Get the free Brokerage Account

Show details

This document is an application form for opening a brokerage account with Prudential. It includes sections for specifying account ownership types, providing personal information for account holders,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign brokerage account

Edit your brokerage account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your brokerage account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

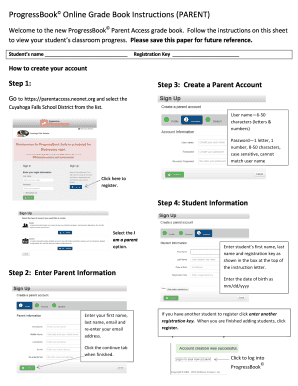

Editing brokerage account online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit brokerage account. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out brokerage account

How to fill out Brokerage Account

01

Step 1: Research brokerage firms to find one that suits your needs.

02

Step 2: Visit the brokerage firm's website or local office.

03

Step 3: Complete the online application form or paper application if necessary.

04

Step 4: Provide personal information, including your name, address, Social Security number, and employment details.

05

Step 5: Choose the type of account you want (individual, joint, retirement, etc.).

06

Step 6: Authorize funding for your account by linking a bank account or submitting a check.

07

Step 7: Review and agree to the brokerage's terms and conditions.

08

Step 8: Submit your application and wait for approval.

09

Step 9: Once approved, log in to your account to start trading.

Who needs Brokerage Account?

01

Individuals looking to invest in stocks, bonds, or other securities.

02

Retirement savers wanting to grow their long-term savings.

03

People who wish to engage in day trading or other short-term trading strategies.

04

Those wanting to diversify their investment portfolio.

05

Investors interested in accessing various investment products and services.

Fill

form

: Try Risk Free

People Also Ask about

What do you mean by brokerage account?

A brokerage account is an investment account that allows you to buy and sell investments like stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Many people have other investment accounts, such as a 401(k) through an employer, an IRA (traditional or Roth), or a health savings account (HSA).

What is a broking account?

A brokerage account is an investment account that allows you to buy and sell a variety of investments, such as stocks, bonds, mutual funds, and ETFs. Whether you're setting aside money for the future or saving up for a big purchase, you can use your funds whenever and however you want.

Can I withdraw money from a brokerage account?

How Does a Brokerage Account Differ From a Bank Account? Brokerage accounts hold securities such as stocks, bonds, and mutual funds, as well as any unused cash, and are used for investment purposes. A bank account only holds cash deposits and provides money-managing tools such as debit cards and checks.

What is a brokerage in English?

brokerage Business English an organization that buys and sells currency, shares, etc.

Is putting money in a brokerage account a good idea?

"If you want to save money to buy a house, a brokerage account would be more appropriate," Moyers says. If you want to invest for retirement, consider opening a retirement account rather than a taxable brokerage account.

What is an example of a broker account?

Some common brokerage account examples include cash accounts, margin accounts, and prime brokerages.

What is the purpose of a broker account?

A brokerage account is an investment account that allows you to buy and sell investments like stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Brokerage Account?

A brokerage account is a type of investment account that allows investors to buy and sell securities such as stocks, bonds, and mutual funds through a licensed brokerage firm.

Who is required to file Brokerage Account?

Individuals and entities that have engaged in trading securities and have realized capital gains are typically required to file a brokerage account. This may include both retail investors and institutional investors.

How to fill out Brokerage Account?

To fill out a brokerage account application, you need to provide personal information such as your name, address, Social Security number, employment information, financial situation, investment objectives, and risk tolerance.

What is the purpose of Brokerage Account?

The purpose of a brokerage account is to facilitate the buying and selling of securities, to enable investors to manage their investments, and to provide access to various financial markets and investment products.

What information must be reported on Brokerage Account?

Brokerage accounts typically require reporting information such as account holder's personal details, trading activity, capital gains or losses, dividends received, and other relevant financial transactions.

Fill out your brokerage account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Brokerage Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.