Get the free PIRA - Parent IRA Form - drake

Show details

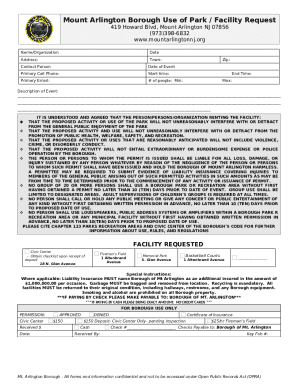

This form is used to collect information regarding IRA distributions for financial aid processing at Drake University. It requires the parent to report the amount rolled over from an IRA to another

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pira - parent ira

Edit your pira - parent ira form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pira - parent ira form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pira - parent ira online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pira - parent ira. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pira - parent ira

How to fill out PIRA - Parent IRA Form

01

Begin by obtaining the PIRA - Parent IRA Form from the appropriate financial institution or online.

02

Fill in your personal information, including your name, address, and contact details at the top of the form.

03

Provide the required identification details, such as your Social Security Number or Tax Identification Number.

04

Specify the details of the child or beneficiary for whom the account is being set up, including their name and Social Security Number.

05

Indicate the type of contributions you wish to make - either a traditional IRA or a Roth IRA.

06

Fill out the section regarding the amount of contribution you plan to make, ensuring it adheres to yearly limits.

07

Review your selections and the overall form for accuracy.

08

Sign and date the form where indicated.

09

Submit the completed form to the financial institution along with any necessary identification documents.

Who needs PIRA - Parent IRA Form?

01

Parents or guardians looking to set up a tax-advantaged retirement account for their children.

02

Individuals who want to invest in their child's future education expenses via an IRA.

03

Family members wanting to contribute to a child's retirement savings in a controlled manner.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to report form 5498 on my tax return?

No. You aren't required to do anything with Form 5498 because it's for informational purposes only. Please be sure to keep this form for your records as you'll need this information to calculate your taxable income when you decide to take distributions from your IRA.

What is the difference between SIMPLE IRA form 5304 and 5305?

Use Form 5304-SIMPLE if you permit plan participants to select the financial institution to receive their SIMPLE IRA plan contributions. Use Form 5305-SIMPLE if you require all contributions under the SIMPLE IRA plan to be initially deposited at a financial institution you designate.

Where do I enter form 5498 on my tax return TurboTax?

A Form 5498 is not entered on a tax return. If you made a contribution to an IRA in 2023 enter the contribution you made on your tax return.

Where do I list form 5498 on my tax return?

No individual taxpayer needs to file Form 5498 with their tax return. You can think of this document as an FYI for your own IRA record-keeping. Your financial institution will automatically share Form 5498 with the IRS.

Should I report form 5498 on taxes?

You aren't required to do anything with Form 5498 because it's for informational purposes only. Please be sure to keep this form for your records as you'll need this information to calculate your taxable income when you decide to take distributions from your IRA.

What is the difference between a 1099 and a 5498?

Form 1099 is used to report distributions and associated tax withholdings, while Form 5498 reports contributions, rollovers, FMVs, and RMDs. Both serve different purposes but are essential for accurate tax reporting. If you take a distribution and make contributions in the same year, you will likely receive both forms.

Do beneficiaries pay tax on Roth IRA inheritance?

For Inherited IRAs, an IRS Form 5498 is generated for the deceased and the beneficiary. If only the year-end fair market value (FMV) is reported, Pacific Life will send the IRS Form 5498 to the IRS only and you will not receive a copy automatically.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PIRA - Parent IRA Form?

PIRA - Parent IRA Form is a tax form used by parents to report their contributions to their child's Individual Retirement Account (IRA), as well as any earnings accrued within that account.

Who is required to file PIRA - Parent IRA Form?

Parents who contribute to their child's IRA or those who manage a custodial IRA on behalf of their child are required to file the PIRA - Parent IRA Form.

How to fill out PIRA - Parent IRA Form?

To fill out the PIRA - Parent IRA Form, parents should provide accurate details regarding contributions, the child's information, account balance, and any relevant financial details required by the IRS.

What is the purpose of PIRA - Parent IRA Form?

The purpose of the PIRA - Parent IRA Form is to ensure that contributions to a child's IRA are reported correctly for tax purposes and to track the growth of the account over time.

What information must be reported on PIRA - Parent IRA Form?

The PIRA - Parent IRA Form must report the parent's name, the child's name, Social Security numbers, total contributions made, earnings on the account, and any withdrawals taken during the year.

Fill out your pira - parent ira online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pira - Parent Ira is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.