Get the free ERISA/Non-ERISA Change of Beneficiary/Spousal Consent

Show details

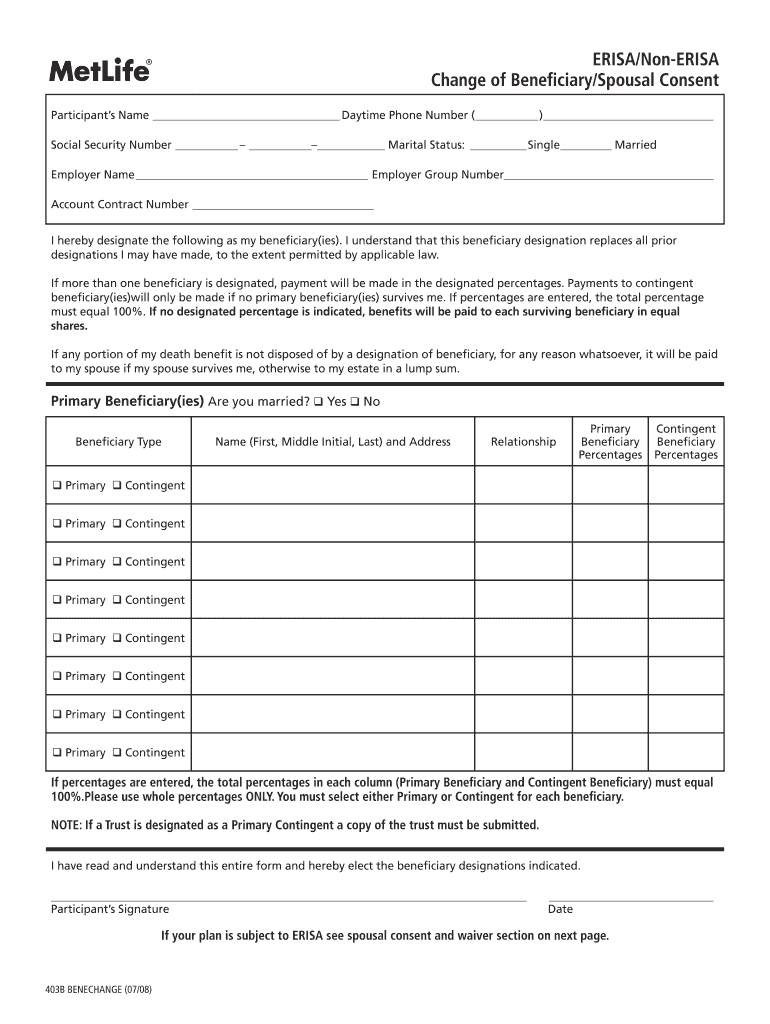

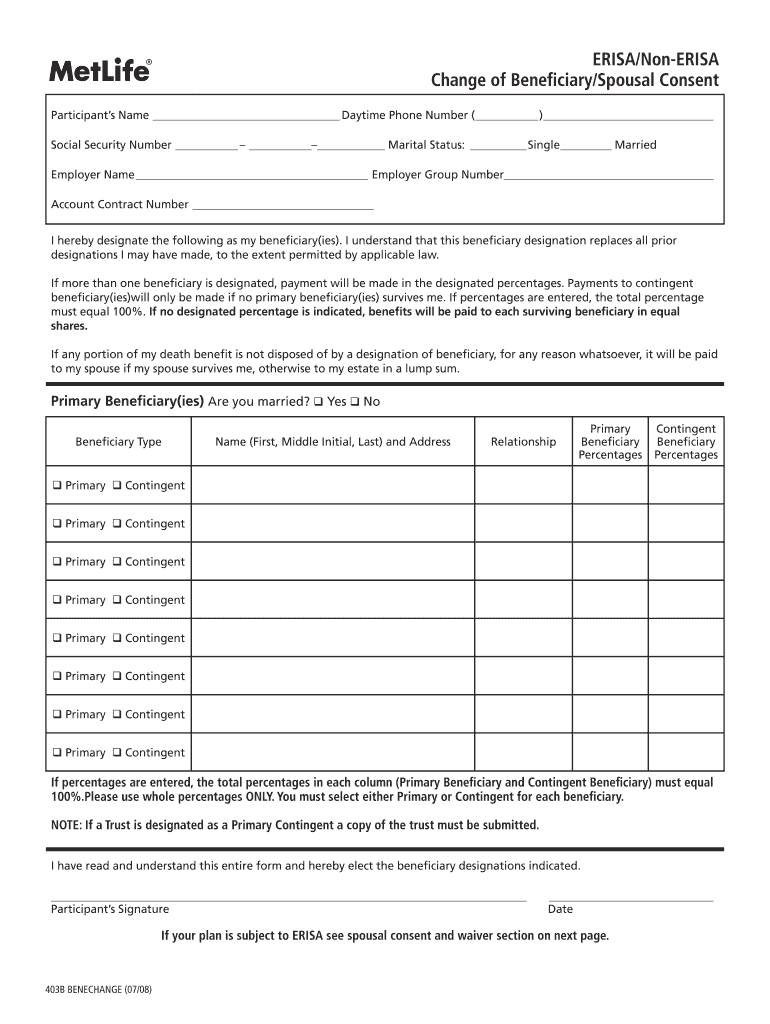

This form is used for designating a beneficiary for death benefits and obtaining spousal consent when necessary under ERISA guidelines.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign erisanon-erisa change of beneficiaryspousal

Edit your erisanon-erisa change of beneficiaryspousal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your erisanon-erisa change of beneficiaryspousal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit erisanon-erisa change of beneficiaryspousal online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit erisanon-erisa change of beneficiaryspousal. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out erisanon-erisa change of beneficiaryspousal

How to fill out ERISA/Non-ERISA Change of Beneficiary/Spousal Consent

01

Obtain the ERISA/Non-ERISA Change of Beneficiary/Spousal Consent form from your plan administrator or the relevant authority.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill out your personal information, including your name, address, and the details of the plan.

04

List the beneficiaries you wish to designate, including their names, relationships, and percentage of benefits they will receive.

05

If applicable, include the spousal consent section to ensure your spouse agrees to your chosen beneficiaries.

06

Sign and date the form to validate your request.

07

Submit the completed form to your plan administrator, ensuring you keep a copy for your records.

Who needs ERISA/Non-ERISA Change of Beneficiary/Spousal Consent?

01

Individuals who have an ERISA-regulated retirement plan and wish to designate or change beneficiaries.

02

Workers with Non-ERISA plans that require spousal consent for beneficiary changes.

03

Employees who are planning for estate management and want to ensure their preferred beneficiaries are documented.

04

Spouses of plan participants who may need to consent to beneficiary designations as per legal requirements.

Fill

form

: Try Risk Free

People Also Ask about

Should I waive QJSa?

A waiver is necessary if the participant wants a different type of payment rather than the QJSA or wants to name someone other than the spouse as the beneficiary. The waiver must be in writing, must specify the new beneficiary or type of benefit, and cannot be changed without the spouse's consent.

Which pension payout option is best for couples?

Joint and survivor options are often best for those who are married, older than their spouse, or in poorer health than their spouse. To help mitigate premature death risks while still receiving a higher payment than joint and survivor amounts, you can also choose a single-life annuity (either term or period certain).

Does fidelity require spousal consent?

For certain retirement savings plans, such as a Fidelity Retirement Plan (Self-Employed 401(k)/Keogh Account), federal law dictates that if you are married, your spouse must consent if you wish to designate someone other than your spouse as the primary beneficiary.

What are the disadvantages of joint and survivor annuities?

Drawbacks of joint and survivor annuities Some disadvantages may include: Lower payments: Because the payments must cover both of you for your lifetimes, you'll likely receive a lower payment with this annuity type than you would with a single-life annuity.

What is a QJSA waiver?

If your spouse agrees to waive the QJSA payment form, you can name someone other than your spouse to be your beneficiary to receive all or part of the survivor benefits from the Plan after you die.

Should I waive the QPSA?

If you do not waive the QPSA, after your death the Plan will pay your spouse the QPSA unless your spouse elects another benefit form. The QPSA will not pay benefits to other beneficiaries after your spouse dies. If you waive the QPSA, the Plan will pay your account to your designated beneficiary.

What is a spousal consent form?

The spousal consent is usually attached as an exhibit to the end of the agreement, and the documents usually states something to the effect of the spouse has read the agreement in full and agrees that the spouse does not claim any ownership interest in the company and waives any later arguments to such an ownership

What is the difference between Erisa and non Erisa?

ERISA provides strong federal protections for employees, including rules against mismanagement of funds and requirements for fair and transparent operations. Non-ERISA plans, governed by state laws or specific exemptions, may not provide the same level of oversight.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ERISA/Non-ERISA Change of Beneficiary/Spousal Consent?

ERISA (Employee Retirement Income Security Act) Change of Beneficiary refers to changes made to the designated beneficiaries of retirement plans governed by ERISA. Non-ERISA Change of Beneficiary relates to changes made to beneficiary designations for plans not subject to ERISA. Spousal Consent is a requirement under ERISA for certain beneficiary changes to ensure that a spouse is aware and approves of the changes.

Who is required to file ERISA/Non-ERISA Change of Beneficiary/Spousal Consent?

Individuals enrolled in ERISA-covered retirement plans or beneficiaries of such plans are required to file a Change of Beneficiary. Additionally, if a participant chooses a different beneficiary than their spouse, spousal consent is also needed.

How to fill out ERISA/Non-ERISA Change of Beneficiary/Spousal Consent?

To fill out the Change of Beneficiary form, one must provide personal information such as name, Social Security number, and details of the existing beneficiaries and any new beneficiaries being designated. If applicable, the spouse must sign to provide consent, acknowledging they understand the change.

What is the purpose of ERISA/Non-ERISA Change of Beneficiary/Spousal Consent?

The purpose of the Change of Beneficiary/Spousal Consent is to ensure that beneficiaries are correctly designated for benefit distributions and that a spouse is informed and agrees to any changes that may affect their rights to benefits.

What information must be reported on ERISA/Non-ERISA Change of Beneficiary/Spousal Consent?

The information that must be reported includes the participant's name, plan name, type of plan, current beneficiaries' names, new beneficiaries' names, the effective date of change, and the spouse's signature if consent is required.

Fill out your erisanon-erisa change of beneficiaryspousal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Erisanon-Erisa Change Of Beneficiaryspousal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.