Get the free SPEN - Student Pension Form - drake

Show details

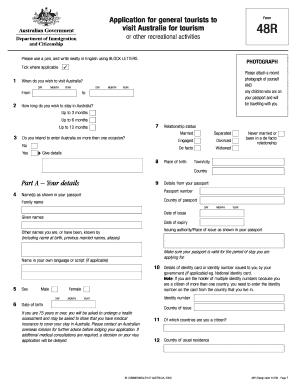

This form is used by students at Drake University to report the rollover amount from their pension/annuity distribution for the 2011-2012 Financial Aid application.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign spen - student pension

Edit your spen - student pension form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your spen - student pension form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing spen - student pension online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit spen - student pension. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out spen - student pension

How to fill out SPEN - Student Pension Form

01

Obtain the SPEN - Student Pension Form from your educational institution or their website.

02

Read the instructions carefully to understand the requirements.

03

Fill out your personal information, including your full name, student ID, and contact details.

04

Provide details about your current course or program, including your enrollment status.

05

Indicate your financial status and any other required information as specified on the form.

06

Review your completed application for accuracy and completeness.

07

Sign and date the form where required.

08

Submit the form by the specified deadline, either online or in person as instructed.

Who needs SPEN - Student Pension Form?

01

Students who are currently enrolled in a higher education institution and wish to apply for pension benefits.

02

Individuals who are seeking financial assistance through a pension plan while pursuing their studies.

Fill

form

: Try Risk Free

People Also Ask about

What is SSA Title II benefits?

Title II provides for payment of disability benefits to disabled individuals who are "insured" under the Act by virtue of their contributions to the Social Security trust fund through the Social Security tax on their earnings, as well as to certain disabled dependents of insured individuals.

How to fill out SSA 795 form pdf?

How to fill out an SSA-795 form? Open the SSA-795 form in the editor. Fill in your personal information, including Social Security number and contact details. Provide a clear statement regarding your claim or report. Sign the form with an electronic signature, if accepted. Review all details for accuracy.

What is a SSA 787 form?

SSA-787: Physician's/Medical Officer's Statement of Patient's Capability to Manage Benefits (PDF) SSA-1699: Registration for Appointed Representative Services (PDF)

What is an SSA form for?

An SSA-1099 is a tax form we mail each January to people who receive Social Security benefits. It shows the total amount of benefits you received from us in the previous year. It also tells you how much Social Security income to report to the Internal Revenue Service (IRS) on your tax return.

What is a SSA 11?

The SSA-11 (or the computer generated equivalent, SG-SSA-11, produced by the Electronic Representative Payee System (eRPS)) is the proper representative payee application.

What is an SSA 11 form?

The SSA-11-BK is the paper form a potential payee completes to apply to be payee. Use the paper form only, when it is not possible to use eRPS. For example, we must take paper applications for applicants who do not have a Social Security Number (SSN).

What is the SSA Form 7050 F4?

Who needs an SSA Form 7050-F4? An individual taxpayer should file Form SSA-7050-F4 in case they want to obtain an itemized earnings statement (either certified or noncertified, including the names of employers) or certified yearly earnings totals, providing no employment details, only the earnings.

Why would someone need a representative payee for Social Security?

The purpose of a representative payee is to receive Social Security benefits on behalf of a minor or another person who is unable to care for themselves or manage their own finances.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SPEN - Student Pension Form?

SPEN - Student Pension Form is a document used to report pension-related information for students who are receiving pension benefits or are eligible for such benefits.

Who is required to file SPEN - Student Pension Form?

Students who are receiving pension benefits or are beneficiaries of a pension plan are required to file the SPEN - Student Pension Form.

How to fill out SPEN - Student Pension Form?

To fill out the SPEN - Student Pension Form, gather the necessary information about your pension plan, complete each section of the form accurately, and submit it to the designated pension authority or institution.

What is the purpose of SPEN - Student Pension Form?

The purpose of the SPEN - Student Pension Form is to collect necessary information for the administration of pension benefits for students and to ensure compliance with regulatory requirements.

What information must be reported on SPEN - Student Pension Form?

The information that must be reported on the SPEN - Student Pension Form includes personal details of the student, pension plan details, dates of benefits eligibility, and any other relevant financial information related to the pension.

Fill out your spen - student pension online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Spen - Student Pension is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.