ZA SARS DA 185.D 2012 free printable template

Show details

DA 185. D NOT IN ACTION OF REGISTERED AGENT 1. NOTES FOR THE COMPLETION OF FORM 1. Please indicate with an X in the appropriate block(s) whichever is applicable 2. Please reflect the relevant customs

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ZA SARS DA 185D

Edit your ZA SARS DA 185D form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ZA SARS DA 185D form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ZA SARS DA 185D online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ZA SARS DA 185D. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ZA SARS DA 185.D Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ZA SARS DA 185D

How to fill out ZA SARS DA 185.D

01

Gather the necessary documents including proof of income and identity.

02

Download the ZA SARS DA 185.D form from the official SARS website.

03

Fill in personal details such as name, ID number, and contact information.

04

Provide details of the income earned and any deductions applicable.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form at the designated section.

07

Submit the form to the local SARS office or via the SARS online platform.

Who needs ZA SARS DA 185.D?

01

Individuals or entities who are required to declare their income for tax purposes.

02

Taxpayers seeking to claim deductions or credits against their income.

03

Anyone needing to rectify their tax information with SARS.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my import code?

Look for the Import Code located on your W-2 form.

How long does it take to get an importers code?

The validity period of the Importers Code is indefinite. There is no fee to register for the Importers Code and you should receive the Importers Code from SARS in approximately ten (10) business days.

How do I get an importer number in Canada?

Obtain a Business Number This import/export account is free of charge and can usually be obtained in a matter of minutes. To register for a BN or add an import/export RM account identifier to an existing BN : Call the CRA 's Business Window at 1-800-959-5525. Visit the CRA 's Business Registration Online (BRO)

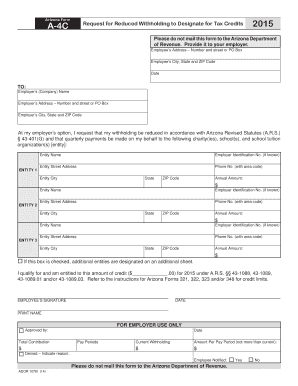

What is a DA185 form?

APPLICATION FORM: REGISTRATION / LICENSING OF. CUSTOMS AND EXCISE CLIENTS. For official use.

How do I register for import and export with SARS?

How to register as a Local Importer Fill in the required application forms and relevant annexure(s): DA 185 – Application form – Registration and licensing of Customs and Excise Clients – External Form. Send all forms and supporting documents to the nearest Customs and/or Excise office. Pay the security if applicable.

Do I need an import license to buy goods from China?

Do I Need a Permit to Import from China? There is no general import permit for importing products from China. However, you might need a permit to import from a federal agency certain goods from China. Different federal agencies oversee different imported products and requirements can vary.

What is the importer code?

I – What is an Importer / Exporter Customs Code: It is a official code that is issued by Dubai Customs for UAE businesses to import or export goods into and from the UAE. It is a code which will link your shipments with your UAE trade license.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ZA SARS DA 185D in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign ZA SARS DA 185D and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send ZA SARS DA 185D to be eSigned by others?

Once your ZA SARS DA 185D is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Where do I find ZA SARS DA 185D?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the ZA SARS DA 185D in seconds. Open it immediately and begin modifying it with powerful editing options.

What is ZA SARS DA 185.D?

ZA SARS DA 185.D is a form used by the South African Revenue Service (SARS) for individuals or entities to declare specific sources of income or details of investments for tax purposes.

Who is required to file ZA SARS DA 185.D?

Individuals or entities that have income or investment details that need to be reported to SARS, typically those with foreign investments or specific financial activities, are required to file ZA SARS DA 185.D.

How to fill out ZA SARS DA 185.D?

To fill out ZA SARS DA 185.D, gather all relevant financial documentation, complete the form by providing accurate details about your income and investments, and ensure all figures are correct before submitting it to SARS.

What is the purpose of ZA SARS DA 185.D?

The purpose of ZA SARS DA 185.D is to provide SARS with necessary details regarding an individual's or entity’s financial activities, ensuring compliance with tax regulations and accurate income assessment.

What information must be reported on ZA SARS DA 185.D?

Information that must be reported includes details of all income sources, investment earnings, foreign income, and any other financial disclosures required by SARS.

Fill out your ZA SARS DA 185D online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ZA SARS DA 185d is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.