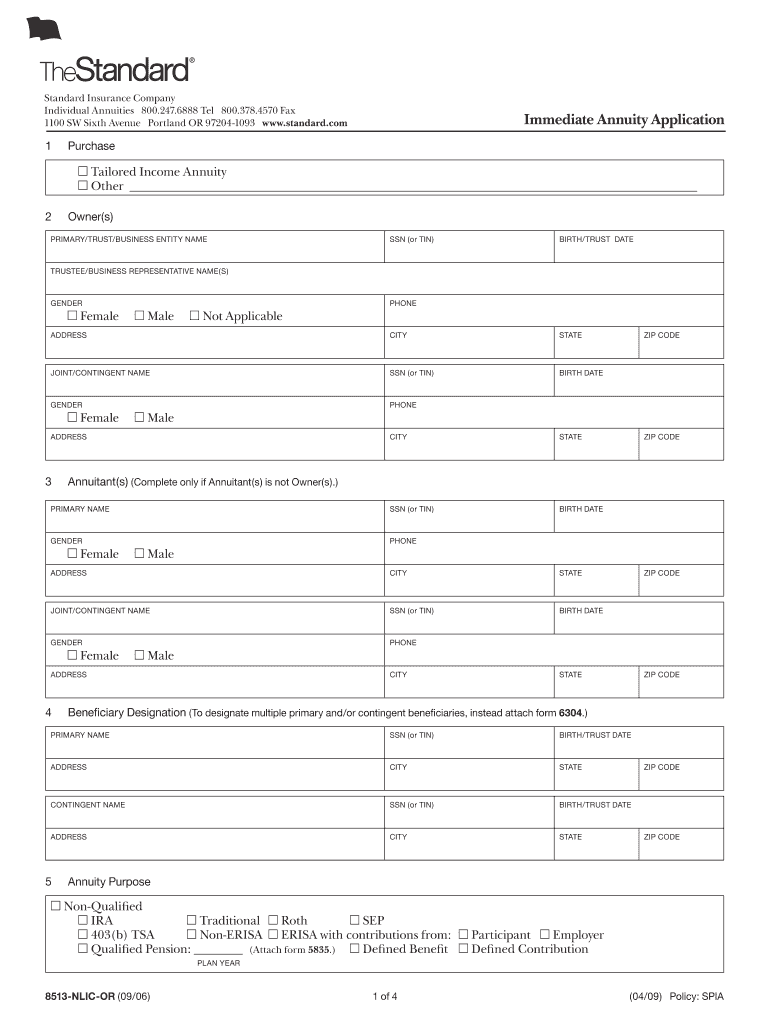

Get the free Immediate Annuity Application

Show details

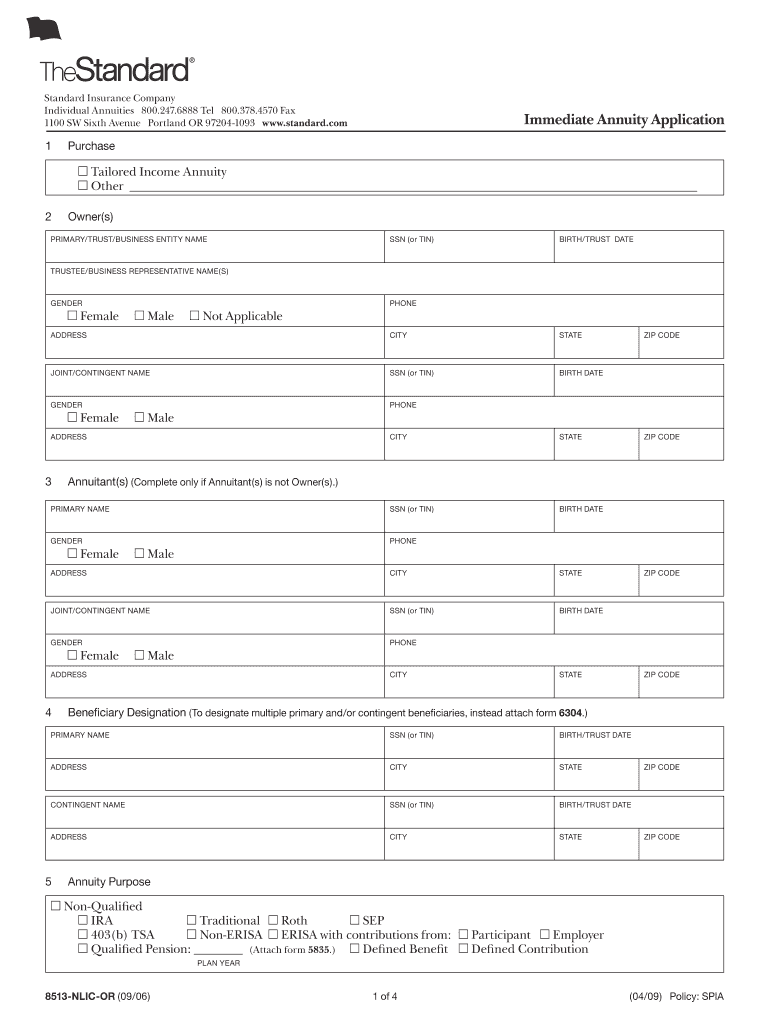

Este formulario es para solicitar la compra de una anualidad inmediata, incluyendo información sobre el propietario, beneficiarios, propósito de la anualidad y opciones de ingreso. También incluye

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign immediate annuity application

Edit your immediate annuity application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your immediate annuity application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing immediate annuity application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit immediate annuity application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out immediate annuity application

How to fill out Immediate Annuity Application

01

Gather personal information: Include your name, address, and date of birth.

02

Select the type of annuity: Choose the immediate annuity type that fits your financial goals.

03

Determine the payment options: Decide on how frequently you want to receive payments (monthly, quarterly, annually).

04

Enter the premium amount: Specify the amount of money you wish to invest.

05

Provide beneficiary information: Designate who will receive the benefits in case of your passing.

06

Review any additional options: Consider options like inflation protection or return of premium.

07

Sign the application: Ensure all information is accurate and sign the application form.

08

Submit the application: Send the completed application to the insurance company or financial institution.

Who needs Immediate Annuity Application?

01

Individuals seeking a steady income during retirement.

02

People looking for a safe investment option to secure their financial future.

03

Those who prefer guaranteed payments over a specific period.

04

Retirees wanting to convert a lump sum into regular income.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of an immediate annuity?

An individual makes a single premium payment to an insurance company into an immediate annuity, such as $200,000. They then immediately receive regular payments such as $5,000 a month for a fixed time. The payout amount for immediate annuities depends on market conditions and interest rates.

How far in advance should I apply for federal retirement?

Check with Your Agency: Contact your agency to understand their specific retirement application timelines. Some agencies allow retirement applications six months in advance, which is fantastic. However, most agencies still operate on a three-month (90 days) advance submission policy.

How long does it take to process an annuity application?

Processing your annuity cannot begin until after your date of separation for retirement from your agency. The entire process typically takes 3-5 months from this date.

What does English is a deferred annuity from an immediate annuity?

Deferred annuity -- Annuity payments that will begin at some future date. Flexible premium deferred annuity -- An annuity contract that permits varying premium payments from year to year, and which is often used for IRAs. Immediate annuity -- Annuity payments that begin immediately or within about a year.

How long does it take an OPM to process a retirement application?

It takes around 60 days (2 months) to process applications for common cases. Your application could take longer if: We need additional information from you or your former employing agency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Immediate Annuity Application?

An Immediate Annuity Application is a financial document used to initiate an immediate annuity contract, which begins making payments shortly after a lump sum investment is made.

Who is required to file Immediate Annuity Application?

Individuals who wish to convert a lump sum of money into a stream of income through an annuity are required to file an Immediate Annuity Application.

How to fill out Immediate Annuity Application?

To fill out an Immediate Annuity Application, you typically need to provide personal information, select the type of annuity desired, specify the payment options, and indicate the amount to be invested.

What is the purpose of Immediate Annuity Application?

The purpose of an Immediate Annuity Application is to formally request an annuity contract that provides immediate income to the annuitant in exchange for a lump sum payment.

What information must be reported on Immediate Annuity Application?

The information that must be reported includes the applicant's personal and financial details, the investment amount, desired payout frequency, and any beneficiaries.

Fill out your immediate annuity application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Immediate Annuity Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.