Get the free Health Insurance Proposal Form

Show details

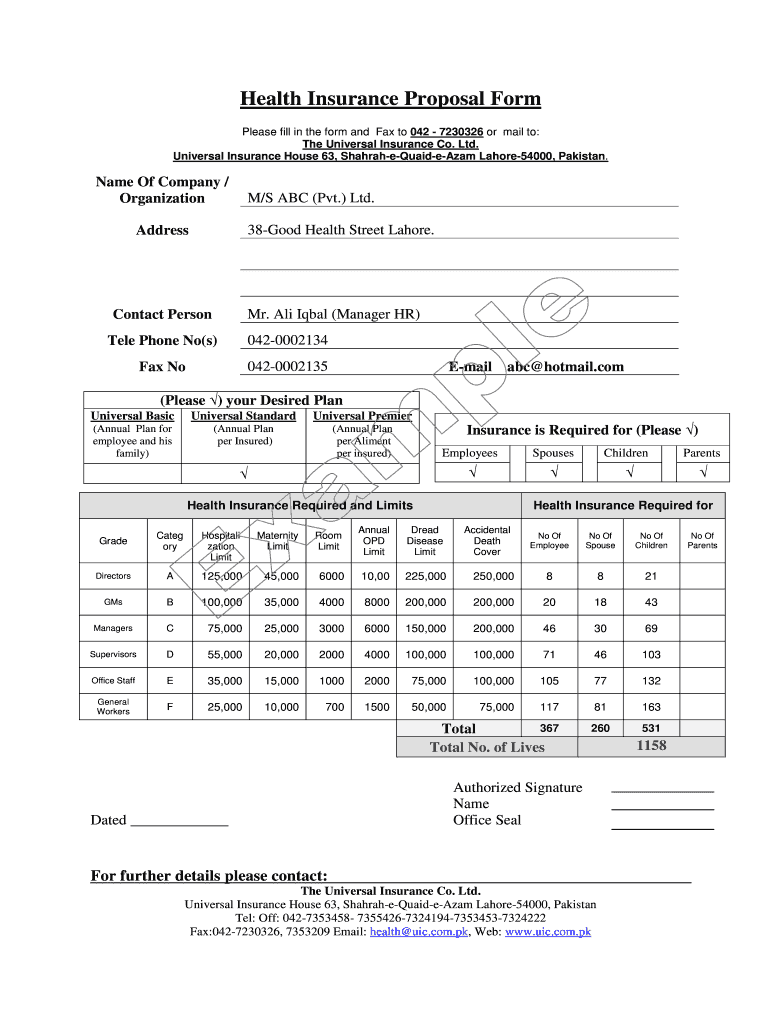

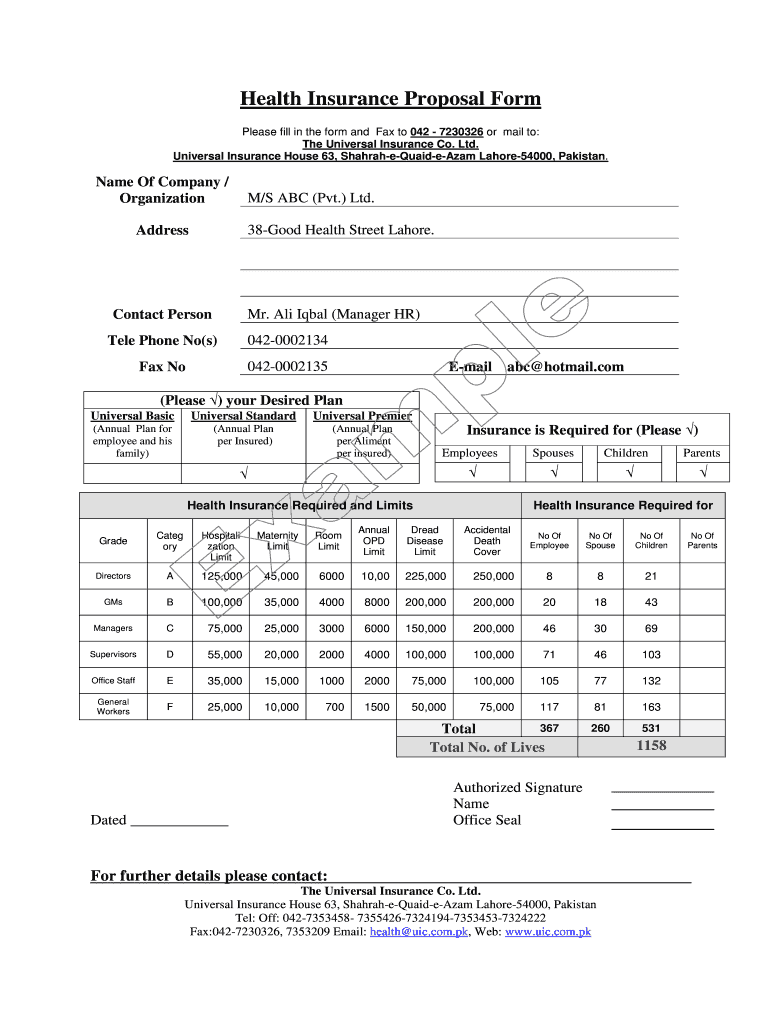

This document serves as a proposal form for health insurance with options for employees and their families, detailing coverage limits and required information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign health insurance proposal form

Edit your health insurance proposal form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your health insurance proposal form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit health insurance proposal form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit health insurance proposal form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out health insurance proposal form

How to fill out Health Insurance Proposal Form

01

Gather necessary personal information such as name, address, and contact details.

02

Provide details about any dependents you want to include in the insurance.

03

Indicate your preferred level of coverage and type of plan.

04

Fill out any medical history questions accurately.

05

Provide information about your employment and income details if required.

06

Review the completed form for accuracy and completeness.

07

Submit the form as instructed, whether online or in person.

Who needs Health Insurance Proposal Form?

01

Individuals seeking health coverage for themselves or their families.

02

Employees enrolling in employer-sponsored health plans.

03

Self-employed individuals looking for private health insurance.

04

Students needing health insurance for college.

05

Anyone seeking to switch or renew their existing health insurance plan.

Fill

form

: Try Risk Free

People Also Ask about

What is the content of insurance proposal form?

IN THE ABSENCE OF SUCH GUIDELINES, the following format, including a cover/title page, abstract, table of contents, introduction/statement of need, description of proposed research, biographical sketch, current and pending, facilities and equipment, and budget, may be useful.

What are proposal forms in insurance?

A proposal form is a formal application document that an individual fills out when applying for an insurance policy. This form is used by insurance companies to gather detailed information about the prospective policyholder.

What is the difference between an insurance policy and a proposal?

An insurance proposal is a document that provides critical personal information on the potential client so that the insurance underwriters can best provide the necessary coverage. An insurance policy is an actual contract that details the insurance coverage and the agreement between the insured and the insurer.

What should be used to create an insurance proposal?

Schedule: An outline, usually in table form, of the key areas of coverage, the value insured and the excess, where applicable. Description of the proposed coverage: Further detail on the areas of coverage, situations and items covered by the policy. Exclusions: A clear description of what isn't covered by the policy.

What is the purpose of a proposal form?

Proposal forms are the foundation of the application process for Professional Indemnity insurance. These forms serve as a means for professionals to provide detailed information about their business practices, operations, and risk exposures to insurance providers, allowing them to accurately assess the risk exposure.

How to write a proposal for insurance?

Creating a comprehensive insurance proposal involves several key sections, which may or may not include: Cover letter and title page. An executive or client summary. Summary of benefits. Coverage details, costs, and policies. Detailed description of products and services. A section about your business or organization.

What is the primary purpose of the proposal from in an insurance contract?

Proposal Form Purpose and Importance Risk Assessment: The primary purpose of an insurance proposal form is to collect comprehensive information that allows the insurer to assess the level of risk they would be taking on by providing coverage to the applicant.

Who fills the proposal form?

It needs to be completed by the proposer who may seek the assistance of a life insurance advisor to fill it up. A proposal form seeks basic information of the proposer and the life assured. This includes the name, age, address, education and employment details of the proposer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Health Insurance Proposal Form?

The Health Insurance Proposal Form is a document submitted by individuals seeking health insurance coverage, providing essential personal and medical information to the insurer.

Who is required to file Health Insurance Proposal Form?

Any individual or entity looking to purchase health insurance must file a Health Insurance Proposal Form to initiate the underwriting process.

How to fill out Health Insurance Proposal Form?

To fill out the form, provide accurate personal details, such as your name, age, contact information, and medical history, and answer all questions truthfully to ensure proper evaluation by the insurer.

What is the purpose of Health Insurance Proposal Form?

The purpose of the Health Insurance Proposal Form is to collect necessary information to assess the risk, determine eligibility, and calculate premiums for health insurance coverage.

What information must be reported on Health Insurance Proposal Form?

The form typically requires personal details like name, date of birth, address, employment information, medical history, and any pre-existing health conditions that may impact the coverage.

Fill out your health insurance proposal form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Health Insurance Proposal Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.