Get the free VAT-11

Show details

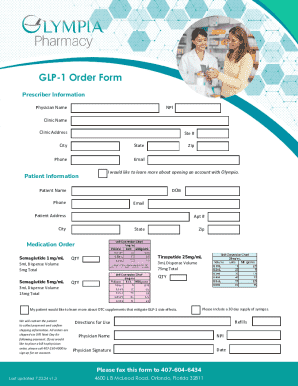

This document is a VAT return form to be filled by dealers for the purpose of reporting tax dues and other related information as per the relevant tax regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vat-11

Edit your vat-11 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vat-11 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing vat-11 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit vat-11. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out vat-11

How to fill out VAT-11

01

Begin by gathering all necessary documents related to your VAT transactions.

02

Open the VAT-11 form, either in digital format or a printed copy.

03

Fill in your personal details, including your name, address, and VAT identification number.

04

Detail the taxable supplies made during the reporting period, including date, description, and VAT rates applied.

05

Calculate the total output tax in the relevant section of the form.

06

Declare any deductible input tax associated with your taxable supplies.

07

Double-check all entries for accuracy to ensure compliance.

08

Submit the completed VAT-11 form by the due date, ensuring you keep a copy for your records.

Who needs VAT-11?

01

Businesses registered for VAT in the jurisdiction requiring VAT reporting.

02

Self-employed individuals who need to report VAT on their sales.

03

Entities that provide taxable goods or services and are obligated to submit VAT returns.

Fill

form

: Try Risk Free

People Also Ask about

What is VAT in English grammar?

VAT Business English abbreviation for Value Added Tax: a tax that is paid at each stage in the production of goods or services, and by the final customer.

What is VAT in American English?

Value-added tax (VAT) is a broad consumption tax assessed on the value added to goods and services as they move through the supply chain.

What does VAT mean?

The term value-added tax (VAT) refers to a consumption tax on goods and services levied at each stage of the supply chain where value is added.

What is VAT in American English?

Value-added tax (VAT) is a broad consumption tax assessed on the value added to goods and services as they move through the supply chain.

What is VAT on English?

abbreviation for Value Added Tax: a tax that is paid at each stage in the production of goods or services, and by the final customer.

What does VAT stand for in English?

VAT is an abbreviation for the term Value-Added Tax. It is an indirect tax on the consumption of goods and services in the economy. Revenue is raised for government by requiring certain traders (vendors), that carry on an enterprise to register for VAT.

What is the VAT number in English?

VAT stands for Value Added Tax. Only those countries with a VAT system will require businesses to have a VAT number. A VAT number is an identification number for all VAT purposes in the country where such number was issued.

What is VAT in body in english?

VAT surrounds the small intestine, defending the body from ingested pathogens and toxins. “The fact that visceral tissue evolved to fight visceral infections provides a causal hypothesis for how high fructose sweeteners and saturated fats contribute to chronic diseases such as type 2 diabetes,” West-Eberhard said.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is VAT-11?

VAT-11 is a tax form used to report Value Added Tax (VAT) transactions for businesses and individuals who are registered for VAT.

Who is required to file VAT-11?

Any business or individual registered for VAT and engaged in taxable supply of goods or services is required to file VAT-11.

How to fill out VAT-11?

To fill out VAT-11, a registrant must provide details of sales and purchases, VAT amounts collected and paid, and any adjustments in the respective fields of the form.

What is the purpose of VAT-11?

The purpose of VAT-11 is to enable tax authorities to assess the VAT liabilities of registered businesses and ensure compliance with VAT regulations.

What information must be reported on VAT-11?

VAT-11 must report total sales, total purchases, VAT collected on sales, VAT paid on purchases, and any exemptions or adjustments related to VAT.

Fill out your vat-11 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vat-11 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.