Get the free Student Schedule E Asset Valuation - drake

Show details

This form is used to collect asset valuation information necessary for the processing of the 2008-2009 Financial Aid application at Drake University.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign student schedule e asset

Edit your student schedule e asset form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your student schedule e asset form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing student schedule e asset online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit student schedule e asset. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

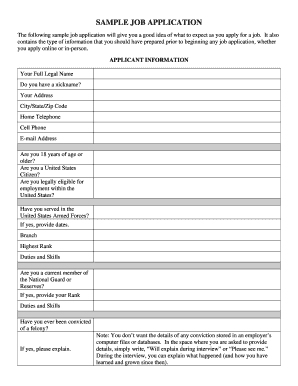

How to fill out student schedule e asset

How to fill out Student Schedule E Asset Valuation

01

Begin by gathering all necessary financial documents and information related to your assets.

02

Identify each asset you own, including cash, stocks, real estate, and other investments.

03

For each asset, list its description, location, and ownership details.

04

Determine the current market value of each asset, ensuring to use reliable valuation methods.

05

Enter the market values in the designated fields of the Student Schedule E form.

06

Review the information for accuracy before submission.

Who needs Student Schedule E Asset Valuation?

01

Students applying for financial aid who possess significant financial assets.

02

Parents of students who need to report their assets for the financial aid process.

Fill

form

: Try Risk Free

People Also Ask about

Can you deduct depreciation on vacant rental property?

The answer is yes, you can. As long as your property remains available for rent, it qualifies for depreciation deductions, regardless of whether it's occupied. Depreciation is based on the useful life of your property, which doesn't pause during vacancy.

Can I claim 100% depreciation on my rental property?

This deduction only applies to tangible personal property, certain improvements to real estate, and business assets with a useful life of 20 years or less. The percentage you can deduct depends on the year, as 100% bonus depreciation was phased out in 2022. Bonus depreciation for 2025 is 40%.

Can you deduct depreciation on Schedule E?

Your rental income and deductions – including for depreciation – are generally reported on Schedule E.

What is the line 17 on Schedule 1?

Line 17 is for the self-employed health insurance deduction. Self-employed individuals may be able to deduct 100% of health, dental, and long-term care insurance premiums that they paid for themselves, their spouses, their dependents, and any nondependent children aged 26 or younger at the end of 2022.

Is depreciation allowed or allowable on rental property?

Depreciation allowed is depreciation you actually deducted (from which you received a tax benefit). Depreciation allowable is depreciation you are entitled to deduct.

What is line 19 on Schedule E?

Line 19 on Schedule E acts as a catch-all for various expenses that don't fit into predefined categories but are essential to rental property operations. Understanding these categories is key for accurate tax filings.

Can I take depreciation on my rental property?

Depreciation is a tax deduction that allows you to recover a property's cost over time. You can typically write off the wear and tear on your residential long-term rental property in equal installments over 27.5 years or 39 years for many short-term rentals.

Can you depreciate rental property on Schedule E?

Your rental income and deductions – including for depreciation – are generally reported on Schedule E.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Student Schedule E Asset Valuation?

Student Schedule E Asset Valuation is a form used to assess the value of an individual's assets, typically for educational financial aid purposes.

Who is required to file Student Schedule E Asset Valuation?

Students applying for financial aid who have assets that may affect their eligibility are required to file Student Schedule E Asset Valuation.

How to fill out Student Schedule E Asset Valuation?

To fill out Student Schedule E Asset Valuation, individuals need to provide information about their assets, including cash, investments, and real estate, following the specific instructions provided on the form.

What is the purpose of Student Schedule E Asset Valuation?

The purpose of Student Schedule E Asset Valuation is to accurately assess a student's financial situation to determine eligibility for financial aid and to calculate the amount of aid they may receive.

What information must be reported on Student Schedule E Asset Valuation?

Information required on Student Schedule E Asset Valuation includes details about the value of assets such as bank accounts, stocks, bonds, real estate, and any other investments owned by the student or their family.

Fill out your student schedule e asset online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Student Schedule E Asset is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.