Get the free Universal Gap/Gap Plus Combination Co-Payment Cover Plan

Show details

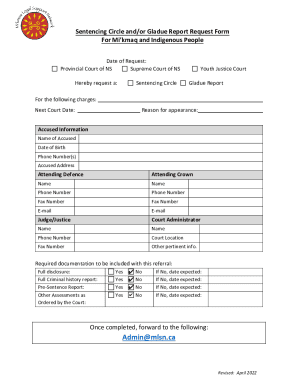

This document serves as an application form for the Universal Gap/Gap Plus Co-Payment Cover Plan, outlining the necessary personal details, payment methods, family member coverage, and specific health

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign universal gapgap plus combination

Edit your universal gapgap plus combination form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your universal gapgap plus combination form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing universal gapgap plus combination online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit universal gapgap plus combination. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out universal gapgap plus combination

How to fill out Universal Gap/Gap Plus Combination Co-Payment Cover Plan

01

Gather necessary personal and financial information, such as your social security number, income details, and existing insurance policies.

02

Review the eligibility criteria and benefits of the Universal Gap/Gap Plus Combination Co-Payment Cover Plan.

03

Visit the official website or contact a representative to access the application form.

04

Fill out the application form with accurate personal details and any required medical history.

05

Provide any necessary documentation, such as proof of income or existing insurance coverage.

06

Review the filled-out application for completeness and accuracy.

07

Submit the application online or by mail as instructed on the form.

08

After submission, keep a copy of your application for your records and await confirmation or additional information.

Who needs Universal Gap/Gap Plus Combination Co-Payment Cover Plan?

01

Individuals who have high medical expenses not fully covered by their primary health insurance.

02

People who want additional financial security against out-of-pocket medical costs.

03

Those who frequently require medical services, specialist consultations, or outpatient treatments.

04

Individuals looking for a plan that provides co-payment assistance for services not included in their standard health coverage.

05

Anyone seeking peace of mind regarding unexpected health care costs.

Fill

form

: Try Risk Free

People Also Ask about

Is gap insurance worth it for health insurance?

What is a “Short Gap” in Coverage? A “short gap” means you were uninsured for a period of less than three consecutive months during the year. Note that if you have coverage for even one day of a month, you're considered to have had coverage for that full month.

What does gap plus insurance cover?

For employees, this will depend on their situation. Employees with extensive or on-going medical issues and high out-of-pocket costs will find the merit in a low-cost gap plan. On the other hand, healthy employees with no planned medical expenses in the future may not see the value in gap insurance.

What is coverage gap coverage?

When policyholders stop paying premiums and when the account value of the insurance policy has already been exhausted, the policy lapses. A policy does not lapse each and every time a premium payment is missed. Insurers are legally bound to give a grace period to policyholders before the policy falls into a lapse.

What is a gap in health insurance?

A “gap in care” is defined as the discrepancy between recommended best practices and the care that's actually provided. For example, here are some common gaps in care: A person is overdue for a recommended screening – like an annual mammogram, colonoscopy, or well visit – based on their age or other risk factors.

What does gap mean in healthcare?

Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen, and you owe more than the car's depreciated value. This coverage, sometimes referred to as loan/lease gap coverage, is only available if you're the original loan or leaseholder on a new vehicle.

What is considered a gap in health insurance coverage?

The gap plan helps cover employees' out-of-pocket costs, including deductibles and copays.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Universal Gap/Gap Plus Combination Co-Payment Cover Plan?

The Universal Gap/Gap Plus Combination Co-Payment Cover Plan is an insurance product designed to cover out-of-pocket expenses and co-payments that policyholders might incur while undergoing medical treatments, thereby minimizing financial burden.

Who is required to file Universal Gap/Gap Plus Combination Co-Payment Cover Plan?

Typically, individuals who have incurred medical expenses that exceed their primary health insurance coverage limits are required to file for the Universal Gap/Gap Plus Combination Co-Payment Cover Plan.

How to fill out Universal Gap/Gap Plus Combination Co-Payment Cover Plan?

To fill out the Universal Gap/Gap Plus Combination Co-Payment Cover Plan, applicants need to provide personal information, details of their primary insurance, a listing of the incurred medical expenses, and any relevant documentation or receipts for services received.

What is the purpose of Universal Gap/Gap Plus Combination Co-Payment Cover Plan?

The purpose of the Universal Gap/Gap Plus Combination Co-Payment Cover Plan is to supplement existing health insurance coverage by covering additional costs, thereby helping patients manage their out-of-pocket expenses more effectively.

What information must be reported on Universal Gap/Gap Plus Combination Co-Payment Cover Plan?

The information required on the Universal Gap/Gap Plus Combination Co-Payment Cover Plan includes personal identification details, primary insurance policy information, a breakdown of medical expenses, and any supporting documents such as bills or receipts from healthcare providers.

Fill out your universal gapgap plus combination online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Universal Gapgap Plus Combination is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.