Get the free PPS Investment Account Application Form

Show details

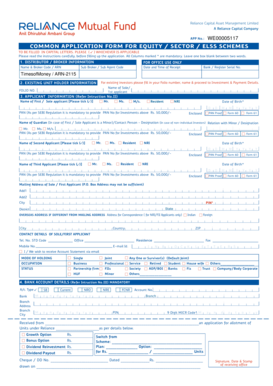

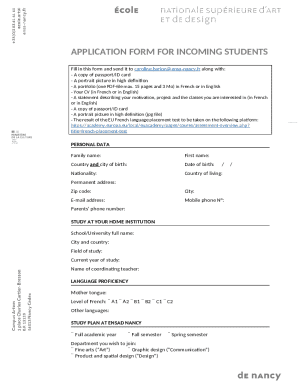

This document serves as an application form for opening a PPS Investment Account, providing detailed information required from the investor, including personal details, investment preferences, payment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pps investment account application

Edit your pps investment account application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pps investment account application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pps investment account application online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit pps investment account application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pps investment account application

How to fill out PPS Investment Account Application Form

01

Begin by downloading the PPS Investment Account Application Form from the official website.

02

Fill in your personal details, including your name, address, and contact information.

03

Provide your identification number or relevant tax identification information.

04

Select the type of investment account you wish to open and indicate your investment preferences.

05

Complete the financial position section, detailing your income, assets, and liabilities.

06

Read and acknowledge any terms and conditions associated with the account.

07

Sign and date the application form where indicated.

08

Submit the completed form along with any required documentation, such as proof of identity and address.

Who needs PPS Investment Account Application Form?

01

Individuals looking to invest their savings in growth-oriented financial products.

02

People seeking a structured approach to manage their investments.

03

Clients of PPS looking to use their investment platforms for portfolio management.

04

Those interested in retirement planning or long-term financial goals.

Fill

form

: Try Risk Free

People Also Ask about

How does the pps profit-share account work?

PPS is a mutual company and has no external shareholders. At PPS, our members (with qualifying products) share in all the profits. The operating profits and investment returns are shared each year in the form of allocations to the PPS Profit-Share Accounts of our members.

What is the registration number for PPS investments?

Professional Provident Society Investments (Pty) Ltd is a company duly incorporated ing to the Laws of the Republic of South Africa under Registration Number 2005/029098/07.

How does PPS investment work?

As a mutual company, PPS has no external shareholders and operates solely to add value to its members. The PPS operating profit (calculated on a portion of premiums and the investment growth thereon) is shared each year by means of profit allocations into these members' PPS Profit-Share Accounts.

Can I withdraw from PPS?

You may either make a full withdrawal or partial withdrawal from your Vested PPS Profit-Share Account. If the Rand value of your withdrawal is 95% or more of the value of your investments, we will withdraw 100% of your investment.

How do public pension funds invest?

How Pension Funds Invest Their Money. The traditional investing strategy for a pension fund is to split its assets among bonds, stocks, and real estate. An emerging trend is to put some money into alternative investments, in search of higher returns and greater diversity.

Is PPS a good investment?

PPS risk rates per month are def not the best on the market, but if you are a professional then factoring in profit share that make it is by far the best in the market.

How long does a pps withdrawal take?

All complete and valid instructions received after 14:00 will be processed on the next business day. Withdrawals with tax will be processed and finalised within a maximum of seven (7) business days and withdrawals without tax within five (5) business days.

What is a PPS investment account?

CIBC Personal Portfolio Services (PPS) A discretionary investment management service that offers a diversified approach to global asset allocation and access to investment managers from around the world. For investors with combined household investable assets of $100,000 or more. Learn more. Tax-Free Savings Accounts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PPS Investment Account Application Form?

The PPS Investment Account Application Form is a document used by individuals or entities to apply for an investment account with the PPS (Professional Provident Society) Investment platform.

Who is required to file PPS Investment Account Application Form?

Individuals or entities wishing to open a PPS Investment Account must file the PPS Investment Account Application Form to provide necessary personal and financial information.

How to fill out PPS Investment Account Application Form?

To fill out the PPS Investment Account Application Form, applicants should provide their personal information, financial details, and investment preferences as required by the form's sections and instructions.

What is the purpose of PPS Investment Account Application Form?

The purpose of the PPS Investment Account Application Form is to formally request the opening of an investment account and to gather the required information to assess the applicant's eligibility and investment goals.

What information must be reported on PPS Investment Account Application Form?

The PPS Investment Account Application Form typically requires information such as the applicant's name, contact details, identification number, financial status, investment experience, and any specific investment preferences.

Fill out your pps investment account application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pps Investment Account Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.