Get the free APPLICATION FOR INSURANCE

Show details

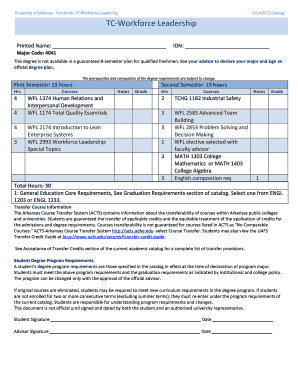

This document is an application form for insurance coverage with United American Insurance Company, detailing the required information for the primary insured and their dependents, options for coverage,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for insurance

Edit your application for insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for insurance online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for insurance. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for insurance

How to fill out APPLICATION FOR INSURANCE

01

Obtain the APPLICATION FOR INSURANCE form from the insurance provider's website or office.

02

Read all instructions carefully to understand the requirements.

03

Provide your personal information, including name, address, and contact details, in the designated sections.

04

Fill in details about the type of insurance you are applying for (e.g., health, auto, home).

05

Disclose any necessary information regarding your health history or previous claims if required.

06

Indicate your preferred coverage level and any riders or add-ons you wish to include.

07

Review the completed application for accuracy and completeness.

08

Sign and date the application as required.

09

Submit the application either online or via mail, along with any additional documentation requested.

Who needs APPLICATION FOR INSURANCE?

01

Individuals seeking personal insurance coverage for health, auto, home, or life.

02

Businesses looking to insure their assets, employees, or liability.

03

Any person or entity that wants to protect against financial loss from specific risks.

Fill

form

: Try Risk Free

People Also Ask about

What is English insurance?

an agreement in which you pay a company money, either in one payment or in regular payments, and they pay your costs, for example, if you lose or damage something, or have an accident, injury, etc.: car/holiday/home/health, etc. insurance.

How much does a TX insurance license cost?

Testing fees for the Texas insurance licensure exam cost between $23 and $43, depending on the type of license you're taking the test for. Fingerprinting services cost around $40, while the license application fee is $50.

What is term insurance in English?

Term life insurance is a type of life insurance policy that provides coverage for a certain period of time, or a specified “term” of years. If the insured dies during the time period specified and the policy is active, or “in force,” then a death benefit will be paid.

What type of insurance is MetLife?

From accident and health to legal, pet, dental, and vision insurance — we've got you covered. Employers and HR partners can find our extensive range of employee benefit solutions here.

What is insurance policy in English?

An insurance policy is a legal contract between the insurance company (the insurer) and the person(s), business, or entity being insured (the insured). Reading your policy helps you verify that the policy meets your needs and that you understand your and the insurance company's responsibilities if a loss occurs.

What is the meaning of insurance in English?

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect against the risk of a contingent or uncertain loss.

Is $200 a month expensive for health insurance?

Is $200 a Month a lot for Health Insurance? Given that the average monthly premium for individual coverage through employer-sponsored plans is about $703 and around $477 for marketplace plans, $200 a month is relatively low for health insurance in the USA.

What is the application for insurance?

In the context of Life Insurance and Living Benefits, an "Application for Insurance" is a formal request or proposal made by an individual or organization seeking to obtain coverage.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR INSURANCE?

An application for insurance is a formal request submitted by an individual or organization seeking coverage from an insurance provider. This document outlines the applicant's details, the type of insurance desired, and any specific coverage requirements.

Who is required to file APPLICATION FOR INSURANCE?

Individuals or businesses seeking insurance coverage need to file an application for insurance. This includes anyone who wants to obtain policies for health, auto, home, life, or any other type of insurance.

How to fill out APPLICATION FOR INSURANCE?

To fill out an application for insurance, applicants should provide accurate personal or business details, specify the type of insurance needed, answer any questions related to risk factors, and disclose relevant information about assets, liabilities, and previous insurance history.

What is the purpose of APPLICATION FOR INSURANCE?

The purpose of an application for insurance is to collect necessary information that allows the insurance company to assess risk, determine coverage eligibility, and calculate the premium for the policy.

What information must be reported on APPLICATION FOR INSURANCE?

Information that must be reported on an application for insurance typically includes the applicant's personal or business information, details about the property or assets to be insured, previous insurance coverage history, claims history, and any applicable health information for certain types of insurance.

Fill out your application for insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.