AR DFA AR8453-OL 2011 free printable template

Show details

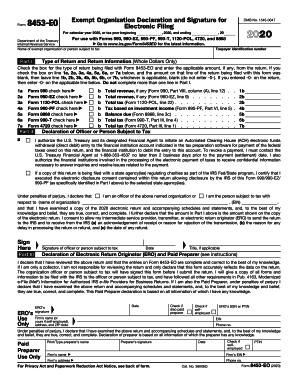

Sign Here Your Signature Date Spouse s Signature Retain this form with your tax return. This form may be needed when submitting documentation to the State of Arkansas for Tax Year 2011 see instructions AR8453-OL Rev 8/23/2011 SPECIAL INFORMATION LINE INSTRUCTIONS TAX DUE Name Address and Social Security Number If you choose to file your State of Arkansas tax return by using one of the online web providers you are required to complete the AR8453-O...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AR DFA AR8453-OL

Edit your AR DFA AR8453-OL form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AR DFA AR8453-OL form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AR DFA AR8453-OL online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AR DFA AR8453-OL. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR DFA AR8453-OL Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AR DFA AR8453-OL

How to fill out AR DFA AR8453-OL

01

Begin with your personal information at the top of the form, including your name, address, and Social Security number.

02

Indicate the tax year for which you are filing the form.

03

Fill in the details of your income sources, ensuring all amounts are accurately reported.

04

Provide information on any deductions or credits you are claiming, including necessary documentation if applicable.

05

If you are filing jointly, ensure both parties' information is included and sign the form accordingly.

06

Review the completed form for accuracy before submission.

07

Submit the form according to the instructions provided, either electronically or by mail.

Who needs AR DFA AR8453-OL?

01

Individuals or couples who have taxable income and need to report their financial information to the Arkansas Department of Finance and Administration.

02

Taxpayers who are claiming deductions or credits specific to Arkansas.

03

Anyone required to file a state tax return in Arkansas.

Fill

form

: Try Risk Free

People Also Ask about

Where to get Arkansas state income tax forms?

State Tax Forms The Arkansas Department of Finance and Administration distributes Arkansas tax forms and instructions in the following ways: In Person: Arkansas Revenue Office, 206 Southwest Drive, Jonesboro, AR. Phone: Arkansas Revenue Office, 870-932-2716 (Jonesboro) 1-800-882-9275 (Little Rock)

What is the Arkansas Inflationary Relief Income Tax Credit?

Inflationary relief income tax credit The nonrefundable tax credit is worth up to $150 for individual taxpayers. Those with net incomes up to $87,000 are eligible for the full tax credit. The tax credit amount gradually decreases for those who make more than $87,000 and up to $101,000.

What happens if my federal tax return is accepted but state is rejected?

With my federal return accepted and my state return rejected, can I still expect a direct deposit of my federal refund money? Yes, the IRS will deposit your federal refund even if your state return was rejected.

What is a form AR8453 OL?

If you choose to electronically file your State of Arkansas tax return by using one of the online web providers, you are required to complete the form AR8453-OL.

Can I get all my tax forms online?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

Does Arkansas have a state tax form?

These 2021 forms and more are available: Arkansas Form 1000F/1000NR – Personal Income Tax Return for Residents and Nonresidents. Arkansas Form 1000-CO – Check Off Contributions Schedule. Arkansas Form AR1000ADJ – Schedule of Adjustments.

How do I find my 1099 online?

Sign in to your my Social Security account to get your copy Creating a free my Social Security account takes less than 10 minutes, lets you download your SSA-1099 or SSA-1042S and gives you access to many other online services.

Do I need to file an Arkansas state tax return?

Non-residents and part-year residents who have received income from any Arkansas source must file an Arkansas income tax return regardless of their individual income level. A non-resident is defined as someone who does not maintain a home or other residence in Arkansas.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete AR DFA AR8453-OL online?

Easy online AR DFA AR8453-OL completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an electronic signature for signing my AR DFA AR8453-OL in Gmail?

Create your eSignature using pdfFiller and then eSign your AR DFA AR8453-OL immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out the AR DFA AR8453-OL form on my smartphone?

Use the pdfFiller mobile app to fill out and sign AR DFA AR8453-OL. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is AR DFA AR8453-OL?

AR DFA AR8453-OL is a form used in the state of Arkansas for the electronic filing of individual income tax returns, specifically for taxpayers who wish to authorize an electronic return originator.

Who is required to file AR DFA AR8453-OL?

Individuals who are filing their Arkansas state income tax returns electronically through a paid preparer or an electronic return originator are required to file AR DFA AR8453-OL.

How to fill out AR DFA AR8453-OL?

To fill out AR DFA AR8453-OL, taxpayers need to provide their personal information, such as name, address, social security number, and the signature of the taxpayer and preparer, along with the date.

What is the purpose of AR DFA AR8453-OL?

The purpose of AR DFA AR8453-OL is to serve as a signature document to authenticate the electronic filing of an Arkansas state income tax return.

What information must be reported on AR DFA AR8453-OL?

The information that must be reported on AR DFA AR8453-OL includes the taxpayer's name, address, social security number, the preparer's information, and signatures of both the taxpayer and the preparer if applicable.

Fill out your AR DFA AR8453-OL online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AR DFA ar8453-OL is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.