector Pension Scheme of VBL application form from the official website or your HR department.

02

Fill in your personal details, including your name, address, date of birth, and national insurance number.

03

Provide details of your employment, including your job title, department, and length of service.

04

Indicate your preferred payment options and contributions on the form as per the guidelines.

05

Include any relevant supporting documents, such as identification and proof of employment.

06

Review the completed form for accuracy and completeness.

07

Submit the form via the specified method (online upload, mail, or in-person at HR) by the deadline.

Who needs PUBLIC SECTOR PENSION SCHEME OF VBL?

01

Public Sector employees who are seeking retirement benefits and financial security in their later years.

02

Individuals planning for their pension within the confines of public sector employment.

03

Those who wish to take advantage of the pension scheme offerings provided by VBL for public sector professionals.

Fill

form

: Try Risk Free

People Also Ask about

What is the VA pension?

Veterans Pension is a tax-free monetary benefit payable to low-income wartime Veterans. Eligibility: Generally, a Veteran must have at least 90 days of active duty service, with at least one day during a wartime period to qualify for a VA Pension.

What is the AV pension scheme?

An Additional Voluntary Contribution (AVC) plan is set up by an employer for employees to make further contributions to potentially build up additional retirement benefits. It's designed to sit alongside the main company pension scheme.

What is an AV pension?

AVCs are exactly what they sound like; additional pension contributions made on a voluntary basis. These are additional payments made beyond what you contribute each month. An AVC can be made as a one-off payment or set up on a regular basis, paid as either a fixed amount or a percentage of your salary.

Is a pension better than a 401k?

There are pros and cons to both plans, but pensions are generally considered better than 401(k)s because they guarantee an income for life.

What is the minimum pension for public sector employees?

EPFO has proposed raising the minimum EPS pension from Rs. 1,000 to Rs. 7,500 per month. The hike is expected to be implemented starting April 2025. Over 6 million pensioners under the Employees' Pension Scheme (EPS) will benefit. The move aims to improve financial security amid rising living costs.

What is the downside of AVC?

What are the disadvantages of an AVC pension? If you opt for an AVC pension through your employer, you won't have as much flexibility as other private pension options. The money tied up in your AVC may be locked until you begin taking money from the main pension scheme.

What is the best public sector pension scheme?

Public sector pensions ing to one study, the NHS has the best pension scheme. £1 saved at the beginning of a career is worth £10 over a 20-year retirement (starting at age 68). The teaching profession also has a strong pension scheme, with employers making a flat contribution of 23.68%.

What is pension fund in English?

Meaning of pension fund in English an amount of money, collected from regular payments made by people who work, which is invested in order to pay pensions to people when they retire: The company's pension fund is facing a worrying shortfall.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PUBLIC SECTOR PENSION SCHEME OF VBL?

The Public Sector Pension Scheme of VBL is a retirement savings plan designed for employees working in the public sector under the VBL organization, providing them with financial security after retirement.

Who is required to file PUBLIC SECTOR PENSION SCHEME OF VBL?

Employees of the public sector who participate in the VBL pension scheme are required to file the Public Sector Pension Scheme of VBL.

How to fill out PUBLIC SECTOR PENSION SCHEME OF VBL?

To fill out the Public Sector Pension Scheme of VBL, one must provide personal details, employment information, contribution amounts, and any other required documentation as specified by the VBL guidelines.

What is the purpose of PUBLIC SECTOR PENSION SCHEME OF VBL?

The purpose of the Public Sector Pension Scheme of VBL is to ensure that public sector employees have a dependable source of income after retirement, thereby promoting financial stability and security.

What information must be reported on PUBLIC SECTOR PENSION SCHEME OF VBL?

The information that must be reported on the Public Sector Pension Scheme of VBL includes personal details of the employee, the total contributions made, the employer's contributions, and any relevant changes in employment status.

Fill out your public sector pension scheme online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Public Sector Pension Scheme is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.