Get the free Valuation Report - mayafiles tase co

Show details

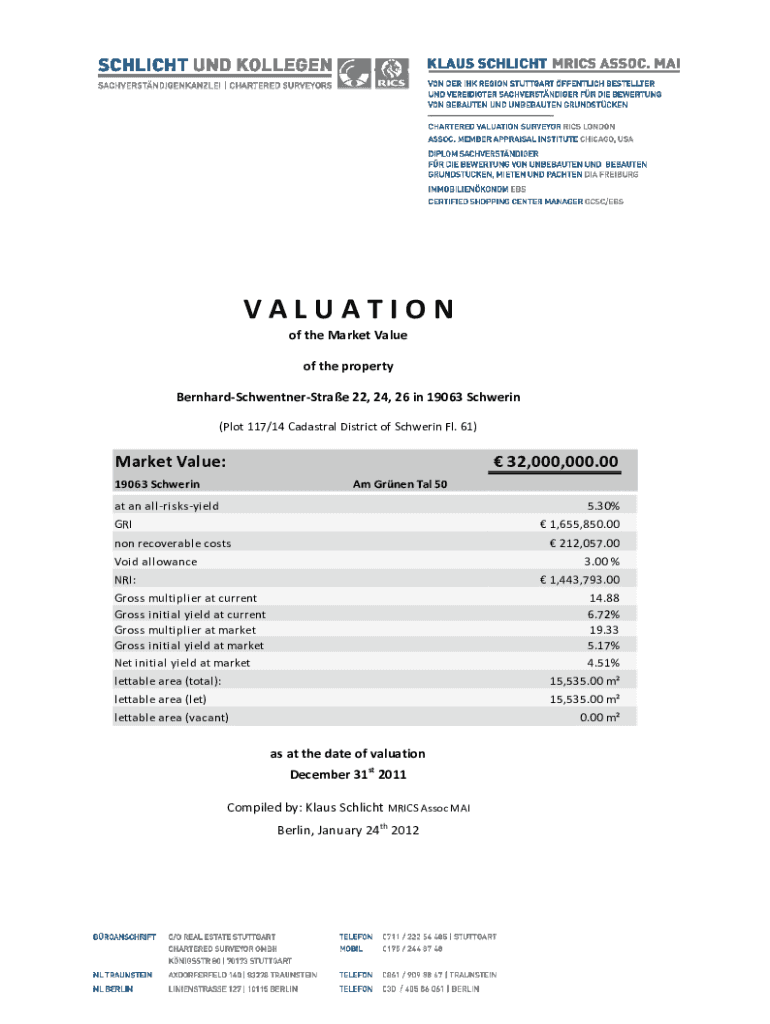

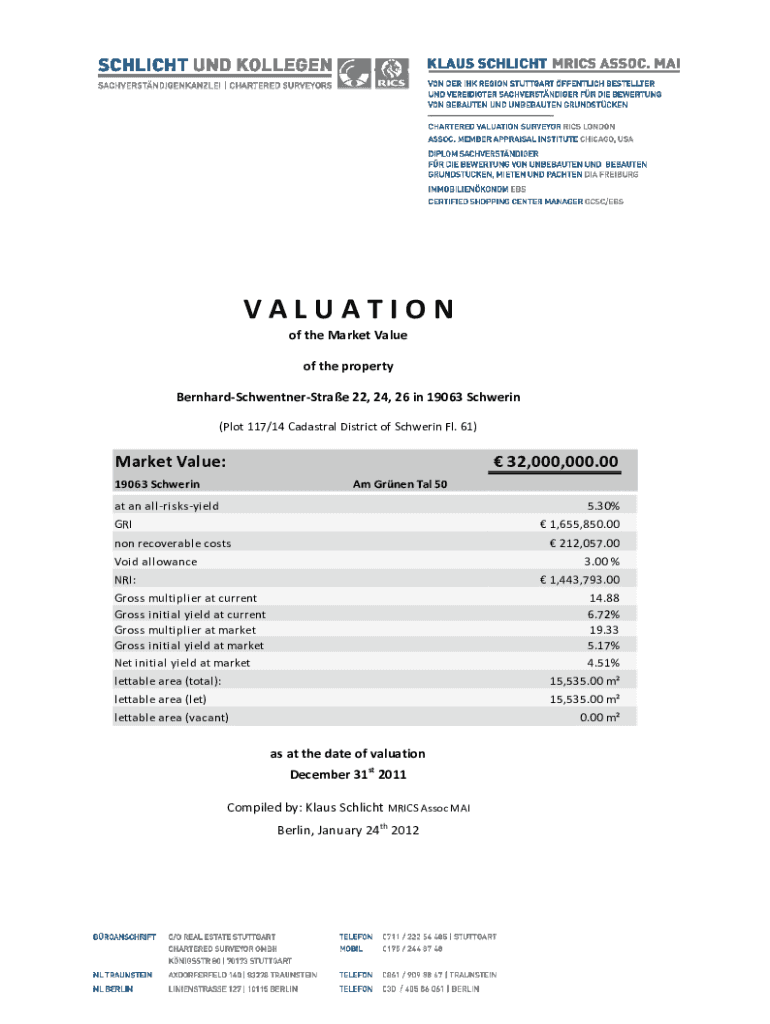

This document provides a detailed valuation of the property located at Bernhard‐Schwentner‐Straße 22, 24, 26 in 19063 Schwerin, including market analysis, financial metrics, and property details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign valuation report - mayafiles

Edit your valuation report - mayafiles form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your valuation report - mayafiles form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit valuation report - mayafiles online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit valuation report - mayafiles. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out valuation report - mayafiles

How to fill out Valuation Report

01

Gather necessary documents and data related to the asset being valued.

02

Determine the purpose of the valuation report (e.g., sale, tax, financial reporting).

03

Choose the appropriate valuation method (e.g., cost, market, income approach).

04

Collect comparable market data for similar assets, if applicable.

05

Analyze the collected data and perform calculations based on the chosen method.

06

Draft the valuation report, clearly stating assumptions, methods used, and findings.

07

Include an executive summary, conclusions, and any disclaimers or limitations.

08

Finalize the report and ensure it is reviewed and approved by relevant stakeholders.

Who needs Valuation Report?

01

Business owners seeking to sell their company or assets.

02

Investors evaluating potential investments.

03

Banks and financial institutions requiring asset valuations for loan purposes.

04

Tax authorities and auditors needing valuation for compliance purposes.

05

Estate planners preparing for asset distribution.

06

Insurance companies that need valuations for policies.

07

Mergers and acquisitions advisors during due diligence processes.

Fill

form

: Try Risk Free

People Also Ask about

What are the 5 steps in the valuation process?

There are five steps involved in the valuation process: Understanding the business. Forecasting company performance. Selecting the appropriate valuation model. Using forecasts in a valuation. Applying the valuation conclusions.

What does a valuation report include?

This report provides an in-depth analysis of a property's value and serves as a cornerstone for buyers, sellers, and lenders. A professional property valuation report should offer valuable insights into the property's worth based on various factors such as market conditions, location, size, and condition.

What is the structure of a valuation report?

A Structural Assessment Report, which might also be referred to as an Engineer's Report, is a planning tool used to determine a historic building or structure's structural condition by analyzing and evaluating foundation, framing, other construction systems, and their associated construction details and providing

How do you write a valuation report?

1 Define the scope. The first step in preparing a valuation report is to define the scope of the valuation, which includes the purpose, date, standard, and basis of the valuation. 2 Choose the method. 3 Collect and analyze data. 4 Estimate the value. 5 Reconcile and conclude. 6 Present the report.

What does a valuation report include?

A professional property valuation report should offer valuable insights into the property's worth based on various factors such as market conditions, location, size, and condition. Property valuation reports play a pivotal role in guiding decision-making processes in property transactions.

What is the valuation of a company if 10% is $100,000?

The Sharks will usually confirm that the entrepreneur is valuing the company at $1 million in sales. The Sharks would arrive at that total because if 10% ownership equals $100,000, it means that one-tenth of the company equals $100,000, and therefore, ten-tenths (or 100%) of the company equals $1 million.

What is the valuation of a company if 10% is $100,000?

The Sharks will usually confirm that the entrepreneur is valuing the company at $1 million in sales. The Sharks would arrive at that total because if 10% ownership equals $100,000, it means that one-tenth of the company equals $100,000, and therefore, ten-tenths (or 100%) of the company equals $1 million.

What is the structure of a valuation report?

A Structural Assessment Report, which might also be referred to as an Engineer's Report, is a planning tool used to determine a historic building or structure's structural condition by analyzing and evaluating foundation, framing, other construction systems, and their associated construction details and providing

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Valuation Report?

A Valuation Report is a formal document that provides an estimate of the value of an asset or a company. It typically includes a description of the asset, the valuation methods used, and the conclusions reached regarding its worth.

Who is required to file Valuation Report?

Typically, companies undergoing mergers and acquisitions, investment firms, real estate entities, and businesses needing to assess their assets for financial reporting or compliance reasons are required to file a Valuation Report.

How to fill out Valuation Report?

To fill out a Valuation Report, gather necessary data about the asset or company, select appropriate valuation methodologies (e.g., market, income, cost approaches), calculate the estimated value, and document these findings thoroughly in the report format.

What is the purpose of Valuation Report?

The purpose of a Valuation Report is to provide an objective assessment of value that can be used in decision-making, negotiations, financial reporting, taxation purposes, and compliance with regulatory requirements.

What information must be reported on Valuation Report?

A Valuation Report must include details such as the purpose of the valuation, the valuation date, the asset's description, the methodologies used, calculations and data sources, any relevant financial information, and the conclusion of value.

Fill out your valuation report - mayafiles online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Valuation Report - Mayafiles is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.