Get the free Waiver of premium claim – Attending physician’s statement of disability

Show details

This document is used by physicians to collect necessary information regarding a patient's disability to assess eligibility for benefits from Sun Life Assurance Company of Canada.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign waiver of premium claim

Edit your waiver of premium claim form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your waiver of premium claim form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing waiver of premium claim online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit waiver of premium claim. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

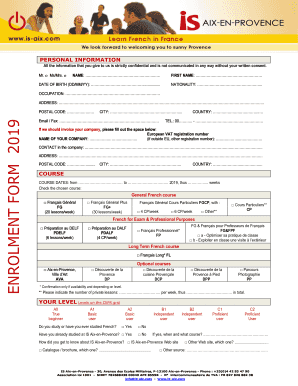

How to fill out waiver of premium claim

How to fill out Waiver of premium claim – Attending physician’s statement of disability

01

Obtain the Waiver of Premium Claim form from your insurance company.

02

Contact your attending physician and request that they complete the physician's statement section.

03

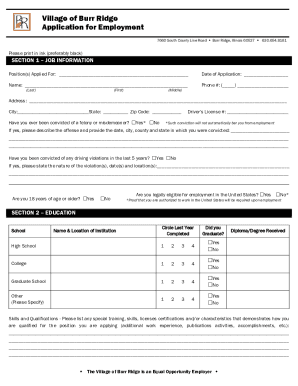

Fill out your personal information on the form, including name, policy number, and contact details.

04

Clearly state the nature of your disability and how it affects your ability to work.

05

Provide any necessary supporting documentation, such as medical records or test results.

06

Review the completed form for accuracy and signatures.

07

Submit the form and any attached documents to your insurance company as instructed.

Who needs Waiver of premium claim – Attending physician’s statement of disability?

01

Individuals who are disabled and unable to work, causing them to face financial hardship.

02

Policyholders with a waiver of premium provision in their insurance policy.

03

Those seeking to maintain their insurance coverage without making premium payments due to their disability.

Fill

form

: Try Risk Free

People Also Ask about

What is a waiver of premium for disability?

Waiver of premium for disability is a provision in an insurance policy that comes into play if the insurer becomes unexpectedly disabled and cannot pay their policy's premium. Insurance companies may charge more for a policy with a waiver of premium for disability attached to it.

What are the waiver of premium provisions?

A waiver of premium rider is optional add-on coverage for life insurance that waives or pays premiums if you become disabled or critically ill and lose the ability to work. This life insurance rider can allow you to maintain coverage and prevent the policy from lapsing if you can't earn income to pay your premiums.

What is waiver of premium on critical illness or accidental disability benefit?

The Waiver of Premium rider is an additional option under the life insurance policy, ensuring continuity of insurance coverage in case you cannot pay premiums owing to an accidentally sustained disability or critical illness. If this rider is opted for, a specific additional cost is tagged to the regular premium.

What is a waiver of premium on TPD?

Waiver of Premium due to Total and Permanent Disability Your subsequent premiums get waived when you become totally and permanently disabled due to bodily injury or disease. Accidental Death and Disablement Benefit Additional cash benefit in case of accidental death, disablement or dismemberment.

What is the meaning of waiver of premium?

Waiver of premium for disability is a provision in an insurance policy that comes into play if the insurer becomes unexpectedly disabled and cannot pay their policy's premium. Insurance companies may charge more for a policy with a waiver of premium for disability attached to it.

What is a waiver of premium provision may be included?

A waiver of premium rider generally is included with guaranteed renewable and noncancellable individual disability income policies. It is a valuable provision because it exempts the insured from paying the policy's premium during periods of total disability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Waiver of premium claim – Attending physician’s statement of disability?

The Waiver of premium claim – Attending physician’s statement of disability is a document required by insurance companies to verify a policyholder's disability status. It is used to suspend premium payments if the policyholder is unable to work due to a qualifying disability.

Who is required to file Waiver of premium claim – Attending physician’s statement of disability?

The policyholder or the insured individual who is unable to pay their premiums due to disability is required to file the Waiver of premium claim along with their attending physician's statement.

How to fill out Waiver of premium claim – Attending physician’s statement of disability?

To fill out the Waiver of premium claim, the policyholder must provide personal information, details of the disability, and the duration of inability to work. The attending physician must then complete the section regarding the medical condition, treatment, and prognosis.

What is the purpose of Waiver of premium claim – Attending physician’s statement of disability?

The purpose of the Waiver of premium claim is to allow policyholders who are disabled to maintain their insurance coverage without having to pay premiums during their period of disability.

What information must be reported on Waiver of premium claim – Attending physician’s statement of disability?

The information required includes the patient's identification details, the nature of the disability, medical history, treatment provided, the expected duration of the disability, and any other relevant medical information deemed necessary by the insurance provider.

Fill out your waiver of premium claim online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Waiver Of Premium Claim is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.