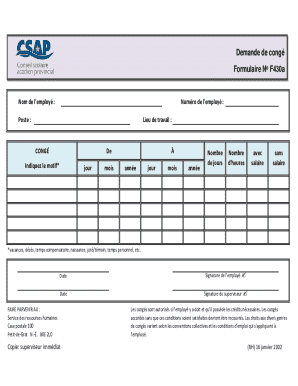

Get the free ETHICS DISCLOSURE FORM - correct state ak

Show details

This document serves as a notice to the designated ethics supervisor regarding an employee's outside employment or services for compensation, ensuring compliance with state ethics laws and addressing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ethics disclosure form

Edit your ethics disclosure form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ethics disclosure form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ethics disclosure form online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ethics disclosure form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ethics disclosure form

How to fill out ETHICS DISCLOSURE FORM

01

Download the ETHICS DISCLOSURE FORM from the designated official website.

02

Read the instructions and guidelines provided with the form carefully.

03

Fill in your personal details including your name, position, and affiliation.

04

Provide a detailed account of any potential conflicts of interest.

05

Disclose any financial interests, relationships, or affiliations that may influence your research or professional activities.

06

Review your entries for accuracy and completeness.

07

Sign and date the form at the designated section.

08

Submit the completed form to the appropriate ethics committee or authority as specified.

Who needs ETHICS DISCLOSURE FORM?

01

Researchers conducting studies involving human subjects.

02

Individuals applying for grants or funding.

03

Professionals in academia and industry where ethical considerations are paramount.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between OGE Form 450 and 278?

Schedule A, Assets and Income. Reportable information for an OGE Form 278 is more detailed than a 450. It requires reporting the value of the asset by range, as well as the type and range of income. Also, more information is reportable on the OGE Form 278.

Who is required to file an OGE form 278?

A financial statement is one specific kind of financial disclosure. There are three common types: an income statement, a balance sheet, and a statement of cash flows.

What is the difference between OGE Form 450 and 278?

Schedule A, Assets and Income. Reportable information for an OGE Form 278 is more detailed than a 450. It requires reporting the value of the asset by range, as well as the type and range of income. Also, more information is reportable on the OGE Form 278.

Who needs to file an OGE 278?

OGE Form 278e's must be filed by Senate-confirmed Presidential appointees, Senior Executive Service (SES) employees, Senior Level (SL) employees, Professional (ST) employees, Schedule C employees, certain Special Government Employees (SGEs) and Certain Intergovernmental Personnel Act (IPA) employees.

What is an OGE form 450?

OGE Form 278e's must be filed by Senate-confirmed Presidential appointees, Senior Executive Service (SES) employees, Senior Level (SL) employees, Professional (ST) employees, Schedule C employees, certain Special Government Employees (SGEs) and Certain Intergovernmental Personnel Act (IPA) employees.

Who is required to complete a financial interest disclosure form?

Employees who occupy positions classified at GS-15 or below and whose duties require them to participate personally and substantially through decision or the exercise of significant judgment in a matter which could have an economic impact on a non-Federal entity are required to file a confidential financial disclosure

What are the requirements for 278-T reporting?

The 278-T discloses purchases, sales, or exchanges of securities in excess of $1,000 made on behalf of the filer, the filer's spouse, or dependent child. Transactions are required to be disclosed within 30 days of receiving notification of a transaction but not later than 45 days after the transaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ETHICS DISCLOSURE FORM?

An ETHICS DISCLOSURE FORM is a document that individuals, particularly those in positions of authority or influence, complete to disclose potential conflicts of interest, financial interests, and other relevant ethical considerations to promote transparency and accountability.

Who is required to file ETHICS DISCLOSURE FORM?

Typically, public officials, employees in certain governmental positions, and individuals in decision-making roles within organizations are required to file an ETHICS DISCLOSURE FORM to ensure they are in compliance with ethical standards.

How to fill out ETHICS DISCLOSURE FORM?

To fill out an ETHICS DISCLOSURE FORM, individuals should provide their personal and professional information, outline any financial interests, report any relationships or affiliations that may present conflicts of interest, and sign the form to attest to its accuracy.

What is the purpose of ETHICS DISCLOSURE FORM?

The purpose of the ETHICS DISCLOSURE FORM is to ensure transparency regarding any potential conflicts of interest and to uphold ethical standards in professional environments by requiring individuals to disclose relevant financial and personal information.

What information must be reported on ETHICS DISCLOSURE FORM?

Individuals must report information such as their name, title, and position; any positions held outside of their official role; financial interests such as investments or assets; gifts received; and relationships that may create a conflict of interest.

Fill out your ethics disclosure form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ethics Disclosure Form is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.