Get the free SYSTEMATIC TRANSFER PLAN (STP) FORM

Show details

This document is an application form for the Systematic Transfer Plan (STP) Enrollment for investors in ICICI Prudential Mutual Fund. It includes instructions for completing the form, details on upfront

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign systematic transfer plan stp

Edit your systematic transfer plan stp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your systematic transfer plan stp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing systematic transfer plan stp online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit systematic transfer plan stp. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

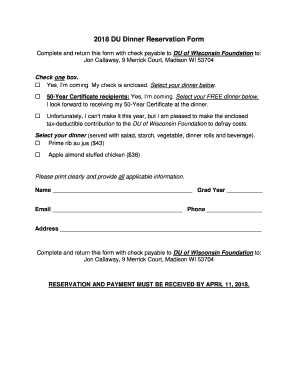

How to fill out systematic transfer plan stp

How to fill out SYSTEMATIC TRANSFER PLAN (STP) FORM

01

Begin by obtaining the SYSTEMATIC TRANSFER PLAN (STP) FORM from your financial institution or advisor.

02

Fill in your personal details, including your name, address, and contact information.

03

Specify the `source account` from which funds will be transferred.

04

Indicate the `destination account` where the funds will be transferred to.

05

Choose the `transfer frequency` (e.g., monthly, quarterly).

06

State the `amount` to be transferred each time.

07

Provide any additional instructions or preferences for the transfers.

08

Review the completed form for accuracy and completeness.

09

Sign and date the form to confirm your authorization.

10

Submit the form to your financial institution as per their submission guidelines.

Who needs SYSTEMATIC TRANSFER PLAN (STP) FORM?

01

Individuals looking to regularly invest or transfer funds without manual intervention.

02

Clients who wish to create a systematic investment strategy.

03

Investors aiming for disciplined saving or investing methods over time.

04

Financial planners or advisors who manage portfolios for clients.

Fill

form

: Try Risk Free

People Also Ask about

Is STP better than lump sum?

STP is often considered better than a lump sum investment for those who prefer to mitigate risk and potentially smooth out returns over time, especially in volatile or uncertain market conditions.

What is STP and how does it work?

Spanning tree protocol (STP) (IEEE 802.1D) is predominantly used to prevent layer 2 loops and broadcast storms and is also used for network redundancy. It was developed around the time where recovery from an outage that took upwards of a minute or more was acceptable.

Is STP a good investment?

It is good for building wealth gradually. STP is ideal for new investors who want to gradually invest a lump sum from a low-risk asset into higher-risk Funds, balancing growth and risk over time.

What is the STP form?

A systematic transfer plan allows investors to shift their financial resources from one scheme to the other instantaneously and without any hassles.

What is the systematic transfer plan (STP)?

STP or Systematic Transfer Plan is a facility offered by mutual funds that allows investors to transfer a fixed amount of money from one mutual fund scheme to another within the same fund house at regular intervals. Typically, the transfer is made from a debt or liquid fund to an equity fund.

How to setup STP?

0:14 1:10 Select the fund you want to set STP. For for registering the STP. Select the fund you want toMoreSelect the fund you want to set STP. For for registering the STP. Select the fund you want to transfer to from the list of funds. Select the one you want to transfer.

What is SIP and how does it work?

An SIP works like a recurring investment, where the amount is auto-debited from your bank account and invested in the mutual fund of your choice. Once the amount is deposited, you get a certain number of units of the mutual fund scheme where you have invested.

What is STP systematic transfer plan?

STP or Systematic Transfer Plan is a facility offered by mutual funds that allows investors to transfer a fixed amount of money from one mutual fund scheme to another within the same fund house at regular intervals. Typically, the transfer is made from a debt or liquid fund to an equity fund.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SYSTEMATIC TRANSFER PLAN (STP) FORM?

The Systematic Transfer Plan (STP) Form is a document used by investors to systematically transfer funds from one mutual fund scheme to another at regular intervals.

Who is required to file SYSTEMATIC TRANSFER PLAN (STP) FORM?

Investors who wish to automate the transfer of a set amount of money from one mutual fund to another, typically when they want to manage their investment strategy more effectively, are required to file the STP form.

How to fill out SYSTEMATIC TRANSFER PLAN (STP) FORM?

To fill out the STP form, the investor needs to provide details such as their personal information, the source scheme from which the funds will be transferred, the target scheme where the funds will be redirected, the amount to be transferred, and the frequency of the transfers.

What is the purpose of SYSTEMATIC TRANSFER PLAN (STP) FORM?

The purpose of the STP form is to facilitate a systematic approach to transferring funds between mutual fund schemes, allowing investors to benefit from rupee cost averaging and potentially reduce investment risk.

What information must be reported on SYSTEMATIC TRANSFER PLAN (STP) FORM?

The information that must be reported on the STP form includes investor's name, folio number, details of the source and target schemes, amount to be transferred, frequency of transfers, and signature of the investor.

Fill out your systematic transfer plan stp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Systematic Transfer Plan Stp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.