Get the free Form E-505 - dor state nc

Show details

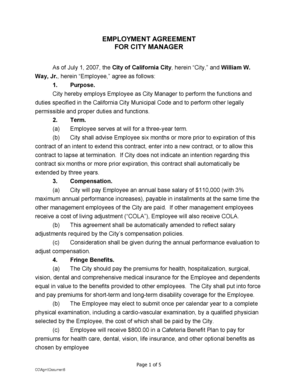

This document lists changes made by the 2002 General Assembly to the taxes administered by the Sales and Use Tax Division, including information about the effective dates of these changes and reminders

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form e-505 - dor

Edit your form e-505 - dor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form e-505 - dor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form e-505 - dor online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form e-505 - dor. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form e-505 - dor

How to fill out Form E-505

01

Gather required information: Collect all necessary documents and personal information needed for the form.

02

Start with personal details: Fill out your full name, address, and contact details in the relevant sections.

03

Provide identification: Enter your identification number, such as Social Security or tax ID number, where prompted.

04

Complete financial sections: Accurately report your income, expenses, assets, and liabilities as instructed.

05

Review instructions: Carefully read any specific instructions for each section to ensure accuracy.

06

Double-check for errors: Review the entire form for any mistakes or omissions before submission.

07

Sign and date: Finally, sign and date the form to certify that the information provided is accurate.

Who needs Form E-505?

01

Individuals or entities required to report specific financial information, often for tax-related purposes or eligibility assessments.

Fill

form

: Try Risk Free

People Also Ask about

Are there three types of tax return forms?

The simplest IRS form is the Form 1040EZ. The 1040A covers several additional items not addressed by the EZ. And finally, the IRS Form 1040 should be used when itemizing deductions and reporting more complex investments and other income.

Does North Carolina have an e-file form?

eFile is an electronic method of filing and paying state and/or federal taxes using NCDOR-approved, commercial tax preparation software.

What is an E500 form in NC?

E-500, Sales and Use Tax Return. The online filing and payment system allows you to electronically file Form E-500, Sales and Use Tax Return, and accompanying schedule Form E-536, Schedule of County Sales and Use Taxes. The system is easy to use, convenient, and secure.

What is the form for NC sales tax refund?

A claim for refund of sales and use tax paid on qualifying purchases is to be filed on Form E-585.

What is form E 585?

Form E-585 FAQ Nonprofit Sales Tax Refunds. This document provides FAQs on Form E-585, guiding nonprofit organizations in claiming refunds for sales and use taxes.

What is form 568 on a tax return?

Use Form 568 to: Determine the amount of the LLC fee (including a disregarded entity's fee) based on total California income. Report the LLC fee. Report the annual tax. Report and pay any nonconsenting nonresident members' tax.

What is a tax exempt certificate form?

Answer: Sales Tax Exemption Certificates can be used by exempt institutions to purchase property or services without having to pay a sales tax. Exempt organizations often include charities, non-profits, educational, or religious institutions.

What form do I need to file NC state taxes?

How to File Your Return. For accurate and efficient processing, the Department strongly recommends taxpayers use an electronic eFile option to file their returns. For taxpayers filing using paper forms, you should send us Your North Carolina income tax return (Form D-400).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form E-505?

Form E-505 is a tax form used in specific jurisdictions for reporting certain financial information to tax authorities.

Who is required to file Form E-505?

Individuals or businesses that meet specific criteria set by tax authorities, usually related to income or financial activity, are required to file Form E-505.

How to fill out Form E-505?

To fill out Form E-505, you must complete all required fields with accurate financial data, ensuring all calculations are correct and that you follow the instructions provided by tax authorities.

What is the purpose of Form E-505?

The purpose of Form E-505 is to collect financial information from taxpayers to ensure compliance with tax laws and to assess tax liabilities.

What information must be reported on Form E-505?

Form E-505 typically requires reporting of income, expenses, deductions, and any relevant financial transactions as outlined by the tax authority's guidelines.

Fill out your form e-505 - dor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form E-505 - Dor is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.