Get the free Application for a Conservation Easement Tax Credit Certificate

Show details

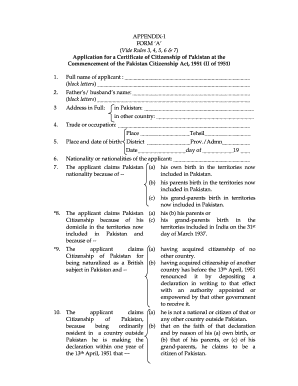

This document serves as an application for a tax credit certificate related to the donation of a conservation easement and outlines the necessary information and disclosures that must be included.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for a conservation

Edit your application for a conservation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for a conservation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for a conservation online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for a conservation. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for a conservation

How to fill out Application for a Conservation Easement Tax Credit Certificate

01

Obtain the Application for a Conservation Easement Tax Credit Certificate form from the appropriate state agency website.

02

Fill out the applicant's information, including name, address, and contact details.

03

Provide a description of the conservation easement, including its location and a summary of its conservation values.

04

Attach any required documentation that supports the conservation easement claim, such as maps or legal descriptions.

05

Indicate the appraised value of the conservation easement, along with relevant appraisal documentation.

06

Sign the application and date it, confirming that all information is accurate and complete.

07

Submit the application along with any required fees to the designated state agency.

Who needs Application for a Conservation Easement Tax Credit Certificate?

01

Individuals or entities that have created a conservation easement and wish to apply for tax credits associated with the conservation values of that easement.

Fill

form

: Try Risk Free

People Also Ask about

What is the conservation tax deduction?

The federal conservation tax deduction If you own land with important natural, agricultural or historic resources, donating a conservation easement can be a prudent way to both save the land you love forever and to realize significant federal tax savings.

How much land is required for a conservation easement?

While there is no minimum amount of acreage that must be put into an easement, not all land qualifies. The intent when creating a conservation easement must be to preserve the land and restrict development.

How are easements treated for tax purposes?

The amount received for granting an easement is subtracted from the basis of the property. If only a specific part of the entire tract of property is affected by the easement, only the basis of that part is reduced by the amount received.

What is a benefit of a conservation easement?

You can set up a conservation easement to: Protect open space or critical habitat on your land– whether it's a family farm or ranch, wetland, pasture or forest — from encroaching development. Preserve the agricultural value and traditional uses of your land by allowing for continued farming, ranching and timber

What is the IRS form for conservation easement?

Form 8283 Evaluation for Conservation Easement Donations IRS Form 8283 is required for all non-cash contributions valued at greater than $500. While the land trust's signature on Form 8283 does not represent agreement with the claimed value, the IRS has asked that land trusts use common sense in Form 8283 compliance.

What is the tax rebate for conservation easement?

Conservation easements facilitate other conservation tools Federal law allows an annual exclusion from the gift tax. In 2022 the exclusion amount is $16,000 per donor per donee. By reducing the value of land, a conservation easement allows more land to pass, tax free, to the next generation.

Is income from a conservation easement taxable?

If you donate some of that land to an entity through a conservation easement, you promise to conserve, or not develop, the donated land. In return for the donation, you get a federal income tax break. Taxpayers can deduct the difference in their donated property's appraised value before and after their donation.

What are the downsides of a conservation easement?

Since you and your heirs retain ownership rights, a conservation easement does not remove the land from your estate entirely. However, an easement reduces the land's value (lowering the value of your overall estate).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for a Conservation Easement Tax Credit Certificate?

The Application for a Conservation Easement Tax Credit Certificate is a formal request submitted by landowners who wish to obtain tax credits for donating conservation easements, which restrict development and protect natural land.

Who is required to file Application for a Conservation Easement Tax Credit Certificate?

Landowners who have donated a conservation easement on their property and wish to claim tax credits for that donation are required to file the Application for a Conservation Easement Tax Credit Certificate.

How to fill out Application for a Conservation Easement Tax Credit Certificate?

To fill out the Application for a Conservation Easement Tax Credit Certificate, you must provide detailed information about the property, the conservation easement, and any relevant documentation supporting the tax credit claim.

What is the purpose of Application for a Conservation Easement Tax Credit Certificate?

The purpose of the Application for a Conservation Easement Tax Credit Certificate is to enable landowners to receive tax benefits for contributing to conservation efforts through the donation of easements that protect land from development.

What information must be reported on Application for a Conservation Easement Tax Credit Certificate?

The information that must be reported on the Application for a Conservation Easement Tax Credit Certificate includes details about the property, the owner, the easement terms, and the appraised value of the conservation easement.

Fill out your application for a conservation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For A Conservation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.