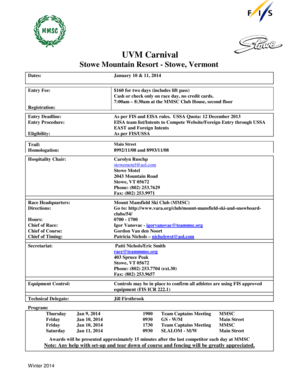

Get the free Public Service Company Property Tax Returns

Show details

This document outlines the new process for filing Public Service Company Property Tax Returns for the tax year 2012. It informs public service companies that the Kentucky Department of Revenue will

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign public service company property

Edit your public service company property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your public service company property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing public service company property online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit public service company property. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out public service company property

How to fill out Public Service Company Property Tax Returns

01

Obtain the Public Service Company Property Tax Return form from the appropriate tax authority.

02

Gather necessary documents, including financial statements and property descriptions.

03

Fill in the company name, address, and tax identification number at the top of the form.

04

Provide a detailed list of all property owned, including location, type, and estimated value.

05

Calculate the total assessed value of the property as per state guidelines.

06

Fill out any additional sections addressing exemptions or special considerations.

07

Double-check all entries for accuracy and completeness.

08

Sign and date the form to certify its correctness.

09

Submit the completed form to the designated tax authority by the deadline.

Who needs Public Service Company Property Tax Returns?

01

Public service companies such as utilities, railroads, and telecommunications providers.

02

Businesses operating within states that require property tax returns for regulated property.

03

Tax assessors and local governments needing property value information for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

Is property tax refund considered income?

If you received a refund or rebate in of real estate taxes you paid in an earlier year, don't reduce your deduction by this amount. Instead, you must include the refund or rebate in income on Schedule 1 (Form 1040), line 8, if you deducted the real estate taxes in the earlier year and the deduction reduced your tax.

Do property taxes get reported to the IRS?

Taxes paid through escrow accounts This amount is often shown on your Form 1098 where it is reported to you and to the Internal Revenue Service (IRS).

Can a tax refund be considered income?

Federal tax credits and refunds are exempt as a resource for 12 months from the date of receipt. This exemption applies to both applicants and recipients. They are NOT considered as income.

Does Ohio have a personal property tax return?

Tangible Personal Property Tax Phase Out The tangible personal property tax was replaced with the Commercial Activity Tax (CAT). The CAT is an annual tax imposed on the privilege of doing business in Ohio, measured by gross receipts from business activities in Ohio.

Do Brits pay property taxes?

The amount of property tax you have to pay in the UK can vary significantly depending on several factors, including the property's value, location, and individual circumstances.

Why does my 1098 not show property taxes paid?

Your 1098 may show that no taxes were disbursed for one of the following reasons: the taxes were paid at closing, the taxes were not paid from the escrow account in the year the 1098 is reporting on, or the loan was paid off before the taxes were due.

Is a tax refund an asset or income?

In some cases, tax refunds may also be considered taxable income, especially if you previously deducted state or local taxes from your federal return. If you did, any state tax refund you receive could be taxable.

Are rebates considered taxable income?

Compensation resulting in a reduced cost to you The rebate payment is not subject to tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Public Service Company Property Tax Returns?

Public Service Company Property Tax Returns are forms that public service companies are required to submit to report their assessed value for taxation purposes on property used for providing utility services.

Who is required to file Public Service Company Property Tax Returns?

Public service companies that own property used in the business of providing utility services, such as electricity, gas, water, and telecommunications, are required to file Public Service Company Property Tax Returns.

How to fill out Public Service Company Property Tax Returns?

To fill out Public Service Company Property Tax Returns, companies should gather relevant financial and property information, complete the necessary forms accurately, report the assessed values, and submit them to the appropriate tax authority by the specified deadline.

What is the purpose of Public Service Company Property Tax Returns?

The purpose of Public Service Company Property Tax Returns is to ensure that public service companies are taxed fairly on the property they own and use to provide services, contributing to local and state revenues.

What information must be reported on Public Service Company Property Tax Returns?

The information that must be reported on Public Service Company Property Tax Returns includes details about the types of property owned, its assessed values, the nature of the business operation, and any applicable exemptions or deductions.

Fill out your public service company property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Public Service Company Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.