Get the free Expenditure Credit Form - uvaforms virginia

Show details

This form is used to deposit funds received as a reimbursement to a University project/task/award combination, ensuring that the initial disbursement was for University business and that returned

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign expenditure credit form

Edit your expenditure credit form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your expenditure credit form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing expenditure credit form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit expenditure credit form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

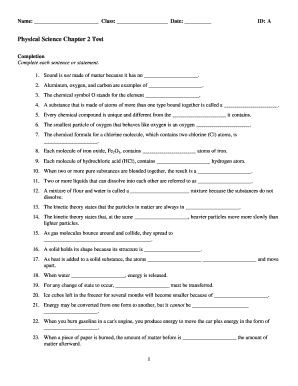

How to fill out expenditure credit form

How to fill out Expenditure Credit Form

01

Obtain the Expenditure Credit Form from the relevant authority or website.

02

Fill in your personal information, including name, address, and contact details.

03

Specify the period for which you are claiming expenditure credits.

04

Itemize all eligible expenses, providing dates, amounts, and descriptions for each expense.

05

Attach relevant documentation, such as receipts and invoices, to support your claims.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form to certify that the information is true and correct.

08

Submit the form to the appropriate office or department by the specified deadline.

Who needs Expenditure Credit Form?

01

Individuals or organizations seeking reimbursement for business-related expenditures.

02

Employees who have incurred expenses on behalf of their employer.

03

Self-employed individuals who want to claim business expenses.

Fill

form

: Try Risk Free

People Also Ask about

What can I claim on form 5695?

You may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, small wind energy property, geothermal heat pump property, battery storage technology, and fuel cell property.

Where is form 2441 in TurboTax?

Ensure that you are in the appropriate area of TurboTax. Choose the "Federal Taxes" option, "Deductions & Credits," and then "Child & Dependent Care Credit" to obtain Form 2441.

Where do you get form 2441?

Form 2441 is a two-page form divided into three sections. Each section details a separate area of qualifying factors and calculations. The first two sections appear on the first page. All pages of Form 2441 are available on the IRS website.

Who fills out form 2441?

Form 2441 is used to claim the Child and Dependent Care Credit, which is available to those who pay someone to care for dependent children under 13, disabled spouses, or other dependents who cannot mentally or physically care for themselves.

What is a 8453 form?

Form 8453 includes the taxpayer's declaration under penalties of perjury that the return is true and complete, as well as the taxpayer's Consent to Disclosure.

How to fill out form 5695?

How to Fill Out IRS Form 5695 for the Solar Tax Credit Step 1 - Calculate the total cost of your solar power system. Step 2 - Add additional energy-efficient improvements. Step 3 - Calculate the tax credit value. Step 4 - Enter your tax credit value. Step 5 - Calculate your tax liability.

Do you get a tax form from daycare?

Daycare centers are required to provide parents with an annual daycare tax statement. This statement shows the total amount parents spent on child care costs during the past year. These annual receipts should cover January 1st through December 31st of the previous year.

Where does form 2441 come from?

What Is Form 2441? IRS Form 2441 determines how much of the Child and Dependent Care Credit a taxpayer can claim on their tax return. Eligible taxpayers must complete and submit Form 2441 with their Form 1040 tax returns to claim the Child and Dependent Care Credit.

What has replaced the 1040EZ form?

However, filing with Form 1040EZ is no longer an option. This form has since been replaced by Form 1040 and Form 1040-SR, depending on your tax situation.

How to calculate residential energy credit?

How it works. The Residential Clean Energy Credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2032. The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Expenditure Credit Form?

The Expenditure Credit Form is a document used to report expenditures and claim credits against taxes owed, typically in relation to specific projects or investments.

Who is required to file Expenditure Credit Form?

Entities or individuals that have incurred eligible expenditures and wish to claim tax credits for those expenditures are required to file the Expenditure Credit Form.

How to fill out Expenditure Credit Form?

To fill out the Expenditure Credit Form, gather all necessary expenditure documentation, complete the form by providing details of the expenditures, attach supporting documentation, and submit the form to the relevant tax authority.

What is the purpose of Expenditure Credit Form?

The purpose of the Expenditure Credit Form is to allow taxpayers to claim credits for eligible expenditures that can reduce their tax liability.

What information must be reported on Expenditure Credit Form?

Information that must be reported includes details of the expenditures made, dates of expenditure, description of the project, and any relevant supporting documentation that verifies the expenses.

Fill out your expenditure credit form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Expenditure Credit Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.