Get the free Non-motor Claims under R20 000 - lyamor co

Show details

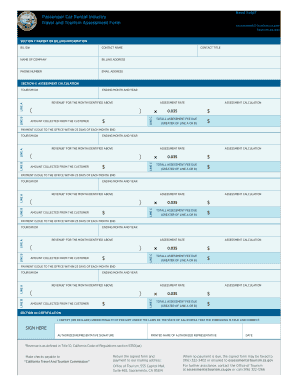

This form is used to claim for non-motor insurance losses or damages under R20,000, requiring details about the incident, the insured property, and payment information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-motor claims under r20

Edit your non-motor claims under r20 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-motor claims under r20 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non-motor claims under r20 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit non-motor claims under r20. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-motor claims under r20

How to fill out Non-motor Claims under R20 000

01

Gather all necessary documents, such as proof of loss, receipts, and identity verification.

02

Fill out the Non-motor Claims form accurately with your personal details.

03

Provide a detailed description of the claim, including dates, amounts, and nature of the loss.

04

Attach all supporting documents to your claim form.

05

Review your claim for completeness and accuracy.

06

Submit the completed claim form and documents to the appropriate claims department.

Who needs Non-motor Claims under R20 000?

01

Individuals who have suffered loss or damage that is not related to vehicles.

02

People seeking compensation for personal belongings or property damage valued under R20 000.

03

Policyholders with insurance coverage that includes non-motor claims.

Fill

form

: Try Risk Free

People Also Ask about

Does a non-fault claim affect my premium?

In most cases, you'll find that your premiums raise in price after you've made a non-fault claim. This is because insurers tend to view any type of claim as increased risk, even if you're not to blame. If your premium does increase after a non-fault claim, there's a few things you can do to help keep costs down.

Does an accident that not my fault affect my insurance?

Yes, insurance rates may go up even if the accident is not your fault, depending on the circumstances of the accident, the types of coverage you have, and your claims history. However, the increase may not be as significant as it would for an at-fault accident.

Do you get money from no fault insurance?

So let's start with a basic definition: no-fault insurance, sometimes referred to as personal injury protection insurance (PIP), can help cover you and your passengers' medical expenses and loss of income in the event of a covered accident, regardless of who is found at fault.

Is it better to file a claim with your insurance or theirs?

It depends. If the other driver is at fault and has adequate coverage, filing a claim with their insurance directly might be faster. However, your own policy may require you to report all accidents, regardless of fault. Also, if the other driver is uninsured or underinsured, you'll likely need to use your own coverage.

How does insurance work if it's not your fault?

Your insurer is not involved since the at-fault driver's insurer is responsible for your medical treatment and vehicle repairs. Even if you file a claim with your insurer to cover what the other insurance company does not pay, it is unlikely that your insurance premiums will go up.

Will insurance pay out if it was not my fault?

If you have collision coverage, it will pay your repair costs. If you have uninsured/underinsured motorist coverage, it will pay if the at-fault driver didn't have insurance or enough insurance to pay your car repairs.

How many claims does a motor insurance have?

The ABI's latest claims data shows: Over the course of 2024 insurers dealt with 2.4 million motor insurance claims.

Should I file an insurance claim if I am not at fault?

The answer to this question is a resounding yes. In fact, calling your insurance company after an accident that was not your fault can protect your rights and ensure you receive the compensation you deserve.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Non-motor Claims under R20 000?

Non-motor claims under R20 000 refer to insurance claims that do not involve vehicles and are valued at R20 000 or less. These claims can cover various types of damages or losses that are not related to motor vehicle incidents.

Who is required to file Non-motor Claims under R20 000?

Individuals or entities who have suffered a loss or damage that is covered under their insurance policy and is valued at R20 000 or less are required to file Non-motor claims. This typically includes policyholders seeking compensation for non-motor related incidents.

How to fill out Non-motor Claims under R20 000?

To fill out Non-motor claims under R20 000, individuals must complete a claims form provided by their insurance company, detailing the nature of the loss, the amount claimed, and attaching any relevant documentation or evidence supporting the claim.

What is the purpose of Non-motor Claims under R20 000?

The purpose of Non-motor claims under R20 000 is to provide policyholders with financial compensation for verified losses or damages that are covered under their insurance policies, thus helping them recover from incidents that do not involve motor vehicles.

What information must be reported on Non-motor Claims under R20 000?

When reporting Non-motor claims under R20 000, the claimant must provide detailed information including their personal details, policy number, description of the incident, items or damages claimed, the total amount claimed, and any supporting documentation such as receipts, photographs, or police reports if applicable.

Fill out your non-motor claims under r20 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Motor Claims Under r20 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.