Get the free TAX RETURN FORM FOR ASSESSING PERSONAL INCOME TAX PREPAYMENT FOR OTHER INCOME - durs...

Show details

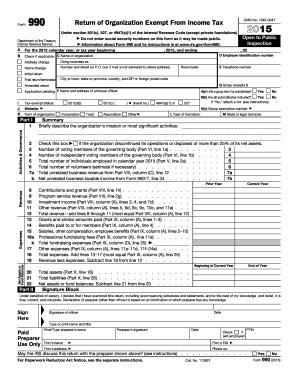

ANNEX 6 TAX RETURN FORM FOR ASSESSING PERSONAL INCOME TAX PREPAYMENT FOR OTHER INCOME 1. CODE NUMBER OF TAX RETURN STATUS To be filled in only by a taxpayer filing his tax return after expiry of the prescribed period as a self-declaration or as a correction of a tax return before an assessment notice is issued 1 filed after the deadline 2 self-declaration 3 correction prior to issue of assessment notice 2. INFORMATION ABOUT THE TAXPAYER Tax ID no...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax return form for

Edit your tax return form for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax return form for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax return form for online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax return form for. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax return form for

How to fill out TAX RETURN FORM FOR ASSESSING PERSONAL INCOME TAX PREPAYMENT FOR OTHER INCOME

01

Gather necessary documents such as previous tax returns, income statements, and documentation of any other income.

02

Obtain the TAX RETURN FORM for assessing personal income tax prepayment for other income from the taxation authority's website or office.

03

Fill in your personal information, including name, address, and taxpayer identification number.

04

Report all sources of income, including wages, dividends, rental income, and any other income.

05

Calculate your total income and apply any relevant deductions or credits.

06

Determine your estimated tax liability for the year based on your total income.

07

Fill in the prepayment amount you owe for the tax year on the appropriate line of the form.

08

Review the entire form for accuracy and completeness.

09

Sign and date the form.

10

Submit the completed form to the appropriate tax authority by the deadline.

Who needs TAX RETURN FORM FOR ASSESSING PERSONAL INCOME TAX PREPAYMENT FOR OTHER INCOME?

01

Individuals who have multiple sources of income aside from their primary employment income.

02

Self-employed individuals or freelancers who need to assess their income tax prepayment.

03

Individuals who received income from investments, rental properties, or other miscellaneous sources.

04

Taxpayers who anticipate owing additional taxes due to other income throughout the year.

Fill

form

: Try Risk Free

People Also Ask about

What is IRS form 8915?

IRS Form 8915 reports distributions from retirement plans due to qualified disasters and repayments. It lets you spread the taxable portion of these distributions over three years and waives the early withdrawal penalty in the year of the disaster.

What is IRS form 8941 used for?

Eligible small employers use Form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after 2009. For tax years beginning after 2013, the credit is only available for a 2 consecutive tax year credit period.

What is the difference between 1040-ES and 941?

So, Form 1040-ES needs to be filed when you do not have an employer withholding these taxes from you. In contrast, Form 941 is the form that shows the IRS how much tax you, as an employer, withheld from each employee's paycheck.

What is the difference between 1040-ES and 941?

So, Form 1040-ES needs to be filed when you do not have an employer withholding these taxes from you. In contrast, Form 941 is the form that shows the IRS how much tax you, as an employer, withheld from each employee's paycheck.

What is IRS form 6765?

Use Form 6765 to: Figure and claim the credit for increasing research activities.

What has replaced the 1040EZ form?

Form 1040EZ is no longer used, and has been replaced by Form 1040 and Form 1040-SR. Form 1040EZ was used for taxpayers with a simple tax return, filing status of single or married filing jointly, taxable income of less than $100,000 with less than $1,500 of interest income, and no dependents.

What is a 2210 form used for?

Purpose of Form Use Form 2210 to see if you owe a penalty for underpaying your estimated tax. The IRS will generally figure your penalty for you and you should not file Form 2210. You can, however, use Form 2210 to figure your penalty if you wish to include the penalty on your return.

What is the IRS form for prepayment of taxes?

Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TAX RETURN FORM FOR ASSESSING PERSONAL INCOME TAX PREPAYMENT FOR OTHER INCOME?

The TAX RETURN FORM FOR ASSESSING PERSONAL INCOME TAX PREPAYMENT FOR OTHER INCOME is a document used by individuals to report other forms of income that may not be subject to standard withholding taxes, allowing for the calculation of any required prepayment of income tax.

Who is required to file TAX RETURN FORM FOR ASSESSING PERSONAL INCOME TAX PREPAYMENT FOR OTHER INCOME?

Individuals who have other sources of income, such as freelance earnings, rental income, or investment gains that are not subject to regular withholding, may be required to file this tax return form.

How to fill out TAX RETURN FORM FOR ASSESSING PERSONAL INCOME TAX PREPAYMENT FOR OTHER INCOME?

To fill out the form, individuals need to provide personal identification information, report total income from all sources, calculate any deductions or credits, and determine the amount of tax prepayment owed based on the reported income.

What is the purpose of TAX RETURN FORM FOR ASSESSING PERSONAL INCOME TAX PREPAYMENT FOR OTHER INCOME?

The purpose of this tax return form is to ensure individuals accurately report other income sources and calculate the appropriate prepayment of taxes owed, helping to prevent underpayment of income taxes.

What information must be reported on TAX RETURN FORM FOR ASSESSING PERSONAL INCOME TAX PREPAYMENT FOR OTHER INCOME?

The form requires reporting personal information, total income from non-wage sources, deductions, tax credits, and the calculated estimated tax owed based on the reported income.

Fill out your tax return form for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Return Form For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.