Get the free Conduct indepth credit analysis by discretionally utilizing - hkib

Show details

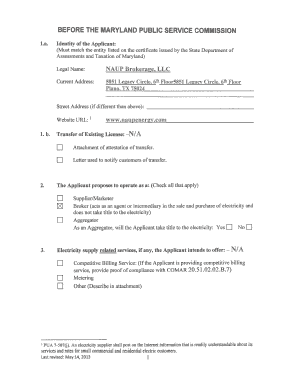

Circular No.:HAA41PP100204 Certificate in Bank Lending 27 February 20 May 2010 Learning Outcomes On completion of this subject, participants should be able to: Conduct in depth credit analysis by

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign conduct indepth credit analysis

Edit your conduct indepth credit analysis form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your conduct indepth credit analysis form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit conduct indepth credit analysis online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit conduct indepth credit analysis. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit conduct indepth credit analysis in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your conduct indepth credit analysis, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for the conduct indepth credit analysis in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your conduct indepth credit analysis in minutes.

How do I edit conduct indepth credit analysis on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as conduct indepth credit analysis. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is conduct indepth credit analysis?

Conducting indepth credit analysis involves thoroughly assessing an individual or organization's creditworthiness including their credit history, financial statements, cash flow projections, and other relevant factors to determine their ability to meet financial obligations and repay debts.

Who is required to file conduct indepth credit analysis?

Financial institutions, such as banks, lending companies, or credit unions, are typically required to conduct indepth credit analysis as part of their risk assessment and loan approval processes.

How to fill out conduct indepth credit analysis?

To fill out a conduct indepth credit analysis, the financial institution typically collects relevant financial documents and information from the borrower, evaluates their credit history, analyzes their financial statements, and uses various assessment methods and industry standards to evaluate creditworthiness.

What is the purpose of conduct indepth credit analysis?

The purpose of conducting indepth credit analysis is to assess the risk associated with extending credit to individuals or organizations. It helps financial institutions make informed decisions on whether to approve or deny credit applications and determine the loan terms, interest rates, and credit limits.

What information must be reported on conduct indepth credit analysis?

The information reported on a conduct indepth credit analysis may include the borrower's personal or business financial statements, credit history, income sources, cash flow projections, debt obligations, collateral, and other relevant financial and non-financial information.

Fill out your conduct indepth credit analysis online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Conduct Indepth Credit Analysis is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.