Get the free merger due diligence checklist

Show details

A Planning Guide for Plan Sponsors Mergers and Acquisitions Planning Guide Defined Benefit Plans insure investStrategies Retirement retire Contents 1 Eight Steps to Successful Mergers and Acquisitions

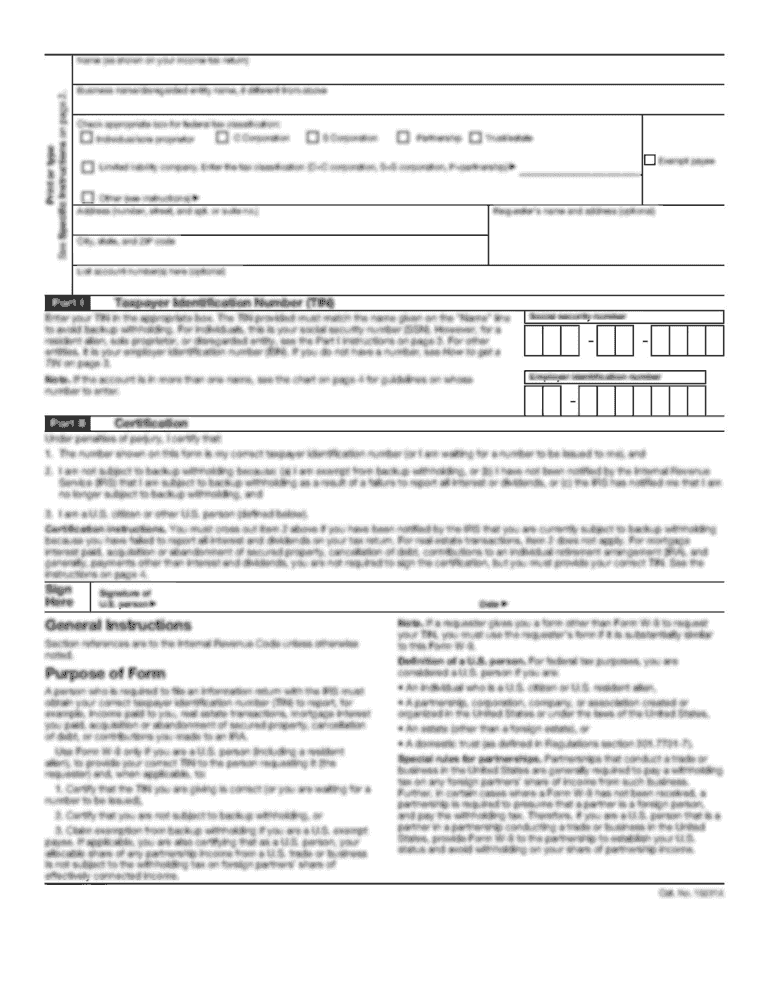

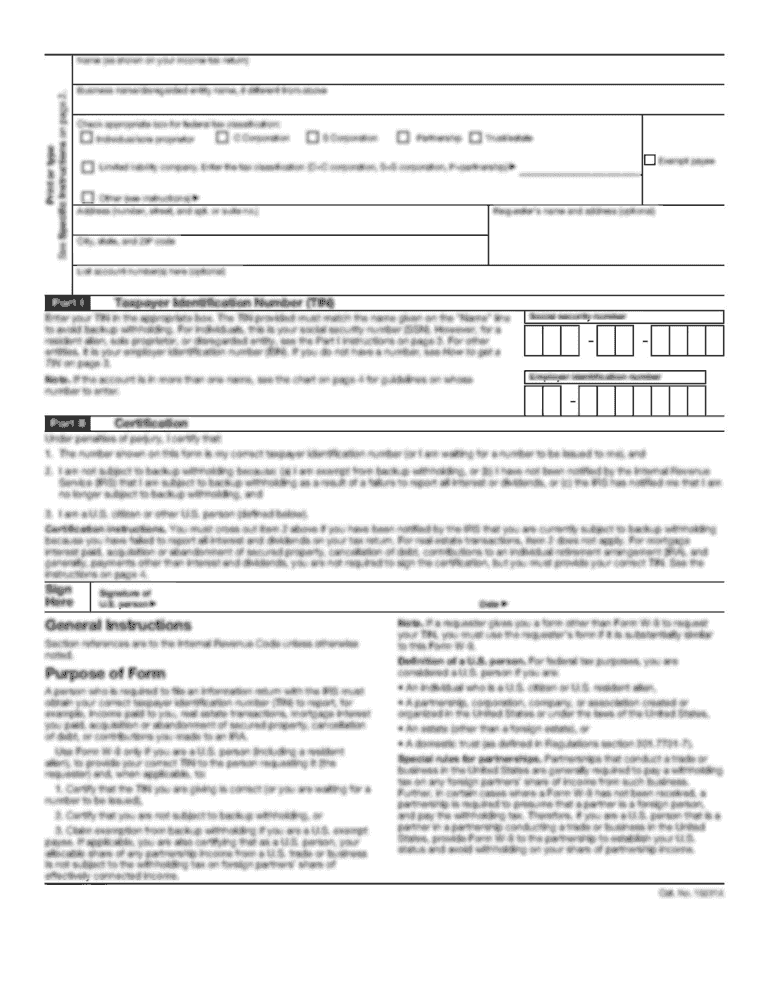

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign merger due diligence checklist

Edit your merger due diligence checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your merger due diligence checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing merger due diligence checklist online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit merger due diligence checklist. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out merger due diligence checklist

How to fill out a merger due diligence checklist:

01

Gather all necessary documents and information related to the merger, such as financial statements, contracts, legal documents, and employee records.

02

Review the financial statements of both companies involved in the merger to assess their financial performance, potential risks, and future projections.

03

Examine the legal documentation, including contracts and agreements, to evaluate any potential liabilities or legal issues that may arise from the merger.

04

Analyze the operational aspects of both companies, including their business processes, technologies, and infrastructure, to ensure compatibility and identify potential synergies or challenges.

05

Evaluate the cultural fit and organizational structure of both companies to determine if the merger will result in a cohesive and efficient combined entity.

06

Perform a thorough assessment of the human resources of both companies, including employee contracts, compensation plans, benefits, and potential redundancies.

07

Consider the regulatory environment and requirements that may affect the merger, such as antitrust regulations or industry-specific laws and regulations.

08

Assess any potential environmental, health, and safety risks associated with the companies' operations, facilities, or properties.

09

Conduct a comprehensive due diligence analysis to identify any hidden or undisclosed risks, liabilities, or issues that may impact the success or feasibility of the merger.

10

Continuously monitor and update the checklist as new information or developments arise throughout the merger process.

Who needs a merger due diligence checklist?

01

Companies considering a merger or acquisition to ensure a thorough evaluation of the potential risks, liabilities, and synergistic opportunities.

02

Legal and financial advisors involved in the merger or acquisition process to guide their clients through the due diligence phase.

03

Investors or shareholders who want to assess the viability and potential risks of their investment in the merged entity.

04

Regulatory authorities or government agencies overseeing the merger or acquisition process to ensure compliance with relevant laws and regulations.

05

Internal teams or departments responsible for managing the merger, including legal, finance, human resources, and operations, to ensure a smooth and successful integration.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify merger due diligence checklist without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your merger due diligence checklist into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an electronic signature for signing my merger due diligence checklist in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your merger due diligence checklist directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Can I edit merger due diligence checklist on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign merger due diligence checklist. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is merger due diligence checklist?

A merger due diligence checklist is a comprehensive document that outlines the tasks and steps required to evaluate the financial, legal, and operational aspects of a potential merger or acquisition.

Who is required to file merger due diligence checklist?

The parties involved in the merger or acquisition, such as the acquiring company and the target company, are generally required to complete and file the merger due diligence checklist.

How to fill out merger due diligence checklist?

The merger due diligence checklist is typically filled out by conducting thorough research, gathering necessary documents and information, and completing the checklist according to the provided guidelines or requirements.

What is the purpose of merger due diligence checklist?

The purpose of a merger due diligence checklist is to ensure that all relevant aspects of a potential merger or acquisition are thoroughly reviewed and evaluated, minimizing risks and ensuring informed decision-making.

What information must be reported on merger due diligence checklist?

The specific information to be reported on a merger due diligence checklist may vary depending on the nature of the merger and applicable regulations, but it generally includes financial statements, legal contracts, operational data, intellectual property information, and other relevant details.

Fill out your merger due diligence checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Merger Due Diligence Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.