Get the free ERISA Memorandum on Form 5500-EZ for Keogh Plans

Show details

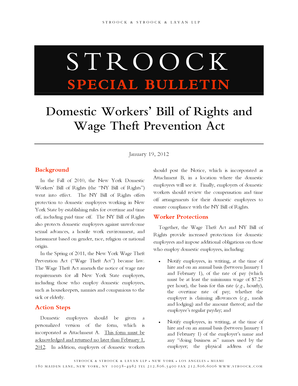

This memorandum provides guidelines and suggestions for filing the Annual Return/Reports (Form 5500-EZ) for institutions using TIAA-CREF fixed and variable annuities for their Keogh Plans that began

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign erisa memorandum on form

Edit your erisa memorandum on form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your erisa memorandum on form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit erisa memorandum on form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit erisa memorandum on form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out erisa memorandum on form

How to fill out ERISA Memorandum on Form 5500-EZ for Keogh Plans

01

Gather all necessary information regarding the Keogh Plan, including plan details, participant information, and financial statements.

02

Obtain a copy of Form 5500-EZ from the IRS website or relevant resources.

03

Fill out Part I of the Form with basic information like the plan name, sponsor name, and tax identification number.

04

Complete Part II by filling in the plan year and the type of plan being reported.

05

Enter participant information in Section 1, including the number of participants and beneficiary details.

06

Report financial information in Section 2, including assets, liabilities, and funding status of the plan.

07

If the plan has any loans or investments, provide the necessary details in the appropriate sections.

08

Ensure all signatures and dates are provided where required.

09

Review the completed form for accuracy and compliance with IRS guidelines.

10

Submit the completed Form 5500-EZ to the IRS by the due date.

Who needs ERISA Memorandum on Form 5500-EZ for Keogh Plans?

01

Plan sponsors of Keogh Plans who are required to report to the IRS.

02

Self-employed individuals and business owners who have established a Keogh Plan.

03

Employers offering retirement plans for their employees under Keogh regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is a form 5500 used for?

The Form 5500 Series is an important compliance, research, and disclosure tool for the Department of Labor, a disclosure document for plan participants and beneficiaries, and a source of information and data for use by other Federal agencies, Congress, and the private sector in assessing employee benefit, tax, and

What is the difference between form 5500 and 5500-EZ?

The standard Form 5500 is for larger plans and requires an audit. Forms 5500-SF and EZ are much shorter and have summarized financial information sections with no additional schedules to attach.

Are Keogh plans subject to ERISA?

Keogh plans (also called qualified retirement plans, H.R. 10 plans, or self-employed retirement plans) are a type of ERISA retirement plan for self-employed individuals and employees of some private businesses.

Do Keogh plans file form 5500?

Form 5500 generally needs to be filed each year by plan administrators for: Keoghs (e.g., money purchase, profit sharing) Company pension (i.e. defined benefit) and company profit-sharing plans. Certain 403(b) plans.

Are you filing a form 5500-EZ 5500-SF as a 1 participant plan?

You will file the Form 5500-EZ if your plan: Is a one-participant 401(k) plan. A one-participant plan is a plan that covers only: An owner who owns the entire business and their spouse. One or more partners in a business partnership and their spouses.

Who is required to file form 5500-EZ?

Employers who sponsor one-participant plans or foreign plans must file Form 5500-EZ electronically using the Department of Labor's EFAST2 filing system. Only employers not subject to the IRS e-filing requirements under Treas. Reg. 301.6058-2 may file paper Form 5500-EZ with the IRS.

Who is exempt from filing form 5500-EZ?

Who Should File The 5500-EZ. Owners of an Individual 401k plan are exempt from these annual tax filings until they reach $250,000 in assets. Once the individual 401k plan hits this level, you must file the IRS form 5500-EZ.

What is the difference between 5500 and 5500-EZ?

There are 3 types of Form 5500: Form 5500-EZ — for one-participant plans only; Form 5500-SF for plans with fewer than 100 participants; and Form 5500 — for plans with 100 or more participants. Forms 5500 and 5500-SF must be filed electronically using the DOL ERISA Filing Acceptance System (EFAST2)Opens in a new window.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ERISA Memorandum on Form 5500-EZ for Keogh Plans?

The ERISA Memorandum on Form 5500-EZ is a reporting document required by the Employee Retirement Income Security Act (ERISA) for Keogh plans, which are retirement plans designed for self-employed individuals and unincorporated businesses.

Who is required to file ERISA Memorandum on Form 5500-EZ for Keogh Plans?

Individuals who are plan sponsors of Keogh plans with assets over a certain threshold generally need to file Form 5500-EZ. This typically includes self-employed business owners and partners in unincorporated businesses using the Keogh plan structure.

How to fill out ERISA Memorandum on Form 5500-EZ for Keogh Plans?

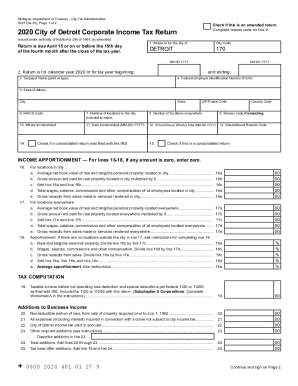

To fill out Form 5500-EZ, plan sponsors must provide information such as the plan name, sponsor information, plan year, total assets as of the end of the year, and other relevant financial data, ensuring that all details are accurate and submitted on time.

What is the purpose of ERISA Memorandum on Form 5500-EZ for Keogh Plans?

The purpose of the ERISA Memorandum on Form 5500-EZ is to ensure compliance with federal regulations governing employee benefit plans, facilitate data collection by the IRS and Department of Labor, and to provide transparency about the financial status of the plan.

What information must be reported on ERISA Memorandum on Form 5500-EZ for Keogh Plans?

The information that must be reported includes details like the plan name, plan number, employer identification number (EIN), total plan assets, plan administrator contact information, and a summary of any income, expenses, and benefits paid during the plan year.

Fill out your erisa memorandum on form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Erisa Memorandum On Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.