Get the free BENEFICIAL OWNER’S CARD FOR NATURAL PERSON NON-RESIDENT CLIENT

Show details

A form used to collect and confirm information about the beneficial owner of a non-resident client for JSC Norvik Bank.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign beneficial owners card for

Edit your beneficial owners card for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your beneficial owners card for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing beneficial owners card for online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit beneficial owners card for. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

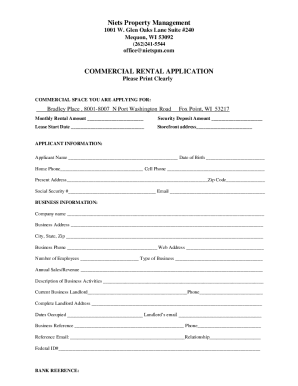

How to fill out beneficial owners card for

How to fill out BENEFICIAL OWNER’S CARD FOR NATURAL PERSON NON-RESIDENT CLIENT

01

Obtain the Beneficial Owner's Card template from the relevant authority or institution.

02

Fill in your full name as it appears on your identification.

03

Provide your date of birth in the specified format.

04

Input your nationality and any other relevant citizenship information.

05

Enter your residential address, ensuring it is accurate.

06

Specify your identification number, such as a passport or national ID number.

07

Include the details of the entity or account for which you are the beneficial owner.

08

Sign and date the card at the bottom where instructed.

09

Review the completed card for any errors or omissions.

10

Submit the card to the financial institution or relevant authority as required.

Who needs BENEFICIAL OWNER’S CARD FOR NATURAL PERSON NON-RESIDENT CLIENT?

01

Individuals who are beneficiaries of trusts or other legal arrangements.

02

Non-resident clients engaging in financial transactions that require identification.

03

Any natural person acting on behalf of a legal entity.

04

Individuals needing to comply with anti-money laundering regulations.

Fill

form

: Try Risk Free

People Also Ask about

Who needs to fill out W-8BEN E?

Who Must Provide Form W-8BEN-E. You must give Form W-8BEN-E to the withholding agent or payer if you are a foreign entity receiving a withholdable payment from a withholding agent, receiving a payment subject to chapter 3 withholding, or if you are an entity maintaining an account with an FFI requesting this form.

Does a beneficial owner need to be a natural person?

In domestic and international commercial law, a beneficial owner is a natural person or persons who ultimately owns or controls an interest in a legal entity or arrangement, such as a company, a trust, or a foundation.

Does a beneficial owner have to be an individual?

As defined by FinCEN's final rule, a beneficial owner is an individual who either owns at least 25% of a company's ownership interest or exercises substantial control over the company. The first criterion is defined precisely enough to make the identification of beneficial owners easy.

Is the boi still required?

Beneficial owner. For payments other than those for which a reduced rate of, or exemption from, withholding is claimed under an income tax treaty, the beneficial owner of income is generally the person who is required under U.S. tax principles to include the payment in gross income on a tax return.

Is a beneficial owner always a natural person?

In domestic and international commercial law, a beneficial owner is a natural person or persons who ultimately owns or controls an interest in a legal entity or arrangement, such as a company, a trust, or a foundation.

Does an UBO have to be a natural person?

What's the FATF definition for a UBO? ing to the Financial Action Task Force (FATF) definition, an ultimate beneficial owner (UBO), “refers to the natural person(s) who ultimately owns or controls a customer and/or the natural person on whose behalf a transaction is being conducted.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BENEFICIAL OWNER’S CARD FOR NATURAL PERSON NON-RESIDENT CLIENT?

The BENEFICIAL OWNER’S CARD FOR NATURAL PERSON NON-RESIDENT CLIENT is a document used to identify the beneficial owner of assets or accounts held by a non-resident individual, ensuring compliance with regulatory requirements regarding ownership and taxation.

Who is required to file BENEFICIAL OWNER’S CARD FOR NATURAL PERSON NON-RESIDENT CLIENT?

Individuals who hold accounts or assets as non-residents and are deemed beneficial owners are required to file the BENEFICIAL OWNER’S CARD. This typically includes foreign nationals holding accounts with financial institutions.

How to fill out BENEFICIAL OWNER’S CARD FOR NATURAL PERSON NON-RESIDENT CLIENT?

To fill out the card, provide personal details such as full name, date of birth, nationality, address, and tax identification number. Ensure that all information is accurate and complete, and sign where required.

What is the purpose of BENEFICIAL OWNER’S CARD FOR NATURAL PERSON NON-RESIDENT CLIENT?

The purpose of the card is to gather essential information about the beneficial owner for identification and compliance purposes, helping authorities monitor and prevent money laundering and tax evasion.

What information must be reported on BENEFICIAL OWNER’S CARD FOR NATURAL PERSON NON-RESIDENT CLIENT?

The card must report the beneficial owner's name, date of birth, nationality, address, and tax identification details, as well as any relevant documents that verify the ownership or status of the accounts.

Fill out your beneficial owners card for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Beneficial Owners Card For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.