Get the free 2003 Act 60 School Property Tax Payment Application - state vt

Show details

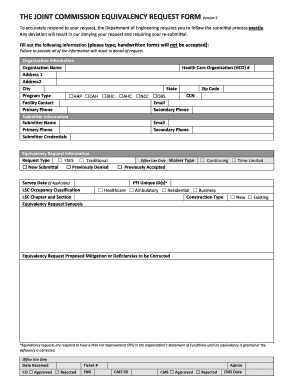

This document is an application form for the 2003 Act 60 school property tax payment, which must be filed by residents claiming homestead property tax adjustments.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2003 act 60 school

Edit your 2003 act 60 school form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2003 act 60 school form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2003 act 60 school online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2003 act 60 school. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2003 act 60 school

How to fill out 2003 Act 60 School Property Tax Payment Application

01

Obtain the 2003 Act 60 School Property Tax Payment Application form from the appropriate local authority or their website.

02

Carefully read the instructions included with the form to understand the eligibility requirements and necessary documentation.

03

Fill out your personal information in the designated sections, including your name, address, and contact information.

04

Provide details about the property for which you are applying, including the property address and tax identification number.

05

Attach any required documents, such as proof of residency or income, based on the criteria outlined by the program.

06

Review the application thoroughly to ensure all information is accurate and complete.

07

Sign and date the application where indicated.

08

Submit the completed application form and all attachments to the appropriate local authority by the deadline.

Who needs 2003 Act 60 School Property Tax Payment Application?

01

Homeowners in the relevant jurisdiction who meet the eligibility criteria set forth in 2003 Act 60.

02

Individuals seeking financial assistance with school property taxes due to financial hardship or specific qualifying conditions.

Fill

form

: Try Risk Free

People Also Ask about

Do property taxes pay for local schools?

California schools today receive the large majority of their funding from the state, primarily from income and sales tax revenues, but also from local property taxes that are collected at the local level and distributed by the state.

Are property taxes in Vermont high?

Vermont Property Taxes That statewide education tax is one reason the Green Mountain State has some of the highest property tax rates in the country. The 1.78% average effective rate in Vermont ranks as the fifth-highest in the country.

What form shows property tax paid?

The amount of real estate taxes paid may be reported to you on Form 1098 Mortgage Interest Statement.

Does Vermont have property tax relief for seniors?

Property Tax Credit The maximum credit is $8,000, with a maximum of $5,600 for the education property tax portion and $2,400 for the municipal property tax portion. The credit will appear as a state payment on your 2024/2025 property tax bill.

Is Vermont a tax-friendly state?

Property taxes in Vermont are among the highest in the nation, but sales taxes are below average. To find a financial advisor who serves your area, try our free online matching tool. Vermont is not tax-friendly toward retirees. Social Security income is partially taxed.

What is the Act 60 in Vermont?

Under Act 60, towns with the same per-pupil spending have the same homestead tax rate regardless of their property wealth.

What towns in Vermont have the highest property taxes?

Vermont's Chittenden County is situated on the eastern shores of Lake Champlain and contains the city of Burlington. It has among the highest property taxes in the state. The median annual property tax homeowners in Chittenden County pay is $6,404, highest in the state and almost double the national average.

Are taxes higher in Vermont or New York?

States with the heaviest tax burden: New York: 12.47% Hawaii: 2.31% Maine: 11.14% Vermont: 10.28% Connecticut: 9.83% New Jersey: 9.76% Maryland: 9.44% Minnesota: 9.41%

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2003 Act 60 School Property Tax Payment Application?

The 2003 Act 60 School Property Tax Payment Application is a form that property owners in certain jurisdictions must complete to apply for benefits related to school property tax payments, introduced under Pennsylvania Act 60 of 2003.

Who is required to file 2003 Act 60 School Property Tax Payment Application?

Property owners who qualify based on specific criteria, such as income limitations and residency status, are required to file the 2003 Act 60 School Property Tax Payment Application.

How to fill out 2003 Act 60 School Property Tax Payment Application?

To fill out the application, applicants must provide personal information, income details, and property information as specified in the instructions included with the form. It is recommended to review the eligibility criteria and ensure all required documentation is submitted.

What is the purpose of 2003 Act 60 School Property Tax Payment Application?

The purpose of the 2003 Act 60 School Property Tax Payment Application is to provide eligible property owners with a mechanism to apply for reductions in school property taxes based on financial need and other qualifying factors.

What information must be reported on 2003 Act 60 School Property Tax Payment Application?

The application requires reporting information such as the applicant's name, address, income, property details, and any other relevant financial information that qualifies the applicant for potential tax benefits.

Fill out your 2003 act 60 school online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2003 Act 60 School is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.