Get the free Charitable Gift Annuity Application - rcgf

Show details

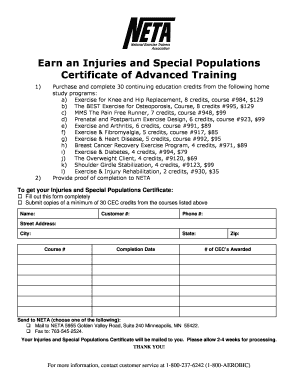

Este formulario es para que los donantes soliciten una anualidad de regalo caritativa a través de la Fundación Caritativa Renaissance Inc. Se requiere completar toda la información solicitada,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable gift annuity application

Edit your charitable gift annuity application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable gift annuity application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing charitable gift annuity application online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit charitable gift annuity application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable gift annuity application

How to fill out Charitable Gift Annuity Application

01

Identify the charitable organization you wish to support through the annuity.

02

Obtain the Charitable Gift Annuity Application form from the organization's website or office.

03

Fill in your personal information including name, address, phone number, and email.

04

Specify the amount you wish to donate to establish the annuity.

05

Select the payment frequency (e.g., monthly, quarterly, annually) for your annuity payments.

06

Provide information about the beneficiaries, if applicable.

07

Review the terms and conditions outlined in the application carefully.

08

Sign and date the application form.

09

Submit the completed application to the charitable organization along with any required documentation.

Who needs Charitable Gift Annuity Application?

01

Individuals looking for a way to support a charitable cause while receiving fixed income payments.

02

Donors who want to make a significant charitable gift and benefit from potential tax deductions.

03

Retirees seeking stable income in retirement while also contributing to their preferred charity.

04

Those interested in making a long-term financial commitment to a nonprofit organization.

Fill

form

: Try Risk Free

People Also Ask about

Can an annuity be gifted to a charity?

A Smart Way to Leave a Gift to Mayo Clinic Like retirement plan assets, commercial annuities provide for tax-deferred growth while the owner is living. Because distributions from commercial annuities are subject to income taxes, they are often considered among the best assets to leave to charity.

What is the difference between a charitable gift annuity and a charitable trust?

While a charitable remainder trust enables you to rest easy that your funds are under your control, a charitable gift annuity requires that you have faith in the charity you donate to. If the charity becomes insoluble and cannot make the payments to you, then there is no recourse to take.

Do you pay taxes on a charitable gift annuity?

Taxation of CGA payments. If the annuity is funded with appreciated securities or real estate owned more than one year, and the donor is receiving the annuity payments, part of the payments will be taxed as ordinary income, part as capital gain, and part may be tax-free.

Can you take a distribution from an annuity?

If you find yourself in a situation where you need cash, your annuity contract provides you with an option. But pulling money from your annuity before you reach age 59½ does come with a cost. If you take out money early, be aware that income taxes may not be the only consequence you'll have to face.

What are the new charitable gift annuity rules?

Charitable Gift Annuity Funded with an IRA If you are 70½ and older, you can make a once-in-a-lifetime election to fund one or more gift annuities. If funded in 2024, the maximum funding amount is $53,000. This amount is adjusted each year for inflation and will increase to $54,000 in 2025.

Can I do a QCD from an annuity?

Charitable Rollover Gift Annuity — Under a new law effective in 2023, some donors can make a QCD in exchange for a charitable gift annuity.

Is a charitable gift annuity a trust?

A gift annuity agreement is a lifelong contract, not a trust, between a single nonprofit organization and an individual or couple, who are referred to as annuitant(s). The terms of this agreement will lock in the rate, amount and timing of all payments the annuitant(s) receive.

Is a charitable gift annuity a good idea?

Benefits of Establishing a Charitable Gift Annuity If funded with appreciated securities, no upfront capital gains tax is due. You can defer the payments until sometime in the future — such as when you reach retirement. You can be confident knowing Mayo Clinic will be a good steward of your gift.

Are charitable gift annuities worth it?

Charitable annuities may not work for many people because they are charity specific. While this works well for some, many people like to support several different charities. They're often better tools for older people looking to help leave and establish their legacy.

What is a major disadvantage to the donor of implementing a charitable gift annuity CGA contract?

However, there is a potential tax drawback of a charitable gift annuity: part of your annuity income is taxable at the federal level, and possibly at the state level as well, depending on whether the state you live in has an income tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Charitable Gift Annuity Application?

A Charitable Gift Annuity Application is a legal document that allows an individual to make a charitable donation to a nonprofit organization while receiving fixed annual payments in return for a specified period, typically for the lifetime of the donor.

Who is required to file Charitable Gift Annuity Application?

Individuals or entities wishing to establish a Charitable Gift Annuity with a nonprofit organization are required to file the application.

How to fill out Charitable Gift Annuity Application?

To fill out a Charitable Gift Annuity Application, provide personal information, specify the amount and terms of the gift, indicate the chosen nonprofit organization, and sign the document as required by state regulations.

What is the purpose of Charitable Gift Annuity Application?

The purpose of the Charitable Gift Annuity Application is to formalize the agreement between the donor and the charity, outlining the donation details and the annuity payments to be received by the donor.

What information must be reported on Charitable Gift Annuity Application?

The application must report the donor's personal information, the value of the donation, the payment frequency and amount, the nonprofit organization details, and any pertinent terms and conditions of the gift.

Fill out your charitable gift annuity application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Gift Annuity Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.