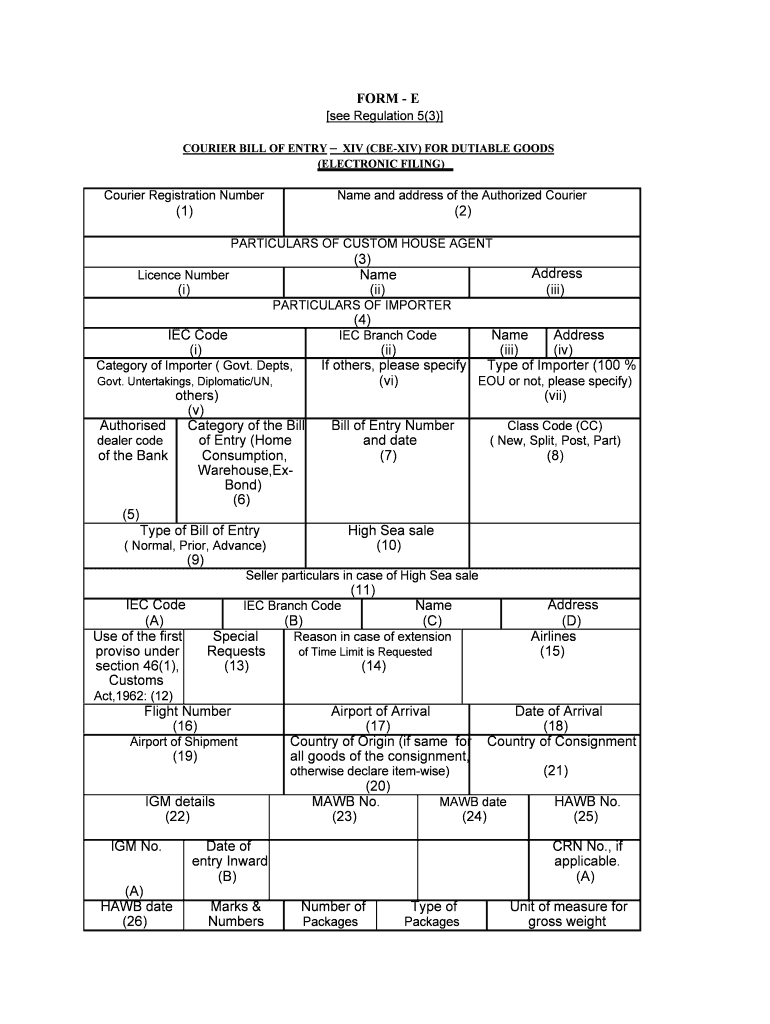

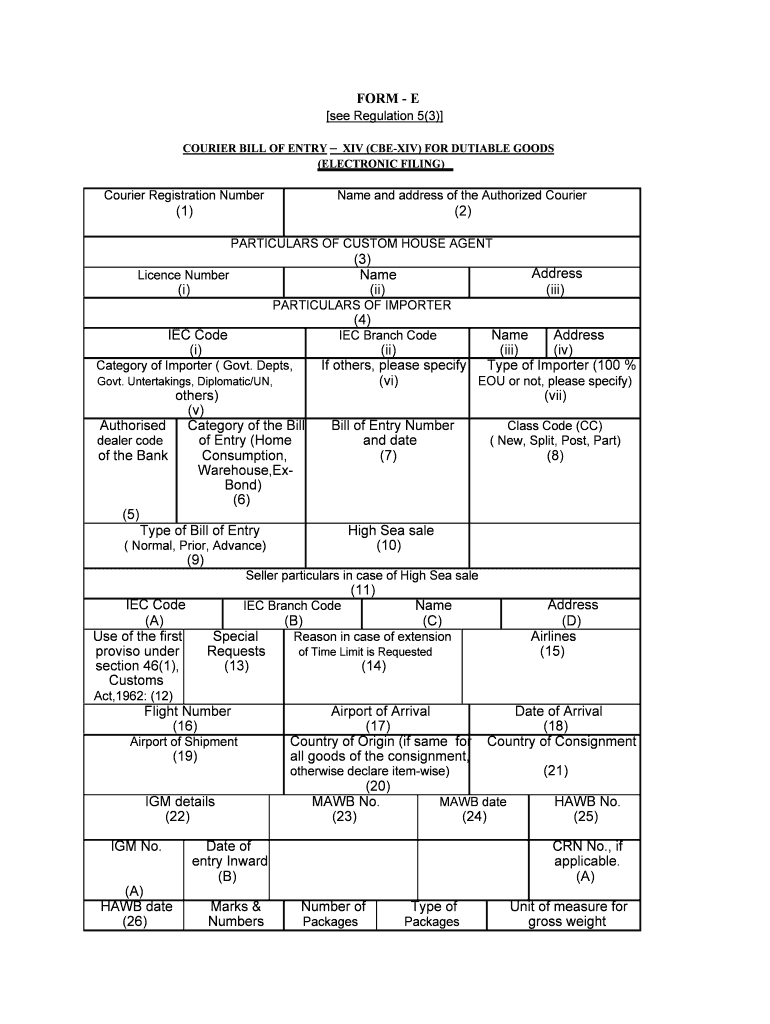

Get the free COURIER BILL OF ENTRY – XIV (CBE-XIV) FOR DUTIABLE GOODS

Show details

This document serves as a bill of entry for goods imported via courier, detailing particulars of the authorized courier, importer, and various declaration requirements related to customs clearance.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign courier bill of entry

Edit your courier bill of entry form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your courier bill of entry form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing courier bill of entry online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit courier bill of entry. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out courier bill of entry

How to fill out COURIER BILL OF ENTRY – XIV (CBE-XIV) FOR DUTIABLE GOODS

01

Obtain the COURIER BILL OF ENTRY – XIV (CBE-XIV) form.

02

Fill in the details of the consignor, including their name, address, and contact information.

03

Provide the consignee's details, including name, address, and contact information.

04

Specify the nature of the goods being imported.

05

Include the total value of the goods in the appropriate currency.

06

List the quantity and description of each item being imported.

07

Indicate the country of origin for each item.

08

Provide any additional documents required for customs clearance, such as invoices or import permits.

09

Review the completed form for accuracy and completeness.

10

Submit the form along with required documents to the appropriate customs authority.

Who needs COURIER BILL OF ENTRY – XIV (CBE-XIV) FOR DUTIABLE GOODS?

01

Individuals or businesses importing goods through courier services that are subject to customs duties.

02

Customs agents or brokers handling imports on behalf of clients.

03

Registered couriers or logistics companies facilitating the import of dutiable goods.

Fill

form

: Try Risk Free

People Also Ask about

What is the full form of CBE in customs?

5.3 After filing ECM, the user can either file a Courier Bill of Entry (CBE) for clearance of the shipment or request to put it on hold pending further documents/clarification.

What is the bill of entry for import of goods?

What is a Bill of Entry? A Bill of Entry (BoE) is a legal document filed by importers or customs agents to facilitate the customs clearance process for imported goods. This document is essential for ensuring that all applicable taxes and duties are paid and the goods comply with the importing country's regulations.

Who will issue the bill of entry?

The bill of entry is issued by the customs authorities or the clearing agent handling the import process. It is provided to importers upon the arrival of goods and after the customs clearance process, detailing the specifics of the imported goods and any duties payable.

What is the full form of CBE in customs?

5.3 After filing ECM, the user can either file a Courier Bill of Entry (CBE) for clearance of the shipment or request to put it on hold pending further documents/clarification.

What is the courier bill of entry XIII?

This document is a courier bill of entry for dutiable goods being imported into India. It provides details of the courier, consignor, consignee, description of goods, applicable notifications, charges, and duties. The importer declares that the contents of the bill are true and correct.

What is the CBE XIV number?

or the Courier Bill of Entry- XIV (CBE-XIV) for other dutiable consignments in Form E. 7. . (4) The Authorised Courier shall present imported goods brought by him or by his agent, in such manner as to the satisfaction of. the proper officer or as per instructions issued by the Board or Public Notice issued by.

What is CBE XIV?

Courier Bill of Entry-XIII (CBE-XIII): For import low-value dutiable consignments in form D (for declared value upto Rs. 1,00, 000/-) Courier Bill of Entry-XIV (CBE-XIV): For other Dutiable Consignments in form E (for declared value more than Rs. 1,00,000/-)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is COURIER BILL OF ENTRY – XIV (CBE-XIV) FOR DUTIABLE GOODS?

The Courier Bill of Entry – XIV (CBE-XIV) is a customs document used in India for the clearance of dutiable goods imported through courier services.

Who is required to file COURIER BILL OF ENTRY – XIV (CBE-XIV) FOR DUTIABLE GOODS?

The courier service provider is required to file the Courier Bill of Entry – XIV on behalf of the importer for goods that are subject to duty.

How to fill out COURIER BILL OF ENTRY – XIV (CBE-XIV) FOR DUTIABLE GOODS?

To fill out the Courier Bill of Entry – XIV, one must provide details such as the description of goods, value, quantity, importer information, and any applicable duty information as per the guidelines from the customs authority.

What is the purpose of COURIER BILL OF ENTRY – XIV (CBE-XIV) FOR DUTIABLE GOODS?

The purpose of the CBE-XIV is to facilitate the assessment and collection of customs duties on imported goods sent through courier services, ensuring compliance with customs regulations.

What information must be reported on COURIER BILL OF ENTRY – XIV (CBE-XIV) FOR DUTIABLE GOODS?

Information that must be reported includes the importer's name and address, a detailed description of the goods, their quantity and value, applicable duty rates, and any necessary documentation to support the claim.

Fill out your courier bill of entry online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Courier Bill Of Entry is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.