Get the free CREDIT INSURANCE PROPOSAL FORM - COMBINED

Show details

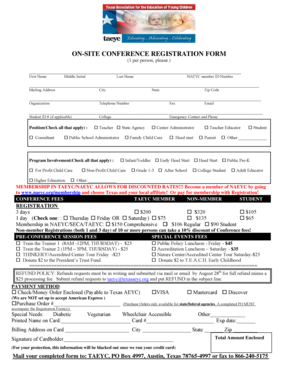

This document is a detailed proposal form for companies seeking credit insurance, containing sections about business information, turnover analysis, debtor information, and broker nomination.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit insurance proposal form

Edit your credit insurance proposal form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit insurance proposal form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit insurance proposal form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit credit insurance proposal form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit insurance proposal form

How to fill out CREDIT INSURANCE PROPOSAL FORM - COMBINED

01

Begin with your personal information: fill in your name, address, and contact details.

02

Provide your business information: include the name of your business, type of business, and registration details.

03

Specify the nature of the credit coverage you need: indicate if it's for accounts receivable, inventory, or other specific types.

04

Detail the amount of credit you wish to insure: this should be an estimate of the total credit exposure.

05

Include any relevant financial information: attach recent financial statements or reports that showcase your business's financial health.

06

List any existing insurance coverage: detail any existing policies that may affect coverage or claims.

07

Specify any particular risks or situations you want to be covered: mention any specific industries or payment terms.

08

Review and sign the form: ensure all details are correct, and sign the form to confirm your application.

09

Submit the form according to the provided instructions: either online, by email, or through traditional postal service.

Who needs CREDIT INSURANCE PROPOSAL FORM - COMBINED?

01

Businesses that extend credit to customers and wish to protect themselves from potential losses.

02

Companies involved in international trade seeking to insure their receivables.

03

Small to medium enterprises looking for ways to manage credit risk and enhance financial stability.

04

Organizations with significant accounts receivable who want to secure their risk against insolvency of clients.

Fill

form

: Try Risk Free

People Also Ask about

What is included in the proposal form of insurance?

Definition: Proposal form is the most important and basic document required for life insurance contract between the insured and insurance company. It includes the insured's fundamental information like address, age, name, education, occupation etc. It also includes the person's medical history.

What is the difference between letter of credit and export credit insurance?

To put it simply, the key difference between a letter of credit and export credit insurance can be summarized as follows. While a letter of credit is used to secure payment from the customer to the exporter, export credit insurance lets an exporter recuperate funds if the customer fails to pay.

What is letter of credit in insurance?

LOCs are frequently used for risk financing purposes to collateralize monies owed by an insured under various cash flow programs such as incurred but not paid losses in paid loss retrospective rating programs, fulfillment of the capitalization requirements of captives, satisfaction of the security requirements of the

What is the difference between LC and LTR?

A Letter of Credit assures the sellers of payment when issued an LC ing to stipulated terms while a Trust Receipt Loan is a form of financing for the buyers whereby the bank makes an advance to the buyers to settle an import bill.

What is export credit insurance?

Export credit insurance (ECI) protects an exporter of products and services against the risk of non-payment by a foreign buyer.

How does credit insurance work?

A proposal form is the form completed by the policyholder when applying for insurance. You will need to fill in information about the risk you are insuring e.g. the rebuild cost of your house or type of car you own.

What is the difference between letter of credit and credit insurance?

Trade credit insurance is a continued partnership, not just one bank-assisted transaction. It covers multiple transactions and multiple customers, whereas a letter of credit covers single transactions in a set time period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CREDIT INSURANCE PROPOSAL FORM - COMBINED?

The CREDIT INSURANCE PROPOSAL FORM - COMBINED is a document used by businesses to apply for credit insurance coverage. It combines various aspects of credit risk assessment to provide insurers with the necessary information to evaluate the application.

Who is required to file CREDIT INSURANCE PROPOSAL FORM - COMBINED?

Any business entity seeking credit insurance coverage, including manufacturers, wholesalers, and retailers, is required to file the CREDIT INSURANCE PROPOSAL FORM - COMBINED.

How to fill out CREDIT INSURANCE PROPOSAL FORM - COMBINED?

To fill out the CREDIT INSURANCE PROPOSAL FORM - COMBINED, applicants should provide accurate business details, including financial statements, credit history, customer information, and any relevant data that may impact the credit risk assessment.

What is the purpose of CREDIT INSURANCE PROPOSAL FORM - COMBINED?

The purpose of the CREDIT INSURANCE PROPOSAL FORM - COMBINED is to allow businesses to request credit insurance by providing insurers with the necessary information to assess the credit risk and determine coverage options.

What information must be reported on CREDIT INSURANCE PROPOSAL FORM - COMBINED?

The information that must be reported includes company details, financial statements, accounts receivable, customer credit limits, payment history, and any other relevant business data to assess creditworthiness.

Fill out your credit insurance proposal form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Insurance Proposal Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.