Get the free SEC Form 4 - mayafiles tase co

Show details

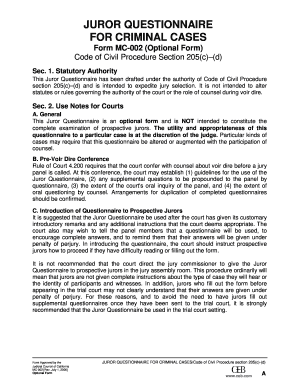

This document is used to report changes in the beneficial ownership of securities by insiders of publicly traded companies, including directors and 10% owners.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sec form 4

Edit your sec form 4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sec form 4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sec form 4 online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sec form 4. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sec form 4

How to fill out SEC Form 4

01

Obtain the SEC Form 4 document from the SEC's website or relevant financial regulatory authority.

02

Fill in the name of the person who is reporting (the insider) at the top of the form.

03

Indicate the relationship of the insider to the company (e.g., officer, director, 10% shareholder).

04

Provide the name of the company for which the insider is reporting.

05

Fill out the table provided in the form with the required transaction details, including the date of the transaction, the number of shares involved, and the price per share.

06

Include any additional information required, such as whether the transaction was a purchase or sale of stock.

07

Review the form for accuracy and completeness.

08

Sign and date the form as required.

09

Submit the form electronically through the SEC's EDGAR system, or file in paper format if necessary.

Who needs SEC Form 4?

01

SEC Form 4 is needed by corporate insiders such as executive officers, directors, and beneficial owners of more than 10% of a company's stock to report their transactions in the company's securities.

Fill

form

: Try Risk Free

People Also Ask about

Where can I see the filing of Form 4?

Form 4 filings are publicly available through the Securities and Exchange Commission's Electronic Data Gathering, Analysis, and Retrieval system — EDGAR.

What does SEC Form 4 tell you?

What's a Form 4? In most cases, when an insider executes a transaction, he or she must file a Form 4. With this form filing, the public is made aware of the insider's various transactions in company securities, including the amount purchased or sold and the price per share.

What is an N 4 filing?

Form N-4 is made to register securities under the Securities Act and securities are sold to the. public, registration fees must be paid on an ongoing basis after the end of the Registrant's fiscal.

Where can I find SEC Form 4?

Form 4 is stored in SEC's EDGAR database and academic researchers make these reports freely available as structured datasets in the Harvard Dataverse.

Where can I get SEC Form 4?

Form 4 is stored in SEC's EDGAR database and academic researchers make these reports freely available as structured datasets in the Harvard Dataverse.

What is the difference between s3 and s4 filing?

The main difference between Form S-3 and Form S-4 lies in their eligibility criteria. Form S-3 is designed for companies that meet certain eligibility requirements, such as having a sufficient public float and a history of timely SEC filings.

What is an SEC S4 filing?

Form S-4 is the registration statement that the Securities and Exchange Commission (SEC) requires reporting companies to file in order to publicly offer new securities pursuant to a merger or acquisition.

What is an N-4 filing?

Form N-4 is made to register securities under the Securities Act and securities are sold to the. public, registration fees must be paid on an ongoing basis after the end of the Registrant's fiscal.

Who is required to file Form 4S?

The SEC requires an S-4 filing from any publicly traded company undergoing a merger or an acquisition. This form must also be filed in bankruptcy situations when there is an exchange offer on the table, and during hostile takeovers. The form must be filed regardless of the underlying purpose of the merger.

Is SEC Form 4 bullish?

As a general rule, Form 4 filings that show substantial insider buying activity are a bullish signal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SEC Form 4?

SEC Form 4 is a document that must be filed with the U.S. Securities and Exchange Commission (SEC) to report changes in the holdings of company insiders, such as officers, directors, and certain shareholders.

Who is required to file SEC Form 4?

Company insiders, including executive officers, directors, and beneficial owners of more than 10% of a company's shares, are required to file SEC Form 4.

How to fill out SEC Form 4?

To fill out SEC Form 4, insiders must provide information about the reporting person, the relationship to the issuer, the date of the transaction, the amount of securities involved, the price of the transaction, and any other pertinent details.

What is the purpose of SEC Form 4?

The purpose of SEC Form 4 is to provide transparency regarding the transactions made by company insiders, helping to ensure that investors are informed about the buying and selling practices of those who have significant influence over the company.

What information must be reported on SEC Form 4?

SEC Form 4 requires the reporting of details such as the name of the reporting person, the relationship to the issuer, the transaction date, the amount of securities acquired or disposed of, the price at which the transaction occurred, and the ownership form (direct or indirect).

Fill out your sec form 4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sec Form 4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.