Get the free ST-930 (5/96) - tax ny

Show details

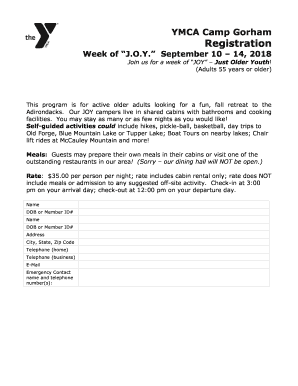

This document is used to certify the tax status of services provided via telephony or telegraphy in New York State and to declare whether the services are exempt from sales tax.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign st-930 596 - tax

Edit your st-930 596 - tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st-930 596 - tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit st-930 596 - tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit st-930 596 - tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out st-930 596 - tax

How to fill out ST-930 (5/96)

01

Step 1: Obtain a copy of the ST-930 form from the official state website or office.

02

Step 2: Enter your name, business name, and contact information at the top of the form.

03

Step 3: Provide your taxpayer identification number in the designated field.

04

Step 4: Fill out the sections related to sales and use tax, specifying the amounts for each category.

05

Step 5: Review any additional instructions provided on the form for specific lines or sections.

06

Step 6: Double-check your entries for accuracy and completeness.

07

Step 7: Sign and date the form at the bottom.

08

Step 8: Submit the completed ST-930 form to the appropriate tax authority by the deadline.

Who needs ST-930 (5/96)?

01

Businesses or individuals required to report sales and use tax obligations.

02

Retailers or service providers who make taxable sales in the state.

03

Any entity that has collected sales tax from customers and needs to remit it to the state.

Fill

form

: Try Risk Free

People Also Ask about

What is the verse 96.1 in the Quran?

96.1 Jalal - Al-Jalalayn. Recite, bring recitation into existence, beginning with: In the Name of your Lord Who created, all creatures; (I fear that something may happen to me.)

What is the Quran 9.30 in English?

Shakir: And the Jews say: Uzair is the son of Allah; and the Christians say: The Messiah is the son of Allah; these are the words of their mouths; they imitate the saying of those who disbelieved before; may Allah destroy them; how they are turned away!

What is the verse 5 96 in the Quran?

Lawful to you is game from the sea and its food as provision for you and the travelers, but forbidden to you is game from the land as long as you are in the state of ihram.

What is 5 96 in the Quran?

Pickthall: To hunt and to eat the fish of the sea is made lawful for you, a provision for you and for seafarers; but to hunt on land is forbidden you so long as ye are on the pilgrimage. Be mindful of your duty to Allah, unto Whom ye will be gathered.

What is surah 9 Ayat 5 in English?

9:5 But once the Sacred Months have passed, the polytheists ˹who violated their treaties˺ wherever you find them, capture them, besiege them, and lie in wait for them on every way. But if they repent, perform prayers, and pay alms-tax, then set them free. Indeed, Allah is All-Forgiving, Most Merciful.

What is the 5 95 verse in the Quran?

Ayah al-Ma`idah (The Table, The Table Spread) 5:95. Believers, do not hunt while you are in the state for sanctity. Whoever kills an animal intentionally must compensate by offering an equivalent domestic animal comparable to what he killed as defined by two just men — an offering to be delivered to the Ka'bah.

What is 96 in Islam?

Chapter 96 of the Qur'an is traditionally believed to have been Muhammad's first revelation. It is said that while Muhammad was on retreat in the Cave of Hira, at Jabal al-Nour near Mecca, the angel Gabriel appeared before him and commanded him to "Read!". He responded, "But I cannot read!".

What does Aya say about seafood in the Quran?

٩٦ It is lawful for you to hunt and eat seafood, as a provision for you and for travellers. But hunting on land is forbidden to you while on pilgrimage. Be mindful of Allah to Whom you all will be gathered.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ST-930 (5/96)?

ST-930 (5/96) is a form used for reporting sales and use tax information to the relevant tax authority.

Who is required to file ST-930 (5/96)?

Businesses and individuals who are engaged in selling taxable goods or services in the state are required to file ST-930 (5/96).

How to fill out ST-930 (5/96)?

To fill out ST-930 (5/96), one must provide accurate sales data, include tax collected, and complete all requested fields such as business information, sales details and any exemptions applicable.

What is the purpose of ST-930 (5/96)?

The purpose of ST-930 (5/96) is to ensure compliance with sales and use tax regulations and facilitate proper reporting of tax liabilities.

What information must be reported on ST-930 (5/96)?

The form requires reporting information such as total sales, taxable sales, any exempt sales, and the amount of sales tax collected.

Fill out your st-930 596 - tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

St-930 596 - Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.