Get the free 403(b) Tax-Sheltered Annuity Plan Information

Show details

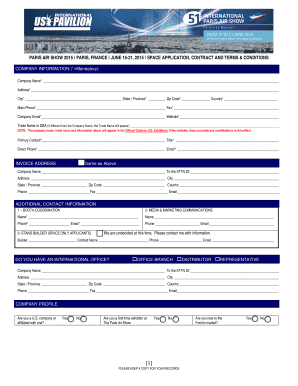

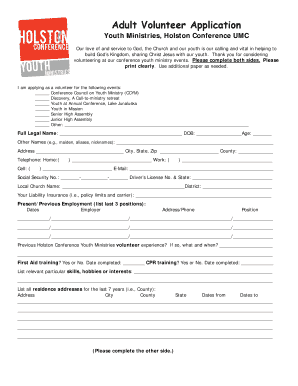

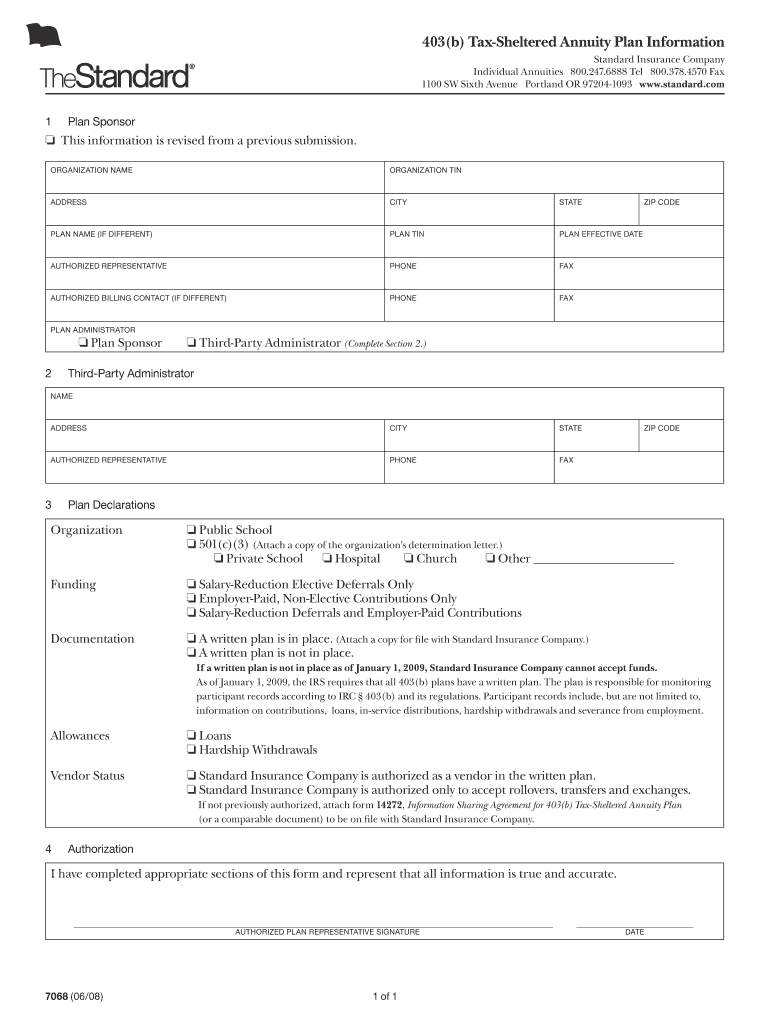

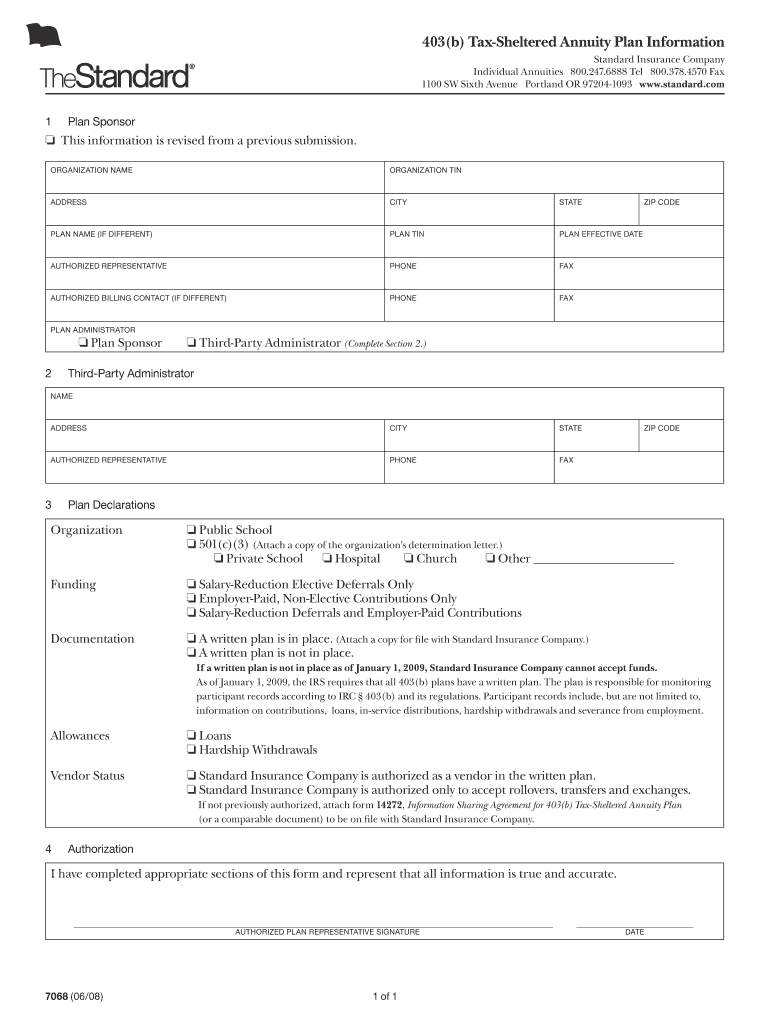

This document provides information regarding the 403(b) Tax-Sheltered Annuity Plan, including details on plan sponsorship, administrators, funding options, and requirements for written plans as mandated

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 403b tax-sheltered annuity plan

Edit your 403b tax-sheltered annuity plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 403b tax-sheltered annuity plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 403b tax-sheltered annuity plan online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 403b tax-sheltered annuity plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 403b tax-sheltered annuity plan

How to fill out 403(b) Tax-Sheltered Annuity Plan Information

01

Gather necessary personal information such as your Social Security Number and employment details.

02

Obtain the 403(b) Tax-Sheltered Annuity Plan Information form from your employer or the plan administrator.

03

Review the plan details including contribution limits, employer match options, and investment choices.

04

Fill in your personal details in the designated sections of the form.

05

Indicate your desired contribution amount and select your investment options.

06

Sign and date the form to authorize participation in the plan.

07

Submit the completed form to your HR department or plan administrator as instructed.

Who needs 403(b) Tax-Sheltered Annuity Plan Information?

01

Employees of tax-exempt organizations such as public schools, certain charities, and non-profit organizations who wish to participate in a retirement savings plan.

02

Individuals looking to benefit from tax-deferred growth on their retirement savings.

03

Those who want to supplement their retirement income beyond other retirement plans like 401(k)s or IRAs.

Fill

form

: Try Risk Free

People Also Ask about

What are the disadvantages of a 403b?

If you are eligible for this type of pension, then TSA plans allow you to defer and save additional funds on a tax advantaged basis for retirement. It is supplemental to your pension plan. Also, if the concept of portability and flexibility are important to you, then a TSA may be a good plan choice.

What is the difference between a tax-sheltered annuity and a 403b?

A 403(b) plan, also known as a tax-sheltered annuity plan, is a retirement plan for certain employees of public schools, employees of certain Code Section 501(c)(3) tax-exempt organizations and certain ministers. A 403(b) plan allows employees to contribute some of their salary to the plan.

What is a 403b tax-sheltered annuity?

A 403(b) plan, also known as a tax-sheltered annuity plan, is a retirement plan for certain employees of public schools, employees of certain Code Section 501(c)(3) tax-exempt organizations and certain ministers. A 403(b) plan allows employees to contribute some of their salary to the plan.

Are tax-sheltered annuities a good idea?

Employees can take money from their TSA plan after they separate employment or at age 59 1/2. There are many options available such as rollovers, annuities, or you can leave your money in the plan.

What are the disadvantages of a 403b?

The IRS imposes a penalty of 10% on withdrawals made before age 59 1/2, unless the withdrawal is made due to certain qualifying events, such as disability or death. Additionally, withdrawals from a TSA are subject to income taxes, which can further reduce the amount of money the employee receives.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 403(b) Tax-Sheltered Annuity Plan Information?

A 403(b) Tax-Sheltered Annuity Plan is a retirement savings plan for certain employees of public schools, tax-exempt organizations, and certain ministers, allowing them to save on a tax-deferred basis.

Who is required to file 403(b) Tax-Sheltered Annuity Plan Information?

Employers who offer 403(b) plans must file information, typically including plan sponsors or administrators, as well as any entity that services the plan.

How to fill out 403(b) Tax-Sheltered Annuity Plan Information?

To fill out the 403(b) Tax-Sheltered Annuity Plan Information, gather relevant employee data, plan details, and contribution amounts, then complete the required forms specified by the IRS or relevant authority.

What is the purpose of 403(b) Tax-Sheltered Annuity Plan Information?

The purpose is to ensure compliance with tax regulations, provide transparency in reporting retirement plan activities, and facilitate accurate tax reporting for participants.

What information must be reported on 403(b) Tax-Sheltered Annuity Plan Information?

Details such as employee contributions, employer contributions, plan assets, investment performance, and participant information must be reported.

Fill out your 403b tax-sheltered annuity plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

403b Tax-Sheltered Annuity Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.