Get the free Form 11

Show details

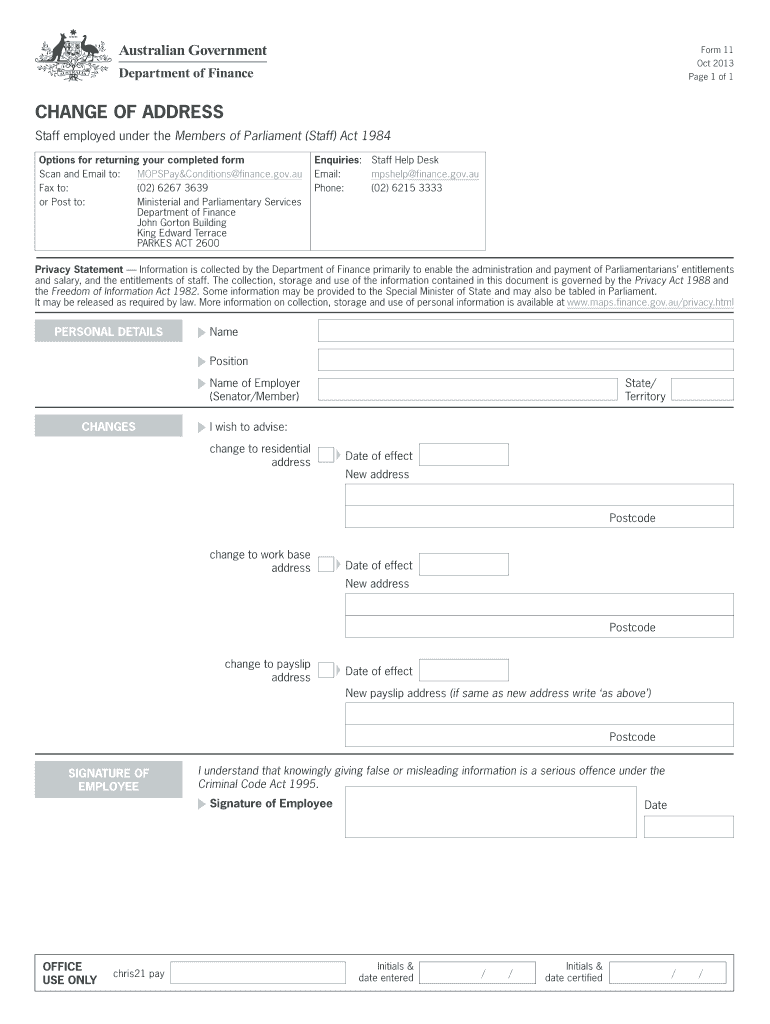

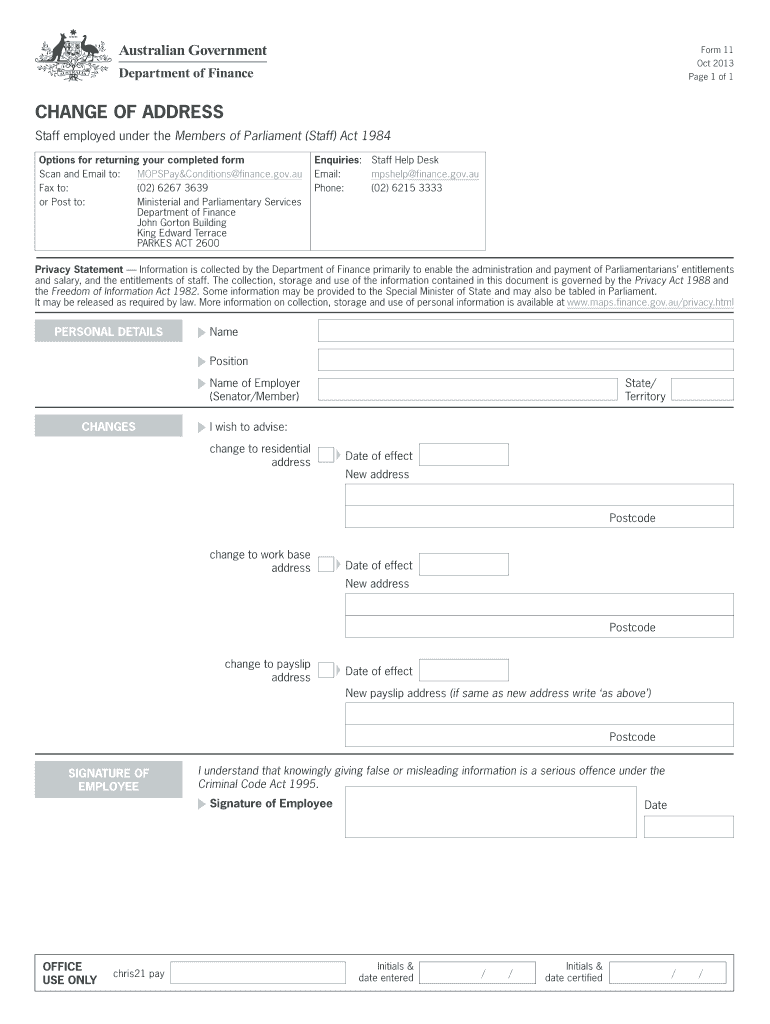

This document is used by staff employed under the Members of Parliament (Staff) Act 1984 to notify changes of their residential, work base, or payslip addresses.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 11

Edit your form 11 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 11 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 11 online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 11. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 11

How to fill out Form 11

01

Obtain Form 11 from the official government website or local office.

02

Read the instructions carefully to understand the required information.

03

Fill in your personal details including name, address, and contact information.

04

Complete the relevant sections based on your income sources and tax obligations.

05

Provide any necessary supporting documents as outlined in the form instructions.

06

Review your completed form for accuracy and ensure all sections are filled out.

07

Sign and date the form as required.

08

Submit the form by the specified deadline either online or by mail.

Who needs Form 11?

01

Individuals who are self-employed or have multiple sources of income.

02

People earning above the tax threshold who need to declare their income.

03

Residents in need of tax relief or credits that require a formal income declaration.

Fill

form

: Try Risk Free

People Also Ask about

What's the difference between a DS 82 and a DS-11?

What is the difference between DS-82 and DS-11? The DS-82 is used for passport renewal, while the DS-11 is for first-time applications.

What is form 11 for?

Form 11 EPF is a declaration form used by employees to join the Provident Fund and Pension Scheme. Any individual starting a new job in a company that is part of the Employees' Provident Fund and Family Pension Scheme must complete this form.

What is the DS-11 form used for?

DS-11 Application Form for New U.S Passport.

Do both parents need to be present for a child's passport?

All children under 16 must appear in person to apply. A parent (preferably both) must be present and must sign the passport application.

Who should file form AR-11?

If you are a alien in the United States, you must report any change of address to USCIS within 10 days of moving. This reporting requirement does not apply to A and G visa holders and visa waiver visitors.

What does a form DS 11 do?

Application For A U.S. Passport (DS-11) Use if you are applying for the first time, for your child who is under age 16, or you don't meet our requirements to renew your passport. Print the form but do not sign it until we ask you to do so.

Can I download form 11?

If a pre-populated Form 11 is available, it can be downloaded from ROS for completion using the ROS Offline Application. The pre-populated form includes details from the most recent information available on Revenue systems relevant to the period of the Form 11 being completed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 11?

Form 11 is an annual income tax return form used in Ireland for self-assessment. It is primarily used by self-employed individuals, companies, and others with income that is not fully taxed at source.

Who is required to file Form 11?

Individuals who are self-employed, have non-PAYE income, or those whose income exceeds certain thresholds are required to file Form 11. This includes sole traders, company directors, and individuals with rental income.

How to fill out Form 11?

To fill out Form 11, taxpayers should gather their income statements, details of expenses, and any other relevant financial information. They can complete the form online using the Revenue Online Service (ROS) or submit a paper form, following the instructions provided.

What is the purpose of Form 11?

The purpose of Form 11 is to report income and expenses to the Revenue Commissioners for tax assessment. It helps determine the tax liability of an individual or entity for a given tax year.

What information must be reported on Form 11?

Form 11 requires reporting details such as nature and amount of all income sources, allowable expenses, capital gains, tax credits, and any other deductions or reliefs claimed.

Fill out your form 11 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 11 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.