Get the free RENTAL PROPERTIES REQUEST FOR 7.5% LANDLORD RATING ALLOWANCE - nidirect gov

Show details

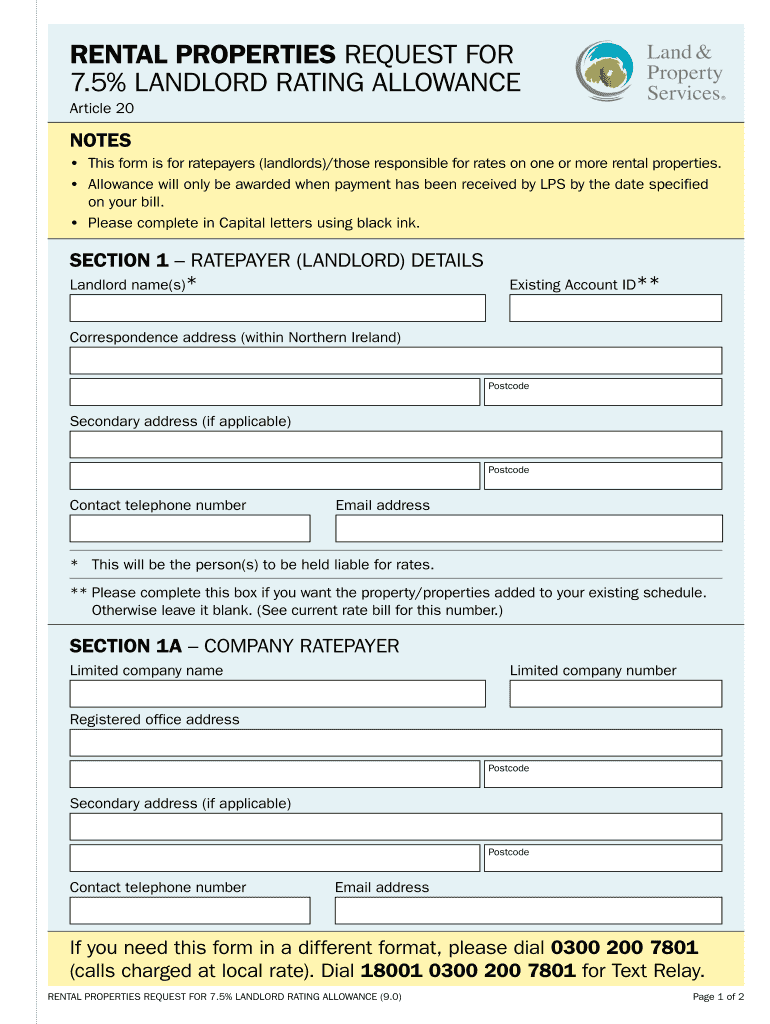

This document is a request form for landlords seeking a 7.5% rating allowance on rental properties in Northern Ireland.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rental properties request for

Edit your rental properties request for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rental properties request for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rental properties request for online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit rental properties request for. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rental properties request for

How to fill out RENTAL PROPERTIES REQUEST FOR 7.5% LANDLORD RATING ALLOWANCE

01

Begin by downloading the RENTAL PROPERTIES REQUEST FOR 7.5% LANDLORD RATING ALLOWANCE form from the appropriate website or office.

02

Fill in your personal information, including your name, address, and contact details in the designated fields.

03

Provide the property details such as the address of the rental property and any identification numbers associated with it.

04

Clearly indicate the reason for your request for the 7.5% landlord rating allowance, ensuring to provide any necessary supporting documentation.

05

Review the application for any errors or omissions before submission.

06

Submit the completed form to the appropriate department or office as indicated on the application.

Who needs RENTAL PROPERTIES REQUEST FOR 7.5% LANDLORD RATING ALLOWANCE?

01

Landlords who manage rental properties and are seeking financial relief or adjustments in their tax rating may need the RENTAL PROPERTIES REQUEST FOR 7.5% LANDLORD RATING ALLOWANCE.

02

Property owners who have experienced financial hardship or significant changes that affect property management might also require this form.

03

Real estate management firms managing multiple properties may need to submit this request on behalf of their clients.

Fill

form

: Try Risk Free

People Also Ask about

What is the new rent law in New York?

Under AB 1482, landlords are limited to increasing rent by no more than 5% plus the local CPI (inflation rate) or 10%, whichever is lower. The local inflation rate is determined by the California Consumer Price Index (CCPI), which is released annually by the California Department of Finance.

Can my landlord raise my rent 20% in California?

Landlords cannot raise rent more than 10% total or 5% plus the percentage change in the cost of living – whichever is lower – over a 12-month period. If the tenants of a unit move out and new tenants move in, the landlord may establish the initial rent to charge. (Civ. Code § 1947.12.)

How to write a letter for rental assistance?

Clearly state the purpose of the letter upfront. For example, ``I am writing to ask if you would be able to help me with my overdue rent payment.'' Provide relevant details about the situation, such as how much rent is owed, when the payment is due, and why you are unable to cover the cost on your own.

What is the most a landlord can increase your rent?

While there's no legal cap on how much a private landlord can increase rent, there are still a few things to consider before going ahead with the uptick.

What is the most a landlord can raise the rent?

Under this law, rent can only be increased by 5% plus the local rate of inflation, or 10% of the current rent, whichever is lower.

What is the maximum rent increase a landlord can do?

While there's no legal cap on how much a private landlord can increase rent, there are still a few things to consider before going ahead with the uptick.

How much is the maximum rent increase?

For periodic tenancies, the maximum allowable increase is once every 12 months. The Act outlines that landlords must provide at least 60 days' notice for rent increases in these cases. However, it is important to note that there is no specific percentage cap for periodic tenancies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RENTAL PROPERTIES REQUEST FOR 7.5% LANDLORD RATING ALLOWANCE?

The RENTAL PROPERTIES REQUEST FOR 7.5% LANDLORD RATING ALLOWANCE is a form that landlords can submit to request a reduction on their property tax assessment, reflecting a 7.5% allowance based on the rental status of their properties.

Who is required to file RENTAL PROPERTIES REQUEST FOR 7.5% LANDLORD RATING ALLOWANCE?

Landlords who own rental properties that qualify for the 7.5% rating allowance are required to file this form to adjust their property tax obligations.

How to fill out RENTAL PROPERTIES REQUEST FOR 7.5% LANDLORD RATING ALLOWANCE?

To fill out the form, landlords need to provide details about the property, including address, ownership information, rental status, and any required supporting documentation that proves eligibility for the allowance.

What is the purpose of RENTAL PROPERTIES REQUEST FOR 7.5% LANDLORD RATING ALLOWANCE?

The purpose of this request is to formally apply for a tax adjustment that acknowledges the unique financial circumstances of landlords providing affordable rental housing.

What information must be reported on RENTAL PROPERTIES REQUEST FOR 7.5% LANDLORD RATING ALLOWANCE?

Landlords must report property details, including the property's location, rental income status, and any relevant financial documentation to support the claim for the 7.5% allowance.

Fill out your rental properties request for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rental Properties Request For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.