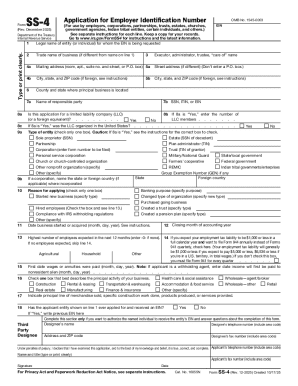

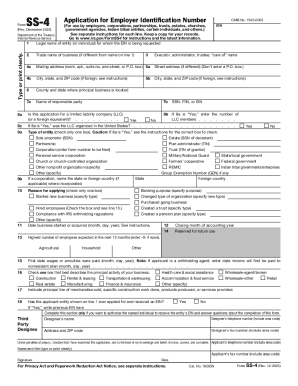

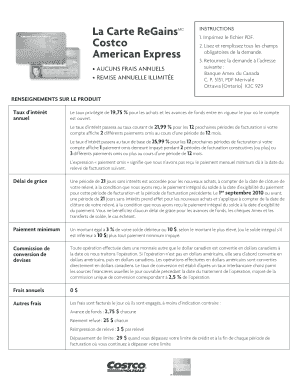

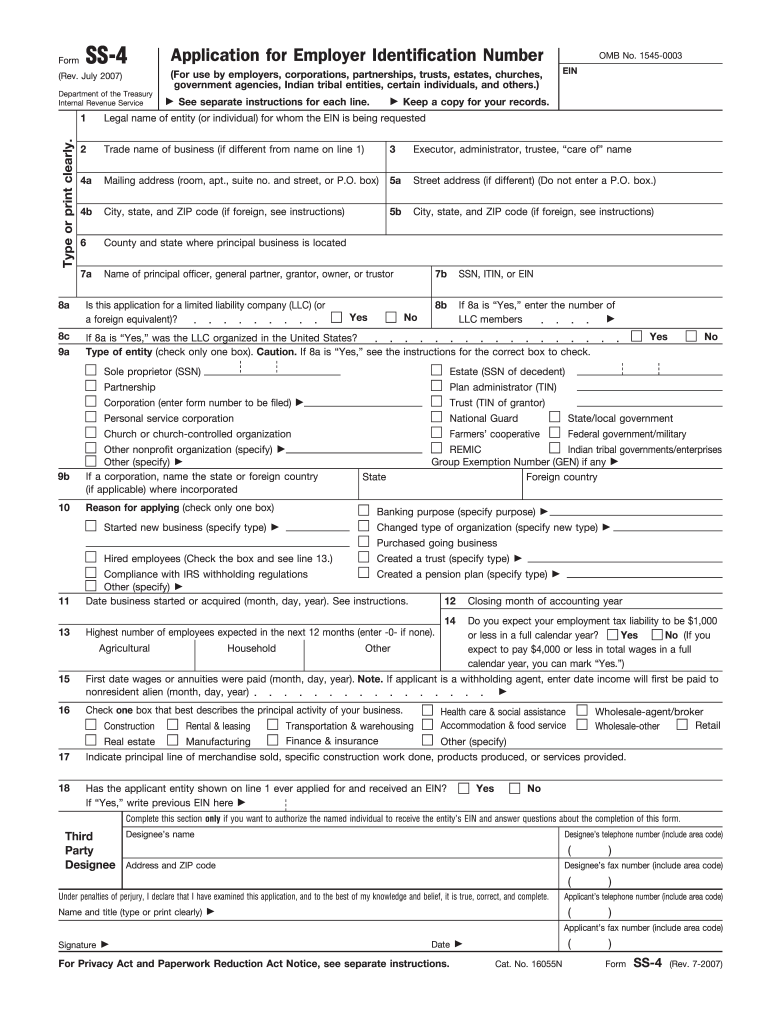

IRS SS-4 2007 free printable template

Instructions and Help about IRS SS-4

How to edit IRS SS-4

How to fill out IRS SS-4

About IRS SS-4 2007 previous version

What is IRS SS-4?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS SS-4

What should I do if I realize I made a mistake after filing the ss 4 form 2007?

If you discover an error in your submitted ss 4 form 2007, you can submit a corrected version. Ensure you clearly mark it as an amendment and include a brief explanation of the changes for clarity. This will help avoid confusion during processing.

How can I verify if my ss 4 form 2007 was received and processed?

To verify the status of your ss 4 form 2007, you can use the online tracking system provided by the IRS or contact them directly for updates. Make sure to have your details ready, as it will help streamline the inquiry process.

What common errors should I watch out for when filing the ss 4 form 2007?

Common errors in the ss 4 form 2007 include incorrect taxpayer identification numbers, typos in entity names, and misclassification of business type. Carefully reviewing all fields before submission can help mitigate these issues.

What if I receive a notice regarding my ss 4 form 2007 submission?

If you receive a notice related to your ss 4 form 2007, it’s crucial to read it carefully to understand what actions are required. Gather any necessary documentation and respond promptly to resolve any issues raised in the notice.

Are there any technical requirements for e-filing the ss 4 form 2007?

When e-filing the ss 4 form 2007, ensure your software is compatible with IRS e-file systems and that you have a stable internet connection. Using modern browsers can help avoid technical issues during the filing process.