ZA Old Mutual Unit Trusts Selling Form 2006 free printable template

Show details

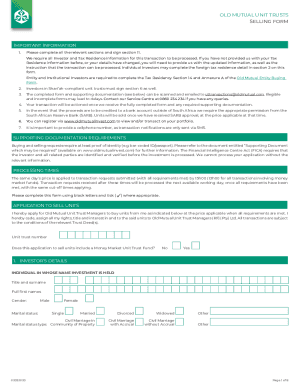

This selling form along with the necessary supporting documentation see page 2 can be submitted at any Old Mutual branch or faxed to 27 21 509 7100. In terms of the conditions of the relevant Trust Deed/s I hereby request Old Mutual Unit Trust Managers Ltd to purchase the units indicated below from me at the price applicable on the date that this form and the necessary supporting documentation see page 2 are received before 15h00 13h00 for the Money Market Fund by the above addressee. OLD...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ZA Old Mutual Unit Trusts Selling

Edit your ZA Old Mutual Unit Trusts Selling form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ZA Old Mutual Unit Trusts Selling form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ZA Old Mutual Unit Trusts Selling online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ZA Old Mutual Unit Trusts Selling. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ZA Old Mutual Unit Trusts Selling Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ZA Old Mutual Unit Trusts Selling

How to fill out ZA Old Mutual Unit Trusts Selling Form

01

Obtain the ZA Old Mutual Unit Trusts Selling Form from the official Old Mutual website or your financial advisor.

02

Fill in your personal details, including your full name, identification number, and contact information.

03

Provide the details of the unit trusts you wish to sell, such as fund name and number of units.

04

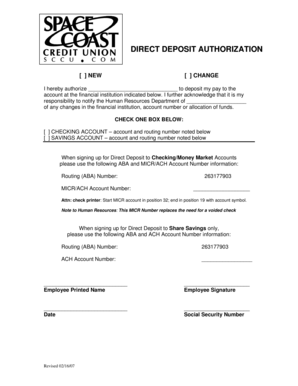

Indicate the payment method for the proceeds of the sale, including bank account details if necessary.

05

Review all information for accuracy to ensure there are no errors.

06

Sign and date the form to authorize the transaction.

07

Submit the form to Old Mutual through the specified method (email, postal service, or online submission).

Who needs ZA Old Mutual Unit Trusts Selling Form?

01

Investors who hold Old Mutual Unit Trusts and wish to sell their investments.

02

Individuals who need to liquidate their assets for financial reasons.

03

People looking to reallocate their investment portfolios.

Fill

form

: Try Risk Free

People Also Ask about

How long does a unit trust withdrawal take?

If a unit trust company receives your withdrawal instruction before their applicable cut-off times and provided all the relevant documentation is in order, the transaction will be processed on the same day.

How much does Old Mutual pay out?

What is Life Insurance? Old Mutual's Life Insurance is cover that pays a tax free single amount starting from R100 000 or a monthly payment from R3 000 when you die. Your loved ones can use the pay-out to cover expenses, such as a home loan, estate duty, ongoing living expenses or education costs.

How do I withdraw money from Old Mutual unit trust?

In order to withdraw money from this investment, you need to sell your units and the money must be paid into the same bank account that we have on record for your Tax Free Investment. 5. You may switch between unit trusts within your Tax Free Investment portfolio but you may not switch out of this portfolio.

What is the unit trust of Old Mutual?

Unit trusts offer you the flexibility to tailor a portfolio that suits your specific investment needs and time horizon. You can buy them direct or through a financial planner. You can access the stock exchange without needing knowledge or experience of investing in equities.

How long does it take for Old Mutual to pay out investment?

The standard timeline we communicate to customers is 15 working days. Generally most claims take far less time to process. This is to manage expectations as various scenarios could cause delays in processing and payment. Depending on the claim, it can also take up to 60 days also depending on requirements.

What happens if I cancel my Old Mutual investment?

All premiums paid for the cancelled policy up to, or after, the date that Old Mutual receives the written cancellation notice, will be refunded to the policyholder, subject to the deduction of the cost of any cover enjoyed.

How do I withdraw from Old Mutual unit trusts?

You request Old Mutual to deposit the withdrawal/surrender proceeds into the bank account, the particulars of which you provided during this claim and declare that the details provided by you are complete and accurate.

How long does a unit trust withdrawal take?

Payment will be made within two business days provided we receive your instruction and all supporting documents before the cut-off time. Units purchased via direct debit or debit order (i.e. provisional units) can only be withdrawn 45 days after the purchase date.

Can I withdraw unit trust anytime?

Because unit trusts are easily liquidated, unitholders may redeem all or part of their units on any business day and the unit trust manager will purchase them. This means that should you need cash, you can easily sell the investment.

Can you withdraw money from a unit trust?

You can withdraw your investment from your unit trust fund at any time. Also known as a repurchase or redemption, this is when you sell some or all of the units that you own in a unit trust fund. The proceeds are then paid into your bank account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get ZA Old Mutual Unit Trusts Selling?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific ZA Old Mutual Unit Trusts Selling and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit ZA Old Mutual Unit Trusts Selling in Chrome?

Install the pdfFiller Google Chrome Extension to edit ZA Old Mutual Unit Trusts Selling and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out the ZA Old Mutual Unit Trusts Selling form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign ZA Old Mutual Unit Trusts Selling and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is ZA Old Mutual Unit Trusts Selling Form?

The ZA Old Mutual Unit Trusts Selling Form is a document used by investors to sell their holdings in Old Mutual unit trusts.

Who is required to file ZA Old Mutual Unit Trusts Selling Form?

Investors who wish to sell their units in Old Mutual unit trusts are required to file the ZA Old Mutual Unit Trusts Selling Form.

How to fill out ZA Old Mutual Unit Trusts Selling Form?

To fill out the form, investors need to provide their personal details, the number of units they wish to sell, and any additional required information as specified on the form.

What is the purpose of ZA Old Mutual Unit Trusts Selling Form?

The purpose of the form is to formally request the sale of units in Old Mutual unit trusts and to ensure that the transaction is processed accurately.

What information must be reported on ZA Old Mutual Unit Trusts Selling Form?

The form must report the investor's name, contact information, unit trust details, the number of units to be sold, and any relevant banking information for the proceeds.

Fill out your ZA Old Mutual Unit Trusts Selling online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ZA Old Mutual Unit Trusts Selling is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.