Get the free Equity Linked Living Annuity Application Form - psgam co

Show details

Este documento es un formulario de solicitud para la inversión en una anualidad vinculada a la equidad, emitido por PSG Asset Management, incluyendo detalles sobre el proceso de inversión y requisitos

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign equity linked living annuity

Edit your equity linked living annuity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your equity linked living annuity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing equity linked living annuity online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit equity linked living annuity. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

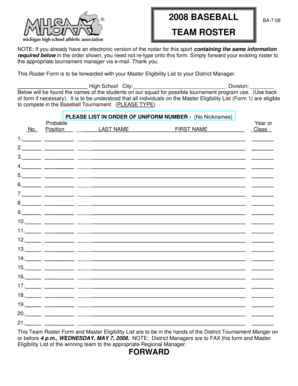

How to fill out equity linked living annuity

How to fill out Equity Linked Living Annuity Application Form

01

Begin by collecting all necessary personal information including your full name, ID number, and contact details.

02

Provide your financial details, including your current income, expenses, and any existing investments.

03

Specify your investment goals and risk tolerance to help determine the appropriate equity linked living annuity options.

04

Indicate how you would like the payments to be structured, including frequency and amount.

05

Review and agree to any terms and conditions outlined in the application form.

06

Sign and date the application form, ensuring all information is accurate and complete.

07

Submit the application form along with any required supporting documents to the relevant financial institution.

Who needs Equity Linked Living Annuity Application Form?

01

Individuals planning for retirement who wish to convert their retirement savings into a regular income stream.

02

People who want to benefit from market-linked investment opportunities while securing a steady income.

03

Investors seeking more flexible retirement planning options that allow them to adjust their income as needed.

Fill

form

: Try Risk Free

People Also Ask about

What happens to a living annuity on death?

Your living annuity will only fall within your deceased estate and be subject to your Will if you do not nominate any beneficiary(ies) or if your beneficiary(ies) cannot be traced. Get valuable investment insights as well as access to webinars and podcasts on tax, retirement, and strategies to grow your wealth.

Can I transfer my living annuity to another provider?

Answer: The living annuity is a post-retirement product. You can transfer your current living annuity to another provider, or you can use the proceeds from your retirement fund to buy a living annuity. It is not clear from your question what product you are currently invested in (ie a pre or post-retirement product).

Can you change your annuity provider?

Can I change my mind once I've bought an annuity? Providers may offer a short cooling-off period where you can cancel. But after that, once you have purchased an annuity you cannot normally cancel it, change to a different provider or get your money back.

Can you withdraw all your money from a living annuity?

Can I cash out my Living Annuity? The short answer is no. Once you have entered into your living annuity, you are only able to withdraw funds ing to the regulations of the annuity. To withdraw a larger amount from your fund, your only option is to increase your drawdown rate, which has a maximum of 17.5%.

Can I move an annuity from one company to another?

Yes, deferred annuities that have not been annuitized can be transferred using the IRS 1035 rule without penalty. Immediate annuities cannot be transferred. Neither can deferred annuities that have been annuitized. Annuities are a powerful way to prepare yourself for retirement.

Can a living annuity be transferred?

Answer: The living annuity is a post-retirement product. You can transfer your current living annuity to another provider, or you can use the proceeds from your retirement fund to buy a living annuity. It is not clear from your question what product you are currently invested in (ie a pre or post-retirement product).

What are the disadvantages of a living annuity?

What are the risks involved? The income you choose to draw from your living annuity may be too high, causing your capital to reduce over time. This means that your future income could fail to keep pace with inflation or even that you outlive your investment. Choosing your own investment portfolio brings inherent risks.

What are the disadvantages of a living annuity?

The main disadvantages of a Living Annuity include exposure to market risk, which can cause fluctuations in your investment value. Unlike a Life Annuity, a Living Annuity doesn't provide a guaranteed income for life. If withdrawals exceed investment growth, there's a risk of depleting your funds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Equity Linked Living Annuity Application Form?

The Equity Linked Living Annuity Application Form is a document that individuals use to apply for a living annuity product that is linked to investments in equities. This form captures necessary personal information, investment preferences, and other relevant details needed to facilitate the setup of the annuity.

Who is required to file Equity Linked Living Annuity Application Form?

Individuals looking to invest in an Equity Linked Living Annuity must file this application form. Typically, this includes retirees seeking regular income from their investments or anyone transitioning from a lump sum payout to an annuity structure.

How to fill out Equity Linked Living Annuity Application Form?

To fill out the form, applicants should provide personal details such as name, address, identification number, and financial information. They need to indicate their investment preferences, including risk appetite and selected equity link options. It is important to review the form for accuracy before submission.

What is the purpose of Equity Linked Living Annuity Application Form?

The purpose of the Equity Linked Living Annuity Application Form is to formalize the application process for individuals wishing to invest in a living annuity linked to equity markets, thereby ensuring that the financial institution has all relevant information to process the application and set up the investment appropriately.

What information must be reported on Equity Linked Living Annuity Application Form?

The reported information includes the applicant's personal details (name, address, and ID), income details, investment preferences, details about beneficiaries, risk profile, and choice of equity investments. This comprehensive information helps ensure the annuity meets the applicant's financial needs and goals.

Fill out your equity linked living annuity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Equity Linked Living Annuity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.