Get the free Financial Advisor Application Form - psgam co

Show details

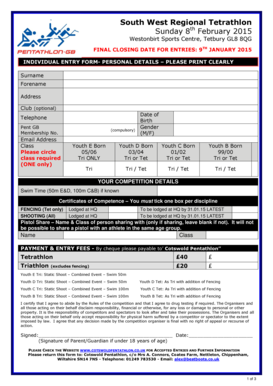

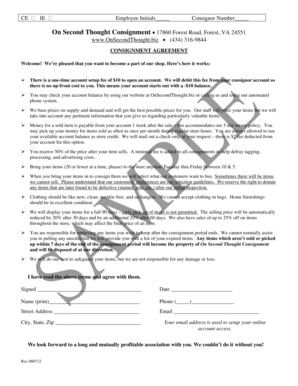

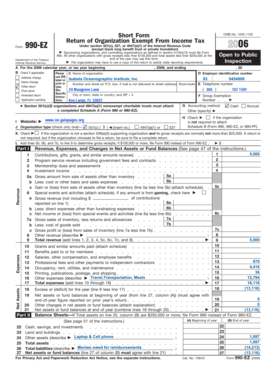

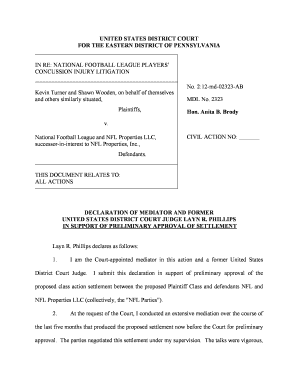

This document serves as an application for financial advisory services, detailing the necessary criteria, additional requirements, and information needed for the submission of the application. It

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial advisor application form

Edit your financial advisor application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial advisor application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing financial advisor application form online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit financial advisor application form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial advisor application form

How to fill out Financial Advisor Application Form

01

Begin with your personal information: Fill in your full name, address, phone number, and email.

02

Provide your educational background: List your highest degree, the institution attended, and year of graduation.

03

Detail your professional experience: Include your current and previous job titles, companies worked for, and duration of employment.

04

Disclose any relevant certifications: List any financial certifications or licenses you hold (e.g., CFP, CFA).

05

Complete the financial history section: Provide information about your personal finances, investment experience, and any previous financial advising operations.

06

Answer the background questions: Respond honestly about any legal issues, disciplinary actions, or bankruptcies.

07

Review and sign the application: Double-check all entries for accuracy and sign where required.

Who needs Financial Advisor Application Form?

01

Individuals seeking professional financial guidance for investments, retirement planning, or wealth management.

02

New financial advisors applying for licenses and certifications in the financial industry.

03

Firms hiring financial advisors to assess candidate qualifications and backgrounds.

Fill

form

: Try Risk Free

People Also Ask about

What is the average financial advisor fee?

On average, you can expect to pay between 0.5% and 2% of your total assets under management annually, $150 to $400 per hour, or a flat fee ranging from $1,000 to $3,000 for a comprehensive financial plan.

What is a fair percentage to pay a financial advisor?

What is a typical financial advisor fee? It depends on how the advisor charges, but a common fee is 1-2% of assets under management each year. Some advisors charge less as your portfolio grows, while others may offer flat fees or hourly rates.

Is 2% fee high for a financial advisor?

Below are five common ways to market yourself as a financial advisor. Market With Your Own Website. Consider an Automated Marketing Platform. Build a Social Media Presence. Start an Email Newsletter. Try Direct Mail. Host a Webinar, Masterclass or Workshop.

Can financial advisors make $500,000 a year?

This is what you would expect to earn while you are building your book of business. Most financial advisors and planners that I know who have become established are earning $150k to $300, and there are of course the really successful ones who make $500k or more a year.

What is a red flag for a financial advisor?

A financial advisor should help you make informed decisions, but there are warning signs of a bad financial advisor that could indicate when they are doing otherwise. These signs generally include pushing unsuitable products, lacking transparency about fees, or being unresponsive to your questions or concerns.

What is a red flag for a financial advisor?

A financial advisor should help you make informed decisions, but there are warning signs of a bad financial advisor that could indicate when they are doing otherwise. These signs generally include pushing unsuitable products, lacking transparency about fees, or being unresponsive to your questions or concerns.

Is 1% fee for financial advisor too much?

The short answer is yes. Ken Robinson, certified financial planner at Practical Financial Planning, says while a 1% fee may be common, advisers who charge based on AUM are increasingly scaling down from 1% at lower thresholds in the past. But if you get a lot of service, the 1% fee isn't always a bad thing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Financial Advisor Application Form?

The Financial Advisor Application Form is a document used by individuals seeking to become licensed financial advisors or to apply for positions within financial advisory firms.

Who is required to file Financial Advisor Application Form?

Individuals who wish to work as financial advisors, those applying for certification or licensing in the financial advisory field, and professionals transitioning into advisory roles are typically required to file this form.

How to fill out Financial Advisor Application Form?

To fill out the Financial Advisor Application Form, applicants should gather necessary personal information, educational background, work history, and any relevant certifications or licenses, then complete the form by providing accurate and honest responses to all required sections.

What is the purpose of Financial Advisor Application Form?

The purpose of the Financial Advisor Application Form is to collect information about the applicant's qualifications, background, and intentions to assess their suitability for a role within the financial advisory profession.

What information must be reported on Financial Advisor Application Form?

The Financial Advisor Application Form typically requires personal information, educational history, employment background, professional certifications, and disclosure of any legal or regulatory issues that may affect the applicant's ability to practice as a financial advisor.

Fill out your financial advisor application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Advisor Application Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.