Get the free Form 3.28 - legislation act gov

Show details

This document serves as an application for an adoption order in the Supreme Court of the Australian Capital Territory, detailing the particulars of the proposed adoptive parents and the child to be

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 328 - legislation

Edit your form 328 - legislation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 328 - legislation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 328 - legislation online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 328 - legislation. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

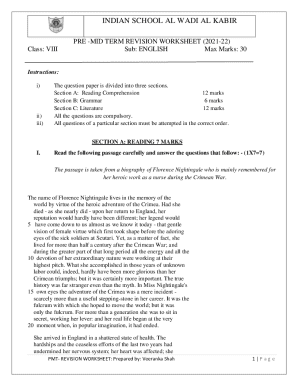

How to fill out form 328 - legislation

How to fill out Form 3.28

01

Obtain Form 3.28 from the official website or relevant institution.

02

Read the instructions carefully provided on the form.

03

Fill in your personal information in the designated fields, ensuring accuracy.

04

Provide any required financial information, if applicable.

05

Review the form for any errors or missing information.

06

Sign and date the form at the bottom.

07

Submit the completed form according to the provided submission instructions.

Who needs Form 3.28?

01

Individuals applying for specific government assistance programs.

02

Organizations or entities required to report certain financial information.

03

Applicants needing to provide documentation for regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

What does a referral mean with the IRS?

If your tax matters are being worked by an IRS examiner or collection officer, you may request the transfer of a developed but unagreed issue to the IRS Independent Office of Appeals (Appeals), while the IRS continues to develop other issues in the case. This is known as an early referral.

How long does an IRS referral take?

1:02 2:49 And up to 30 days after that for the formal. Notification. If your request is accepted. So in totalMoreAnd up to 30 days after that for the formal. Notification. If your request is accepted. So in total you're looking at about 44 days or more depending on the complexity of your. Case.

What happens when you file a 3949A?

The primary purpose of this form is to report potential violations of the Internal Revenue laws. The information may be disclosed to the Department of Justice to enforce the tax laws. Providing the information is voluntary.

Do you get money for reporting someone to the IRS?

The IRS Whistleblower Office pays monetary awards to eligible individuals whose information is used by the IRS. The award percentage depends on several factors, but generally falls between 15 and 30 percent of the proceeds collected and attributable to the whistleblower's information.

What is a 3949a form?

Use Form 3949-A to report alleged tax law violations by an individual, a business, or both. CAUTION: DO NOT USE Form 3949-A: o If you suspect your identity was stolen. Use Form 14039. Follow “Instructions for Submitting this Form” on Page 2 of Form 14039.

What is an IRS referral?

Use Form 3949-A, Information Referral PDF to report alleged tax law violations by an individual, a business or both. You can report alleged tax law violations to the IRS by filling out Form 3949-A online.

Is the form 3949-a anonymous?

Form 3949-A and Whistleblowing While anyone can use the form, it's a valuable tool for whistleblowers who witness tax fraud or misconduct within a company or by an individual. They can use it to report the issue to the IRS without necessarily revealing their identity.

Why does the IRS want me to verify in person?

More In Help The IRS proactively identifies and stops the processing of potential identity theft returns. You may receive a notice or letter asking you to verify your identity and tax return information with the IRS. This helps prevent an identity thief from getting your refund.

How do you get the IRS to release your refund?

The IRS will send you a CP237A if the tax refund check they sent you was never deposited. If you received this notice, call 1-800-829-0115 to claim your refund. In most cases, you will get your refund within 30 days of contacting the IRS.

What is IRS Form 3949 a child support?

The 3949-A Form is a tool provided by the IRS that allows individuals to report tax fraud and noncompliance, including issues related to child support. This form is critical for ensuring compliance with child support obligations, which are essential for the well-being of children.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 3.28?

Form 3.28 is a regulatory form used to report specific financial or operational data as required by authorities.

Who is required to file Form 3.28?

Entities or individuals engaged in activities regulated by specific laws or regulations that mandate the filing of Form 3.28.

How to fill out Form 3.28?

Form 3.28 should be filled out by providing the required information in each designated section, ensuring accuracy and completeness, and submitting it by the specified deadline.

What is the purpose of Form 3.28?

The purpose of Form 3.28 is to collect necessary information for regulatory compliance and monitoring by authorities.

What information must be reported on Form 3.28?

Form 3.28 requires reporting various details including financial statements, operational metrics, and any other information specified by the regulatory body.

Fill out your form 328 - legislation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 328 - Legislation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.