NY Life 18484 2009 free printable template

Show details

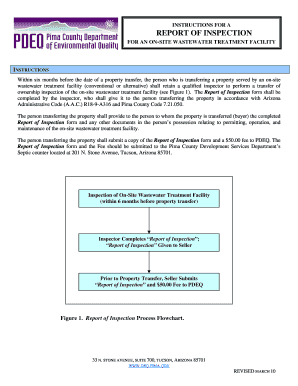

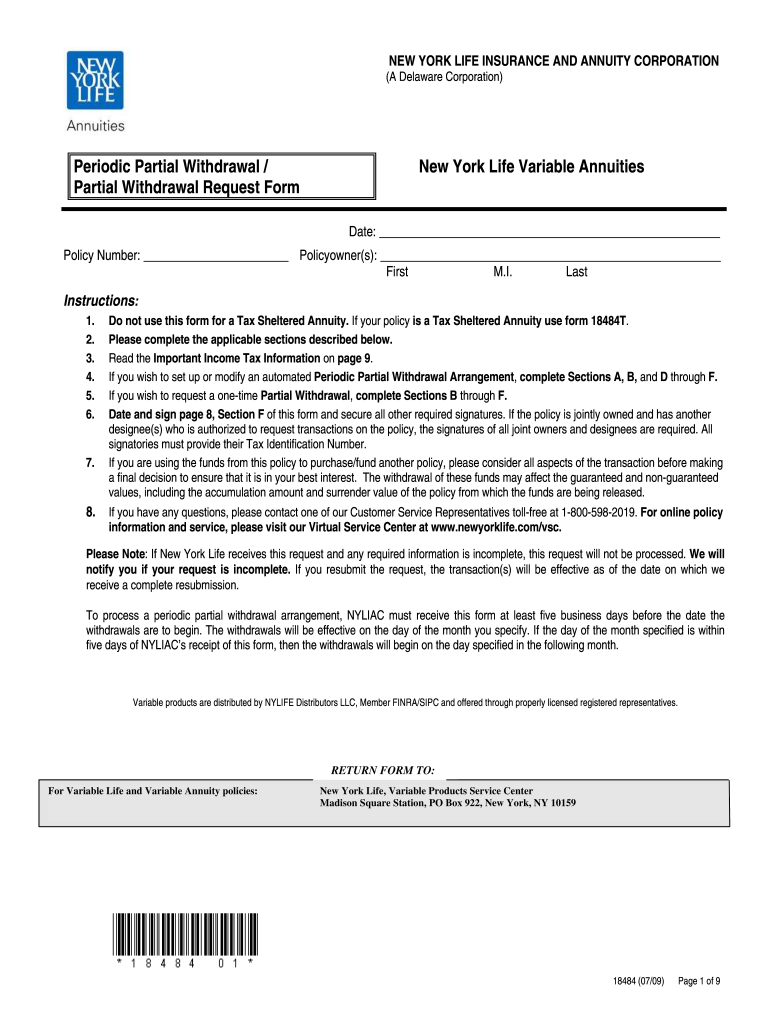

This option is not available for New York Life Access Variable Annuity policies. The Required Minimum Distribution RMD. For New York Life Longevity Benefit Variable Annuity policyowner s please consider the following provision when selecting a PPW arrangement. NEW YORK LIFE INSURANCE AND ANNUITY CORPORATION A Delaware Corporation Periodic Partial Withdrawal / Partial Withdrawal Request Form New York Life Variable Annuities Date Policy Number Policyowner s First M. RETURN FORM TO For Variable...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ny life 18484 variable download form

Edit your new york life 18484 partial template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new york life 18484 print form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new york life 18484 online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit new york life 18484. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY Life 18484 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out new york life 18484

How to fill out NY Life 18484

01

Start by obtaining the NY Life form 18484 from the New York Life website or your agent.

02

Read the instructions carefully before filling out the form.

03

Fill in your personal information, including your name, address, and contact details in the designated fields.

04

Provide information about your insurance policy number, if applicable.

05

Complete any required sections regarding beneficiaries or coverage details.

06

Review the information you have entered to ensure accuracy.

07

Sign and date the form at the bottom where indicated.

08

Submit the completed form as instructed, either online or by mailing it to the designated address.

Who needs NY Life 18484?

01

Individuals seeking to apply for a life insurance policy with New York Life.

02

Existing policyholders who need to make changes to their current insurance plan.

03

Beneficiaries of a New York Life policy who are filing a claim.

Fill

form

: Try Risk Free

People Also Ask about

How much does a $100 000 annuity pay per month?

How much does a $100,000 annuity pay per month? Our data revealed that a $100,000 annuity would pay between $448 and $1,524 monthly for life if you use a lifetime income rider. The payments are based on the age you buy the annuity contract and the time before taking the money.

How does variable annuity work?

A variable annuity is a contract between you and an insurance company, under which the insurer agrees to make periodic pay- ments to you, beginning either immediately or at some future date. You purchase a variable annuity contract by making either a single purchase payment or a series of purchase payments.

How do I withdraw money from New York Life?

You can receive your cash value on an annual or monthly basis through an automatic deposit into your bank account or in the form of a check. Loans or surrenders will reduce the cash value and death benefit.

What is a variable annuity life insurance policy?

What Is A Variable Annuity? A variable annuity is a contract between you and an insurance company. It serves as an investment account that may grow on a tax-deferred basis and includes certain insurance features, such as the ability to turn your account into a stream of periodic payments.

How does a variable annuity pay?

A variable annuity has two phases: an accumulation phase and a payout (annuitization) phase. During the accumulation phase, you make purchase payments. The amount of the purchase payments that go into the account may be less than you paid because fees were taken out of the purchase payments.

At what age can you withdraw from annuity without penalty?

To avoid owing penalties to the IRS, wait to withdraw until you are 59 ½ and set up a systematic withdrawal schedule. What is the free annuity withdrawal provision? Many, but not all, insurance companies allow you to withdraw up to 10% of your funds prior to the end of the surrender period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get new york life 18484?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the new york life 18484. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for the new york life 18484 in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your new york life 18484 and you'll be done in minutes.

How do I complete new york life 18484 on an Android device?

Complete your new york life 18484 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is NY Life 18484?

NY Life 18484 is a specific form used by New York Life Insurance Company for reporting certain insurance-related information.

Who is required to file NY Life 18484?

Individuals and entities who have certain insurance transactions or policies with New York Life Insurance Company are required to file NY Life 18484.

How to fill out NY Life 18484?

To fill out NY Life 18484, you need to provide personal identification information, details about the insurance policy or transaction, and any other required information as specified on the form.

What is the purpose of NY Life 18484?

The purpose of NY Life 18484 is to catalog and report specific insurance transactions and ensure compliance with state regulations regarding insurance reporting.

What information must be reported on NY Life 18484?

Information that must be reported includes policyholder details, policy numbers, transaction dates, amounts involved, and any relevant notes specified by New York Life Insurance Company.

Fill out your new york life 18484 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New York Life 18484 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.