Get the free MORTGAGE CREDIT CERTIFICATE (“MCC”) PROGRAM GUIDE - housing mt

Show details

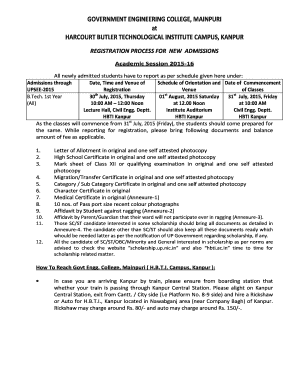

This document provides a comprehensive guide for the Mortgage Credit Certificate (MCC) Program administered by the Montana Board of Housing, detailing the eligibility criteria, procedures, and responsibilities

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage credit certificate mcc

Edit your mortgage credit certificate mcc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage credit certificate mcc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage credit certificate mcc online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mortgage credit certificate mcc. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage credit certificate mcc

How to fill out MORTGAGE CREDIT CERTIFICATE (“MCC”) PROGRAM GUIDE

01

Obtain the MORTGAGE CREDIT CERTIFICATE (MCC) application form from your local issuing authority.

02

Complete the application form by providing required personal information such as name, address, and income details.

03

Gather necessary documentation including proof of income, tax returns, and identification.

04

Submit the completed application form along with the required documents to the designated agency for review.

05

Await approval and guidance from the agency regarding the next steps in the MCC process.

06

Review and sign the MCC upon approval, ensuring all details are correct.

07

Keep a copy of the MCC for your records and to utilize for tax purposes.

Who needs MORTGAGE CREDIT CERTIFICATE (“MCC”) PROGRAM GUIDE?

01

Homebuyers looking to obtain financial assistance through tax credits.

02

Individuals seeking to reduce their federal income tax liability while financing a home.

03

First-time homebuyers or those purchasing in designated areas who meet income limitations.

Fill

form

: Try Risk Free

People Also Ask about

Is a mortgage credit certificate a good idea?

If you're a first-time homebuyer or haven't owned a home recently, you might qualify for a mortgage credit certificate, also called a mortgage interest credit certificate or MCC. A mortgage credit certificate could save you money when filing your taxes or make it easier to pay your mortgage each month.

What qualifies as MCC?

While many homeowners may benefit from applying for an MCC, not everyone is eligible. The IRS has strict guidelines on who can qualify for an MCC. Typically, you must be a first-time home buyer, your income must fall below certain limits and you must purchase a home in a state-designated target area.

How does a mortgage tax credit work?

The MCC benefit can equal 15% - 20% of mortgage interest as determined by the locality for their program. It can be redeemed annually on the homebuyer's federal taxes or proportionately each month on their paycheck by increasing their withholdings.

Can the MCC be used by itself without the DPA?

*The MCC Program must be combined with TSAHC's DPA Program.

Is a Mortgage Credit Certificate worth it?

If you're a first-time homebuyer or haven't owned a home recently, you might qualify for a mortgage credit certificate, also called a mortgage interest credit certificate or MCC. A mortgage credit certificate could save you money when filing your taxes or make it easier to pay your mortgage each month.

What is an example of a Mortgage Credit Certificate?

Mortgage credit certificate example Let's say you have a $300,000 mortgage with a 5% interest rate. During the year, you make $15,000 in interest payments. Assuming your program offers a 20% MCC percentage, you'll receive a $3,000 tax credit ($15,000 x 20%).

How do I know if I have an MCC?

0:22 1:21 If you are unsure if you have an MCC. Contact your mortgage lender or local housing agency forMoreIf you are unsure if you have an MCC. Contact your mortgage lender or local housing agency for assistance. To learn more check Check out these links which you can click in the description.

What is an MCC and how does it work?

MCCs are not a loan product, but rather a federal tax credit. MCCs are certificates issued by HFAs that increase the federal tax benefits of owning a home and helps low- and moderate-income, first-time homebuyers offset a portion of the amount they owe in mortgage interest.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MORTGAGE CREDIT CERTIFICATE (“MCC”) PROGRAM GUIDE?

The Mortgage Credit Certificate (MCC) Program Guide provides guidelines for the issuance of MCCs, which enable eligible homebuyers to claim a federal income tax credit based on a percentage of their mortgage interest paid.

Who is required to file MORTGAGE CREDIT CERTIFICATE (“MCC”) PROGRAM GUIDE?

Lenders participating in the MCC program, as well as homebuyers applying for MCCs, are required to file the Mortgage Credit Certificate Program Guide.

How to fill out MORTGAGE CREDIT CERTIFICATE (“MCC”) PROGRAM GUIDE?

To fill out the MCC Program Guide, participants must provide accurate information about the borrower, property, mortgage details, and ensure all required documentation is attached for verification.

What is the purpose of MORTGAGE CREDIT CERTIFICATE (“MCC”) PROGRAM GUIDE?

The purpose of the MCC Program Guide is to facilitate the issuance of MCCs, helping eligible homebuyers reduce their federal tax liability and make homeownership more affordable.

What information must be reported on MORTGAGE CREDIT CERTIFICATE (“MCC”) PROGRAM GUIDE?

Information required includes borrower details, property address, mortgage amount, interest rate, and any other relevant data that supports the eligibility for the MCC.

Fill out your mortgage credit certificate mcc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Credit Certificate Mcc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.