Get the free Request for a Closing Certificate for Fiduciaries - revenue wi

Show details

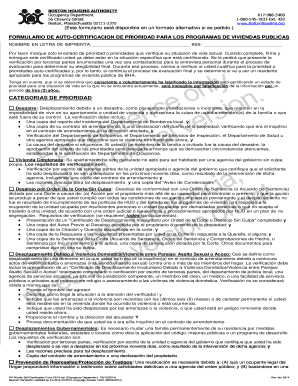

This form is used to request a closing certificate for estates and trusts in Wisconsin. It requires information about the decedent or trust, including income details, asset valuations, and probate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for a closing

Edit your request for a closing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for a closing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing request for a closing online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit request for a closing. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request for a closing

How to fill out Request for a Closing Certificate for Fiduciaries

01

Obtain the Request for a Closing Certificate for Fiduciaries form from the appropriate tax authority's website or office.

02

Fill in the fiduciary's name and contact information at the top of the form.

03

Provide details of the estate or trust, including the date of death of the decedent.

04

Enter the name and address of the decedent.

05

Specify the time period for which the closing certificate is being requested.

06

Include any relevant identification numbers (such as Social Security numbers or Tax ID numbers).

07

Sign and date the form at the bottom, attesting to the accuracy of the information provided.

08

Submit the completed form to the appropriate tax authority along with any required documentation or fees.

Who needs Request for a Closing Certificate for Fiduciaries?

01

Fiduciaries managing estates or trusts who need to settle tax matters or close out tax accounts.

02

Executors of wills who require a closing certificate to finalize the estate settlement.

03

Trustees needing confirmation of tax compliance before distributing trust assets.

Fill

form

: Try Risk Free

People Also Ask about

Does a tax return need to be filed for a grantor trust?

However, if the trust is classified as a grantor trust, it is not required to file a Form 1041, provided that the individual grantor reports all items of income and allowable expenses on his own Form 1040 or 1040-SR, U.S. Individual Income Tax Return.

Who is responsible for filing a tax return for a trust?

The trustee may have to file a return if the trust meets any of these: The trustee or beneficiary (non-contingent) is a California resident. The trust has income from a California source.

What is the threshold for fiduciary income tax return?

The fiduciary (or one of the fiduciaries) must file Form 541 for a decedent's estate if any of the following apply: Gross income for the taxable year of more than $10,000 (regardless of the amount of net income) Net income for the taxable year of more than $1,000. An alternative minimum tax liability.

Does a fiduciary have to file a tax return?

Real Estate Mortgage Investment Conduit (REMIC) Trust. The fiduciary (or one of the joint fiduciaries) must file Form 541 and pay an annual tax of $800 for a REMIC that is governed by California law, qualified to do business in California, or has done business in California at any time during the year.

What are fiduciary forms?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

Is a fiduciary return the same as an estate return?

The IRS requires the filing of an income tax return for trusts and estates on Form 1041—formerly known as the fiduciary income tax return. This is because trusts and estates must pay income tax on their income just like you report your own income on a personal tax return each year.

Do fiduciaries file taxes?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Request for a Closing Certificate for Fiduciaries?

The Request for a Closing Certificate for Fiduciaries is a formal application submitted to a tax authority by fiduciaries to close the tax obligations of a trust or estate.

Who is required to file Request for a Closing Certificate for Fiduciaries?

Fiduciaries, such as executors, administrators, or trustees of estates or trusts, are required to file this request to ensure all tax liabilities are settled before distributing assets.

How to fill out Request for a Closing Certificate for Fiduciaries?

To fill out the request, fiduciaries must provide information such as the name and tax identification number of the estate or trust, details of the fiduciary, and any relevant tax filings or payments made.

What is the purpose of Request for a Closing Certificate for Fiduciaries?

The purpose of the request is to obtain formal confirmation from the tax authority that all tax obligations related to the estate or trust have been fulfilled before the distribution of assets.

What information must be reported on Request for a Closing Certificate for Fiduciaries?

The information that must be reported includes the fiduciary's contact information, the identity of the estate or trust, tax identification numbers, and the details of any tax returns filed and payments made.

Fill out your request for a closing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For A Closing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.