Get the free Immediate Annuity to Long Term Care Funding Request

Show details

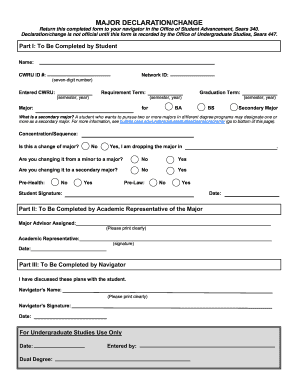

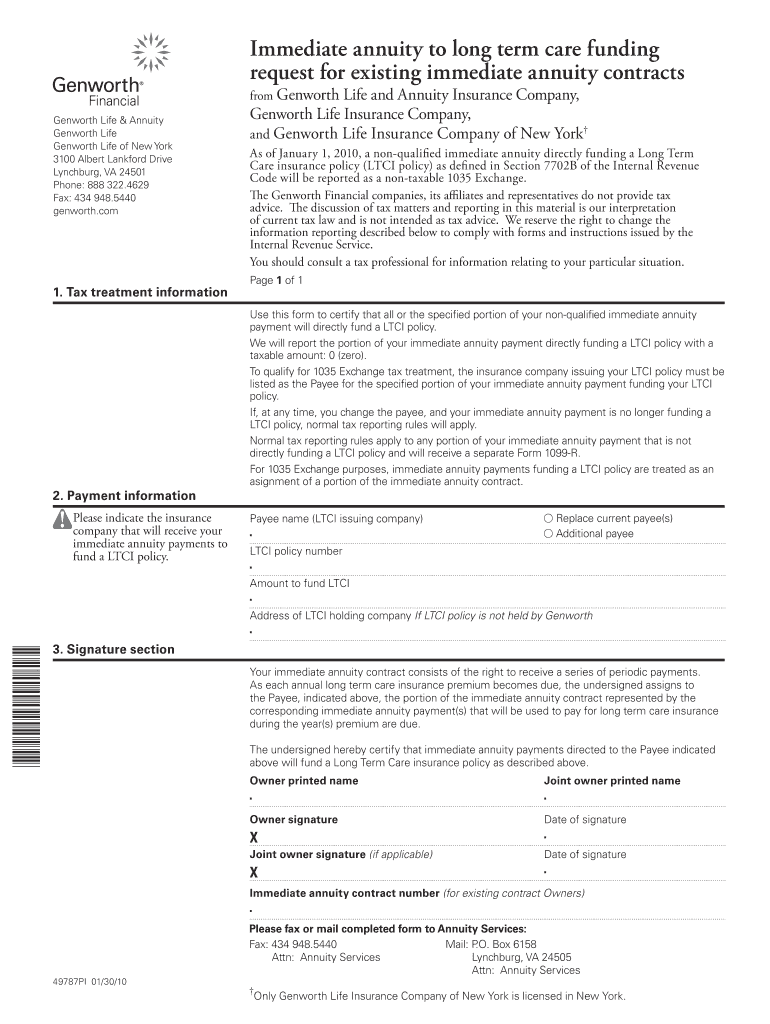

This document is a request form for existing immediate annuity contracts from Genworth Life and Annuity Insurance Company to authorize funding for a Long Term Care insurance policy.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign immediate annuity to long

Edit your immediate annuity to long form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your immediate annuity to long form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit immediate annuity to long online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit immediate annuity to long. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out immediate annuity to long

How to fill out Immediate Annuity to Long Term Care Funding Request

01

Gather necessary personal information, including your name, address, and social security number.

02

Obtain detailed information about your long-term care needs, including the type of care required and the duration.

03

Select an appropriate immediate annuity product that aligns with your funding needs.

04

Fill out the application form for the immediate annuity, providing all required financial information.

05

Specify the intended use of the annuity funds for long-term care funding on the form.

06

Attach any required documentation, such as medical assessments and proof of long-term care costs.

07

Review the application for accuracy and completeness before submission.

08

Submit the application to the annuity provider and follow up to confirm receipt and processing.

Who needs Immediate Annuity to Long Term Care Funding Request?

01

Individuals who require funding for long-term care services.

02

People looking to secure their financial future related to anticipated long-term health care costs.

03

Families planning for a loved one’s long-term care needs.

04

Individuals seeking a stable income source to cover long-term care expenses.

Fill

form

: Try Risk Free

People Also Ask about

What is the downside to an immediate annuity?

Cons. Loss of access to principal: Once you invest in an immediate annuity, you typically can't access your principal investment. This can limit your flexibility if you have unexpected expenses in retirement. Lower overall returns: Immediate annuities tend to offer lower returns than stocks and bonds.

What is the biggest drawback of long-term care insurance?

Cons of Long-Term Care Insurance Cost is a significant issue. To buy $165,000 worth of long-term care coverage in 2022, a 55-year-old man would pay an average of $2,220 per year. Rising premiums. It may not cover all expenses. Loss of premiums. Qualifying can be an obstacle.

Why does Dave Ramsey dislike annuities?

Dave Ramsey, a widely regarded authority on finance and entrepreneurship, is known for his negative view on annuities. He cites high fees, restricted access to invested funds, and complexity as disadvantages of annuities, which he often discusses on the Dave Ramsey Show.

What are the cons of immediate annuities?

Cons. Loss of access to principal: Once you invest in an immediate annuity, you typically can't access your principal investment. This can limit your flexibility if you have unexpected expenses in retirement. Lower overall returns: Immediate annuities tend to offer lower returns than stocks and bonds.

Why would someone buy an immediate annuity?

An immediate annuity, as the name suggests, starts payments to you right away. You should consider an immediate annuity if you're at or near retirement and worried about how long your savings will last, or you want the security of guaranteed payments. Guarantees are based on the claims-paying ability of the issuer.

How much does $100,000 immediate annuity pay?

The bottom line. A $100,000 annuity can provide you with a monthly income of between roughly $525 and just over $1,000, depending on your age, the payout structure and the features you select.

Can you use an annuity to pay for long-term care?

Here's how it works: You purchase an annuity with a long-term care rider. Then, when you eventually need long-term care, you can begin receiving payments to help with those expenses. Payments can be made to you monthly or as a lump sum.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Immediate Annuity to Long Term Care Funding Request?

An Immediate Annuity to Long Term Care Funding Request is a financial instrument used to convert a lump sum investment into a stream of income that supports the costs of long-term care services immediately.

Who is required to file Immediate Annuity to Long Term Care Funding Request?

Individuals seeking to utilize an immediate annuity as a means of funding their long-term care services are required to file this request.

How to fill out Immediate Annuity to Long Term Care Funding Request?

To fill out the request, one must provide personal information, details about the annuity, and information regarding the long-term care services required. It is typically advisable to consult with a financial advisor for assistance.

What is the purpose of Immediate Annuity to Long Term Care Funding Request?

The purpose of this request is to facilitate the establishment of an immediate annuity that will provide funding for long-term care expenses, ensuring that individuals can afford necessary care.

What information must be reported on Immediate Annuity to Long Term Care Funding Request?

The information that must be reported typically includes the applicant's name, date of birth, income details, the type of long-term care services needed, and specifics about the immediate annuity being requested.

Fill out your immediate annuity to long online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Immediate Annuity To Long is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.