Get the free 2008-2009 Student and Spouse Head of Household Form - ecu

Show details

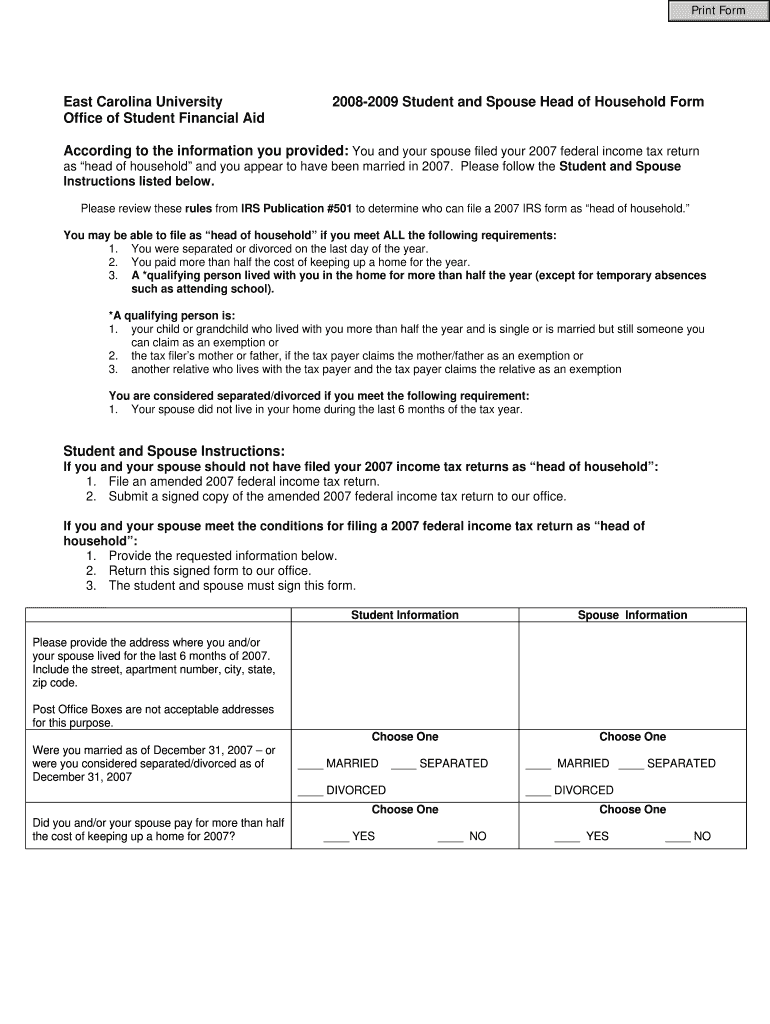

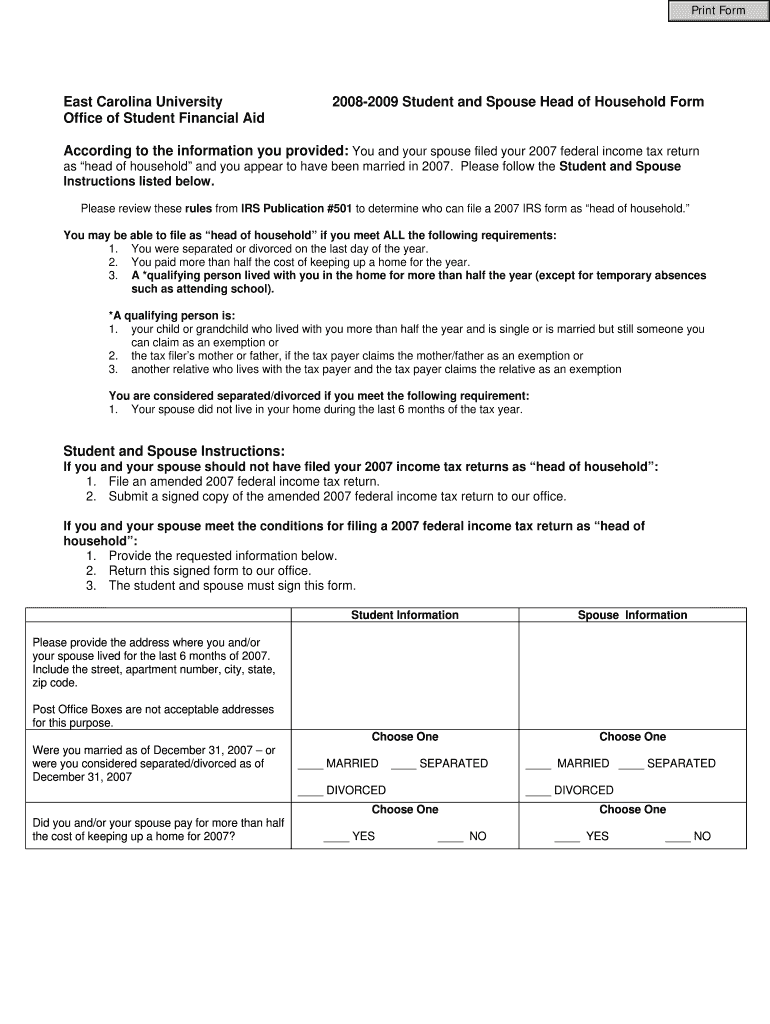

This form is used by students and their spouses at East Carolina University to determine eligibility for filing as head of household for the 2007 tax year, including provisions for filing amended

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2008-2009 student and spouse

Edit your 2008-2009 student and spouse form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2008-2009 student and spouse form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2008-2009 student and spouse online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2008-2009 student and spouse. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2008-2009 student and spouse

How to fill out 2008-2009 Student and Spouse Head of Household Form

01

Obtain the 2008-2009 Student and Spouse Head of Household Form from the appropriate agency or website.

02

Fill in your personal information, including your name, Social Security number, and contact details.

03

Indicate your marital status and the name of your spouse if applicable.

04

Provide information about your dependents, including their names and Social Security numbers.

05

Report your income for the previous year, including wages, self-employment income, and any other taxable income.

06

Fill out the details of your spouse's income, if applicable, using the same format.

07

Include any relevant deductions and credits that you may qualify for according to the guidelines.

08

Review your completed form for accuracy and ensure all required sections are filled out.

09

Sign and date the form before submission.

10

Submit the form according to the instructions provided, either electronically or by mail.

Who needs 2008-2009 Student and Spouse Head of Household Form?

01

Students who are applying for financial aid and wish to be classified as Head of Household based on their financial situation during the 2008-2009 academic year.

02

Spouses of students who need to provide financial information to support the student's financial aid application.

Fill

form

: Try Risk Free

People Also Ask about

Can you claim head of household if you are married?

Two people cannot file as Head of Household on the same return. If they are married, then they typically have to either file as Married Filing Jointly on the same return or as Married Filing Separately on separate returns. Two people can both claim Head of Household filing status while living in the same home.

Which spouse should claim head of household?

You can only claim head of household filing status if you are unmarried. Filing as head of household gives you a higher standard deduction than as a single filer. Married filing jointly makes sense for many married couples, with a few exceptions.

How does the IRS verify head of household?

To qualify for Head of Household on your tax return, you must be unmarried or considered unmarried by the IRS. You also have to pay more than half the costs of keeping up a home during the tax year. In addition, a qualifying dependent, such as a child, should live with you for more than half of the year.

Is it better to file married or head of household?

The Head of Household filing status provides a higher standard deduction and, generally, a lower tax rate than Single or Married Filing Separately.

Which spouse files the head of household?

To qualify for the head of household filing status while married, you must be considered unmarried on the last day of the year, which means you must: File your taxes separately from your spouse. Pay more than half of the household expenses.

Can I claim head of household with a college student?

[1]: Any unrelated person who lived with you all year as a member of your household can qualify you for a Dependent Exemption Credit as long as all the other requirements for the credit are met. However, such a person cannot qualify you for head of household filing status.

Is it better to file head of household or married jointly?

Joint filers receive better Standard Deduction amounts as well as wider tax brackets than those filing as Head of Household. Joint filers have a Standard Deduction twice as large as single filers. Their Standard Deduction is roughly 33% larger than Head of Household filing status ($29,200 vs. $21,900 for 2024).

What is the penalty for filing head of household while married?

There's no tax penalty for filing as head of household while you're married. But you could be subject to a failure-to-pay penalty of any amount that results from using the other filing status. This is 0.5% (one-half of one percent) for each month you didn't pay, up to a maximum of 25%.

What happens if I file head of household while married?

Two people cannot file as Head of Household on the same return. If they are married, then they typically have to either file as Married Filing Jointly on the same return or as Married Filing Separately on separate returns. Two people can both claim Head of Household filing status while living in the same home.

What tax status should a 16 year old claim?

Minors who qualify as dependents on their parent or relative's tax return do not have to file a separate tax return. In the eyes of the Internal Revenue Service (IRS), all dependents are classified as “qualifying children” or “qualifying relatives,” with the qualifying child label being most relevant for teens.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2008-2009 Student and Spouse Head of Household Form?

The 2008-2009 Student and Spouse Head of Household Form is a financial aid form used by students and their spouses to report household information and income for the purpose of determining eligibility for federal financial aid.

Who is required to file 2008-2009 Student and Spouse Head of Household Form?

Students who are financially independent and are married, as well as their spouses, are required to file the 2008-2009 Student and Spouse Head of Household Form to provide necessary financial information.

How to fill out 2008-2009 Student and Spouse Head of Household Form?

To fill out the form, gather accurate financial and household data, including income, number of dependents, and other relevant details. Follow the instructions provided on the form carefully, ensuring all sections are completed accurately.

What is the purpose of 2008-2009 Student and Spouse Head of Household Form?

The purpose of the form is to collect information to assess financial need and eligibility for federal and state financial aid programs for higher education.

What information must be reported on 2008-2009 Student and Spouse Head of Household Form?

The form requires reporting of household income, number of people in the household, marital status, and other relevant financial information needed to determine eligibility for financial aid.

Fill out your 2008-2009 student and spouse online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2008-2009 Student And Spouse is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.